In April 2024, the engineering plastic market showed a mixed trend of ups and downs. The tight supply of goods and rising prices have become the mainstream factor driving up the market, and the parking and price boosting strategies of major petrochemical plants have stimulated the rise of the spot market. However, weak market demand has also led to a decline in some product prices. Specifically, prices of products such as PMMA, PC, and PA6 have increased, while prices of products such as PET, PBT, PA6, and POM have declined.

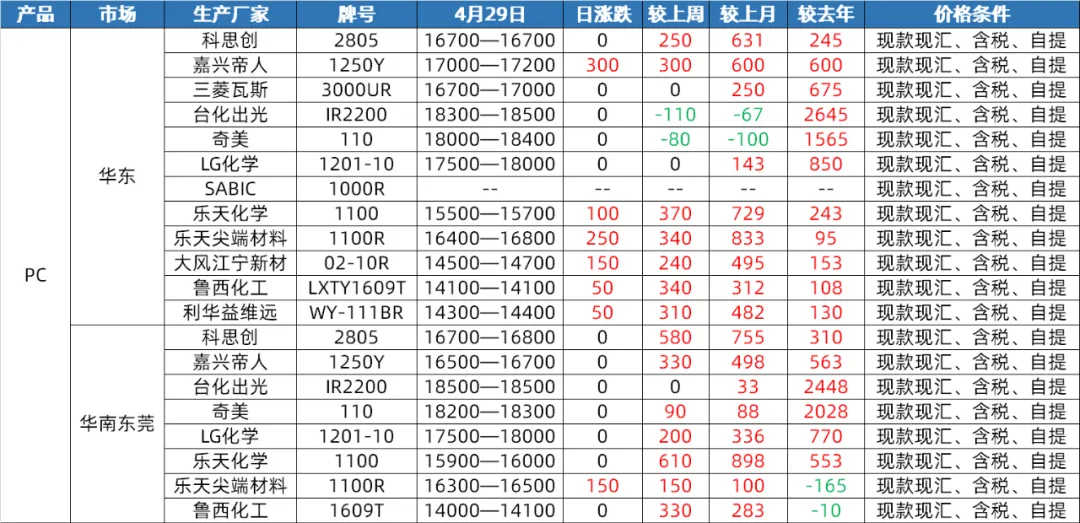

PC market

Supply side: In April, the domestic PC market experienced a narrow range of fluctuations and consolidation before breaking through and rising. At the end of the month, prices rebounded to the highest level since the fourth quarter of last year. In the first half of the month, although the PC equipment of Hainan Huasheng underwent a full line shutdown and maintenance, the overall operation of other domestic PC equipment was stable, and there was not much pressure from both supply and demand sides. However, in the latter half of the year, with the significant rebound of PC upstream raw materials and the continued rise of parallel materials, coupled with stocking operations by some downstream factories before May Day, PC spot prices quickly rose. In May, although there are still plans for PC device maintenance, it is expected that the maintenance losses will be offset. At the same time, Hengli Petrochemical’s 260000 tons/year PC device production capacity will gradually be released, so it is expected that the domestic PC supply in May will increase compared to this month’s expectations.

Demand side: In late April, although the PC market prices have increased, there was no significant positive expectation on the demand side. The downstream procurement of PC has not been able to further drive the market up. Entering May, it is expected that the demand side will remain stable, making it difficult to have a significant driving effect on the PC market.

Cost side: In terms of cost, the raw material bisphenol A is expected to fluctuate narrowly at a high level in May, with limited cost support for PC. In addition, as PC prices rise to nearly half a year high and there is insufficient bullish fundamentals, market risk expectations rise, and profit taking and shipping will also increase, further compressing PC’s profit margins.

PA6 Slice Market

Supply side: In April, the PA6 slicing market had relatively sufficient supply side. Due to the restart of the maintenance equipment for the raw material caprolactam, the operating load has increased, and the raw material inventory in the polymerization plant is at a high level. At the same time, the on-site supply is also showing sufficient status. Although some aggregation factories have limited spot inventory, most of them are delivering orders in the early stage, and the overall supply pressure is not significant. Entering May, the supply of caprolactam continued to remain sufficient, and the production of polymerization factories remained at a high level. On site supply remained sufficient. In the early days, some factories continued to deliver early orders, and supply pressure is expected to continue. However, it is worth noting that the recent positive development of export trade, an increase in aggregated export orders, or the continued negative inventory of a small number of factories, will have a certain impact on the supply side.

