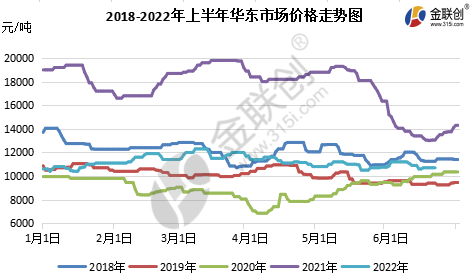

In the first half of 2022, the domestic propylene oxide market price was mainly low, up and down more frequently, with an oscillation range of 10200-12400 yuan/ton, the difference between high and low prices was 2200 yuan/ton, the lowest price appeared in early January in Shandong market, and the highest price appeared in mid-March in East China market. The lowest price in January because: the traditional industry off-season in January, coupled with the approach of the Spring Festival, the downstream demand is poor, while the second phase of Wanhua and Zhenhai second phase of new production capacity put into operation, the supply of incremental, negative cloud, the market mentality more empty under the center of gravity continued to decline; the highest price in March because: Zhenhai a period, Shandong Sanyue, Xinyue, Hangjin and other overhaul good, supply shrinkage, downstream also moderate replenishment, trading Under the improvement, the market center of gravity rose, the highest price in the first half of the year. Slightly broken down in the first half of the year.

Data source: Goldlink

New production capacity, the traditional industry off-season, the market is weak, the North and South frequently inverted

In the first half of January, the inertia of the end of December last year, prices once fell to 10,200 yuan / ton of the lowest price in the first half of the year, followed by pollution in Shandong to reduce the negative and Jishen to reduce the negative impact of maintenance, the supply of good cyclopropane bottoming rebound, but the magnitude is limited; follow-up Zhenhai II smooth output, coupled with the concentration of imported cyclopropane to the port, the supply of abundant market mood is more pessimistic, cyclopropane again under pressure down, but because of raw materials liquid chlorine, propylene But because of the high price of raw materials, liquid chlorine, propylene support strong, chloranol process profit cost inversion under some factories began to limit production to protect prices, downstream also low in the Spring Festival before replenishment, the positive atmosphere in the field heated up, prices rebounded, although the Quan refinery device restarted successfully in late February, but the substantive supply in February, low factory inventory and slow accumulation, the end of January market stalemate.

In the first half of February, coinciding with the Lunar New Year, factories keep low inventory for the New Year, Shi Da, Huatai, Sanyue reduced negative operation, the market temporarily hold stable operation; after the festival, logistics and transportation improved, overlapping with the cost support turned strong, ring C after the festival ushered in the “open door”, downstream modest just after replenishment, return to digesting inventory, wait and see operation; in the middle of the month briefly hold stable, although Shandong In the second half of the month, the raw material propylene and liquid chlorine both rose, and the downstream also panicked and followed up under the international marginal political conflict, but because of the poor terminal, the sustainability was limited, only the northern market rebounded 100 yuan / ton, but the inventory pressure was smoothly transferred.

In March, the epoxy propane market rose and fell frequently, with a “M”-shaped trend and a narrow oscillation range. in the first half of March, the first phase of the Zhenhai plant was completely stopped, and Shandong Sanyue, Xinyue, and Hangjin Technology reduced their negative impacts.

Epidemic multi-point blossom, affecting demand and logistics, the integrity of the industry chain was hit hard

In mid-March, although the planned parking maintenance in Shandong Jinling, but the outbreak of the epidemic multi-point, especially in Shandong polyether gathering place – Zibo fell, the already weak operation of the cyclic propylene added insult to injury, although a number of cyclic propylene plant in Shandong to reduce the negative operation of the device, but demand continues to be light, the center of gravity under pressure to decline, followed by raw material cost pressure turned strong, cyclic propylene follow raw materials At the end of the month, the raw materials turned weak again, and the cost and demand for cyclopropane fell again under the double negative.

During the Qingming Festival in April, the cost pressure rose steeply and the factory raised the factory price, meanwhile, as some logistics resumed after the festival, cyclopropane smoothly bottomed out and rebounded, but the rebound was limited due to the weakness of the terminal and the epidemic, and then the price fell under pressure as the cost support turned weak and the demand continued to be light; after that, liquid chlorine rebounded widely and cyclopropane was supported by the cost. During the Labor Day in May, the supply and cost favorable, cyclopropane manufacturers raised factory prices, after the festival, logistics recovery improved, the market continued to slightly upward exploration However, downstream demand continued to be limited, coupled with an abundance of spot in the East China market, the atmosphere was flat, the market gradually sideways finishing; in the middle, as demand continued to be light, while the raw material liquid chlorine retreat, the field bearish and other down atmosphere, coupled with factory inventory pressure, Shandong on behalf of the factory decisively cut factory prices, downstream hedge, prices fell to a monthly low after the Wanhua Phase II parking, Sinochem Quanzhou to reduce the negative, cyclopropyl rebound, by Downstream demand was briefly affected by the rebound of only 200 yuan / ton, after stabilization and wait-and-see.

Traditional demand off-season, downstream confidence building slowly, new capacity pressure is still large

In June, Shanghai production life slowly orderly release, but demand has not improved, up or down is still frequent, the magnitude is limited. early June, the market continued at the end of May, sideways finishing a week or so, then the supply of incremental, inventory pressure, the factory decisively cut factory prices, downstream chase up to kill under the hedge-oriented, to fall to 10400 yuan / ton, the factory profit squeeze obvious, profit-making mentality is no longer, the downstream Also cautiously wait and see under the low follow up, only a short-lived, cyclopropyl also once again appeared to raise 1 day tour, up 100 yuan / ton; in the second half of the year, three Yue parking, China Shipping shell epoxy propane device unexpected parking, but Daguhua new capacity news negative market, downstream mentality is difficult to have a greater lift, the market more with the pick, cautiously wait and see follow up, the market sentiment is more empty, the follow-up or decline is expected.

Data source: Goldlink

The first half of 2022, as of June 20, the average price of the East China market is about 11213 yuan / ton, much lower than 2021, of course, 2021 market conditions are also relatively out of control, slightly closer to 2018-2019.

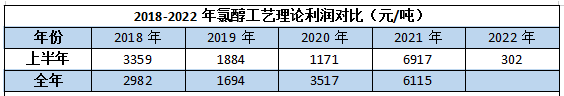

Epichlorohydrin chlorohydrin process theory in the first half of the profit shrinkage is serious, year-on-year decline of more than 90%

In 2022, the theoretical profit of the chlorhydrin process is about 2400 yuan / ton, the lowest is about -1000 yuan / ton, an average of 300 yuan / ton or so, in January, the second phase of Zhenhai drive, superimposed on the downstream before the Spring Festival one after another to withdraw from the market, demand turned weak, prices fell under pressure, profits opened inverted, in February, thanks to the Spring Festival back to the market, logistics and demand are better than the previous period, profits turned positive, more around In February, thanks to the return of the Spring Festival, logistics and demand were better than the previous period, profits turned positive and oscillated around 1000 yuan/ton, from March to May, Shanghai and many domestic epidemic outbreaks, demand continued to weaken compared to the previous period, logistics was not good, propylene oxide prices oscillated around the cost line, prices rose and fell frequently, and theoretical profits of chlorohydrin were also positive and negative conversion frequently. At the same time, propylene prices fell, liquid chlorine oscillation range narrowed, theoretical profit level is not high, but the pressure is significantly narrower than before.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Jul-19-2022