Polycarbonate (PC) contains carbonate groups in the molecular chain. According to the different ester groups in the molecular structure, it can be divided into aliphatic, alicyclic and aromatic groups. Among them, the aromatic group has the most practical value. The most important one is bisphenol A polycarbonate, with a general weight average molecular weight (MW) of 200000 to 100000.

Polycarbonate has good comprehensive properties, such as strength, toughness, transparency, heat resistance and cold resistance, easy processing and flame retardancy. The main downstream application fields are electronic appliances, sheet metal and automobiles. These three industries account for about 80% of polycarbonate consumption. Other fields are also widely used in industrial machinery parts, CD, packaging, office equipment, medical care, film, leisure and protective equipment, and have become one of the fastest growing categories of five engineering plastics.

With the advancement of localization technology, the localization of China’s PC industry has developed rapidly in recent years. By the end of 2022, the scale of China’s PC industry has exceeded 2.5 million tons/year, and the output is about 1.4 million tons. At present, China’s large-scale enterprises include Kesichuang (600000 tons/year), Zhejiang Petrochemical (520000 tons/year), Luxi Chemical (300000 tons/year) and Zhongsha Tianjin (260000 tons/year).

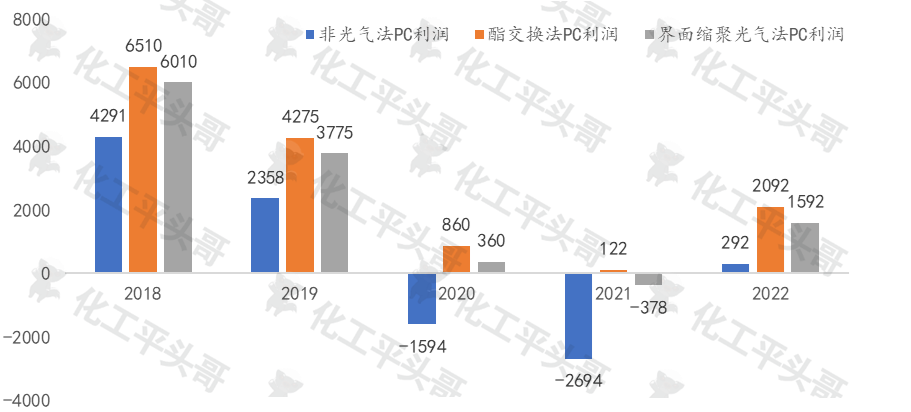

Profitability of three PC processes

There are three production processes for PC: non phosgene process, transesterification process and interfacial polycondensation phosgene process. There are obvious differences in raw materials and costs in the production process. The three different processes bring different profit levels for PC.

In the past five years, the profitability of China’s PC reached the highest level in 2018, reaching about 6500 yuan/ton. Subsequently, the profit level decreased year by year. During 2020 and 2021, due to the reduction of consumption level caused by the epidemic, the profit situation shrank significantly, and the interface condensation phosgene method and non phosgene method showed significant losses.

By the end of 2022, the profitability of transesterification method in China’s PC production is the highest, reaching 2092 yuan/ton, followed by interface polycondensation phosgene method, with the profitability at 1592 yuan/ton, while the theoretical production profit of non phosgene method is only 292 yuan/ton. In the past five years, the transesterification method has always been the most profitable production method in China’s PC production process, while the non phosgene method has the weakest profitability.

Analysis of factors affecting PC profitability

First, the price fluctuation of raw material bisphenol A and DMC has a direct impact on PC cost, especially the price fluctuation of bisphenol A, which has an impact weight of more than 50% on PC cost.

Second, the fluctuations in the terminal consumer market, especially the macroeconomic fluctuations, have a direct impact on the PC consumer market. For example, during the period of 2020 and 2021, when the epidemic affects, the consumption scale of the consumer market on PCs has decreased, resulting in a significant decline in PC prices and a direct impact on the profitability of the PC market.

In 2022, the impact of the epidemic will be relatively serious. The price of crude oil will continue to decline, and the consumer market will be poor. Most of China’s chemicals have not reached normal profit margins. As the price of bisphenol A remains low, the production cost of PC is low. In addition, the downstream has also recovered to a certain extent, so the prices of different production process types of PC have maintained strong profitability, and the profitability is gradually improving. It is a rare product with high prosperity in China’s chemical industry. In the future, the bisphenol A market will continue to be sluggish, and the Spring Festival is approaching. If the epidemic control is released in an orderly manner, consumer demand may grow in a wave, and the PC profit space may continue to grow.

Post time: Dec-07-2022