Demand side: In April, the demand side of the PA6 slicing market was average. Downstream aggregation involves on-demand procurement with limited demand. Under the influence of downstream demand, northern factories have lowered their factory prices. However, as the May Day holiday approaches, the market transaction atmosphere has improved, and some aggregation factories have pre-sale until the end of the May Day holiday. In May, the demand side is expected to remain stable. In the first half of the year, some factories continued to deliver early orders, while downstream aggregation still relied heavily on on-demand procurement, resulting in limited demand. However, considering the positive development of export trade and the increase in aggregated export orders, this will have a certain positive impact on the demand side.

Cost side: In April, weak cost support was the main characteristic of the PA6 slicing market. The price fluctuations of raw material caprolactam have had a certain impact on the cost of slicing, but overall, the cost support is limited. Entering May, the cost side is expected to continue to fluctuate. Due to the sufficient supply of caprolactam, its price fluctuations will have a direct impact on the cost of PA6 slicing. It is expected that the market will remain weak and stable in the first ten days, while in the second ten days, the market may follow cost fluctuations and show a certain adjustment trend.

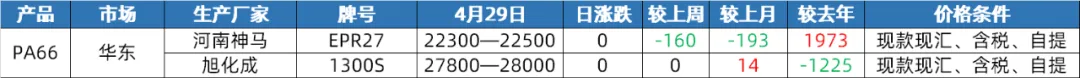

PA66 Market

Supply side: In April, the domestic PA66 market showed a fluctuating trend, with monthly average prices slightly dropping by 0.12% month on month and 2.31% year-on-year. Despite the execution price increase of 1500 yuan/ton by Yingweida for raw material hexamethylenediamine, Tianchen Qixiang’s production of hexamethylenediamine has remained stable, and the increase in raw material supply has led to a weak consolidation of the spot price of hexamethylenediamine. Overall, the supply side is relatively stable and the market has ample spot supply. Entering May, the Nvidia adiponitrile unit is scheduled to undergo maintenance for one month, but the spot execution price of adiponitrile remains stable at 26500 yuan/ton, and the Tianchen Qixiang adiponitrile unit also maintains stable operation. Therefore, it is expected that the supply of raw materials will continue to remain stable and there will be no significant fluctuations in the supply side.

Demand side: In April, terminal demand was weak, and downstream sentiment towards high prices was strong. The market was mainly focused on rigid demand procurement. Although the supply is stable and abundant, insufficient demand makes it difficult for the market to show significant upward momentum. It is expected that terminal demand will remain weak in May, with no positive news boosting it. Downstream enterprises are expected to continue to focus on essential procurement, and market demand is unlikely to improve significantly. Therefore, from the demand side, the PA66 market will still face certain downward pressure.

Cost side: In April, the cost side support was relatively stable, with prices of adipic acid and adipic acid showing a fluctuating trend. Despite fluctuations in raw material prices, there has not been a significant change in overall cost support. Entering May, the maintenance of the Nvidia adiponitrile unit may have a certain impact on raw material costs, but the prices of adipic acid and adipic acid are expected to remain relatively stable. Therefore, from a cost perspective, the cost support of the PA66 market remains relatively stable.

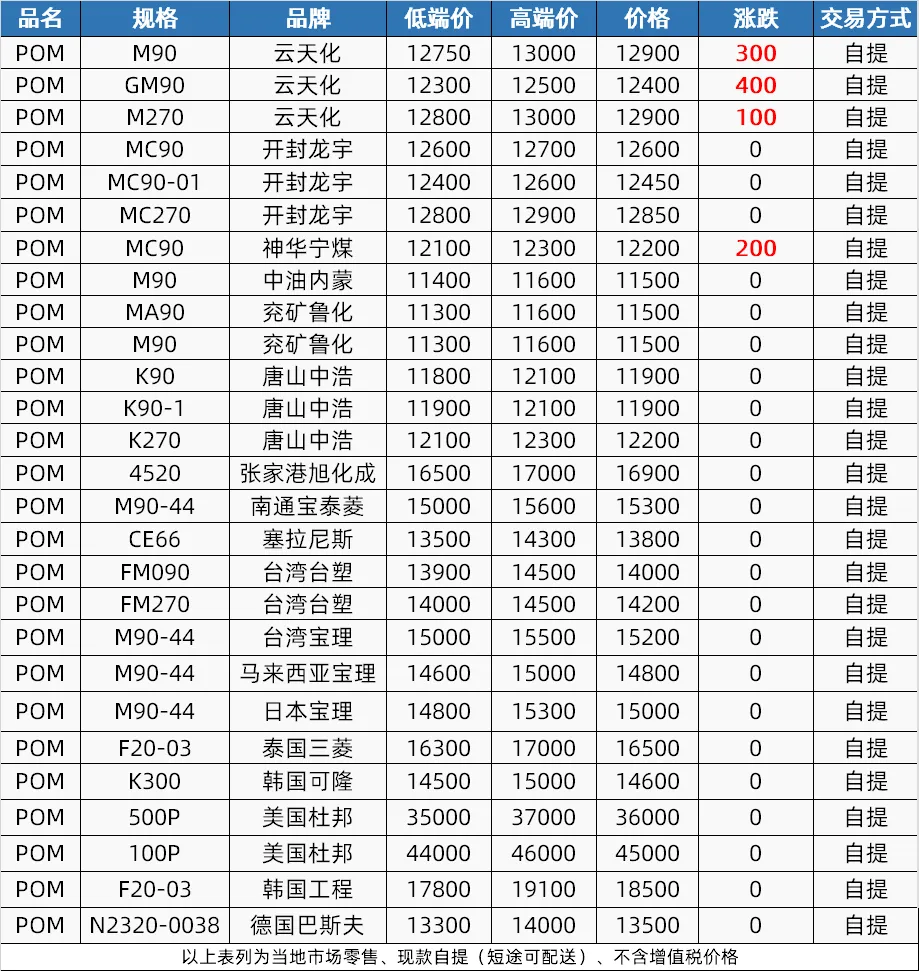

POM market

Supply side: In April, the POM market experienced a process of first suppressing and then increasing supply. In the early days, due to the Qingming Festival holiday and price reductions in petrochemical plants, the market supply was loose; Mid month equipment maintenance led to supply tightening, supporting price increases; In the latter half of the year, the maintenance equipment was restored, but the shortage of goods continued. It is expected that the supply side will maintain a certain positive outlook in May. Shenhua Ningmei and Xinjiang Guoye have maintenance plans, while Hengli Petrochemical plans to increase production, and overall supply will remain tight.

Demand side: The POM market demand in April was weak, and the terminal’s ability to accept orders was poor. In May, it is expected that the terminal demand will continue to be rigid demand for small orders, and the factory will hold 50-60% of the production and wait for new order guidance.

Cost side: The cost side has limited impact on the POM market in April, but it is expected that mid to high end quotations will remain strong in May due to the impact of imported material price increases. However, weak demand and competition from low-end sources will affect low-end offers, potentially leading to downward expectations.

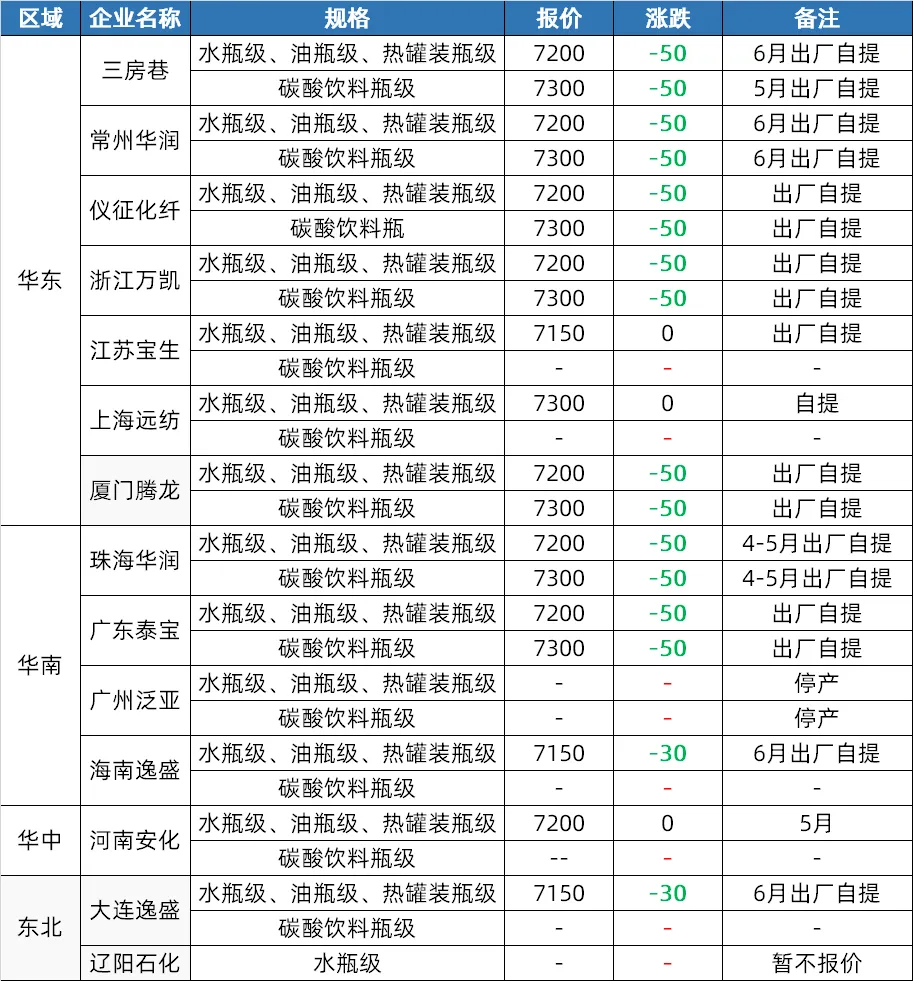

PET market

Supply side: In April, the polyester bottle chip market was initially boosted by crude oil and raw materials, with prices rising. In the second half of the month, raw material prices have fallen, but factories have raised prices, and the market still maintains a certain price level. Entering May, some facilities in the southwest may be adjusted according to the raw material situation, and the supply may slightly increase under the expectation of new facilities being put into operation.

Demand side: Market concerns in April drove downstream and traders to restock, with active trading in the second half of the month. In May, it is expected that the soft drink industry will enter the peak replenishment season, with an increase in demand for PET sheets and an overall improvement in domestic demand.

Cost side: Cost support was strong in the first half of April, but weakened in the second half. Entering May, the expected decline in crude oil and changes in raw material supply may lead to weak cost support.

PBT market

Supply side: In April, there was less maintenance of PBT devices, resulting in higher production and a loose supply side. In May, some PBT devices are expected to undergo maintenance, and it is expected that the supply will slightly decline. However, overall, the supply side will continue to remain high.

Cost side: In April, the cost side showed a volatile trend, with PTA market prices initially strong and then weak, BDO continuing to decline, and poor cost transmission. Entering May, PTA market prices may rise first and then fall, with processing fees being relatively low; The BDO market price is at a low level, with high trading resistance in the market, and it is expected that the cost side will maintain range fluctuations.

Demand side: In April, downstream and terminal buyers mostly restocked on dips, with transactions revolving around small orders in demand, making it difficult for market demand to improve. Entering May, the PBT market has ushered in a traditional off-season, with the spinning industry expected to experience a decline in production. The demand for modification in the field is still good, but profits have decreased. Moreover, due to the bearish mentality in the future market, the enthusiasm for purchasing goods is not high, and many products are purchased as needed. Overall, the demand side may continue to be sluggish.

PMMA market

Supply side: Although the production of PMMA particles in the market increased due to an increase in production capacity base in April, factory operations slightly decreased. It is expected that the tight particle spot situation in May will not be completely alleviated in the short term, and some factories may have maintenance expectations, so supply support still exists.

Demand side: Downstream rigid demand procurement, but cautious in pursuing high demand. Entering May, the terminal buying mentality remains cautious, and the market maintains a strong demand. Demand side:

Cost wise: The average price of raw material MMA in the market significantly increased in April, with monthly average prices in the East China, Shandong, and South China markets rising by 15.00%, 16.34%, and 8.00% month on month, respectively. Cost pressures have led to an increase in particle market prices. It is expected that MMA prices will remain high in the short term, and the cost of particle factories will continue to be under pressure.

Post time: May-07-2024