1、 Fundamental analysis of phenolic ketones

Entering May 2024, the phenol and acetone market was affected by the start-up of the 650000 ton phenol ketone plant in Lianyungang and the completion of maintenance of the 320000 ton phenol ketone plant in Yangzhou, resulting in changes in market supply expectations. However, due to low inventory at the port, the inventory levels of phenol and acetone in East China remained at 18000 tons and 21000 tons respectively, approaching the low levels in three months. This situation has led to a rebound in market sentiment, providing some support for the prices of phenol and acetone.

2、 Price trend analysis

Currently, the prices of phenol and acetone in China are at a relatively low level in the international market. Faced with this situation, domestic businesses are actively seeking overseas export opportunities to alleviate the supply pressure in the domestic market. From export data, there were approximately 11000 tons of phenol export orders waiting for shipment in China between May and June. This trend is expected to continue in the future, thereby boosting the prices of the domestic phenol market to some extent.

In terms of acetone, although there will be arrivals from Dalian and a small amount from Zhejiang next week, considering the restart of two phenol ketone factories in Jiangsu and the delivery of acetone contracts, there is an expectation of a gradual slowdown in the pick-up speed from the warehouse. This means that the supply pressure in the acetone market will be alleviated, providing some support for acetone prices.

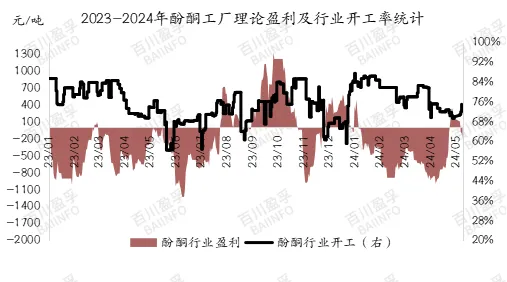

3、 Profit and loss analysis

Recently, the decline in phenol prices has led to a slight loss for high cost phenolic ketone enterprises. According to data, as of May 11, 2024, the single ton loss of non integrated phenolic ketone factories reached 193 yuan/ton. However, considering the limited availability of goods at the phenol terminal and the arrival time of imported goods from Saudi Arabia, it is expected that there will be a possibility of destocking in the phenol market next week. This factor will help boost the prices of the phenol market and have a positive impact on the profitability of phenolic ketone enterprises.

For the acetone market, although its price is relatively stable, considering the overall supply and demand situation of the market and the easing of future supply pressure, it is expected that the acetone market price will maintain a range consolidation trend. The price forecast for acetone at the East China terminal is between 8100-8300 yuan/ton.

4、 Subsequent development analysis

Based on the above analysis, it can be seen that the phenol and acetone markets will be affected by various factors in the future. On the one hand, an increase in supply will exert certain pressure on market prices; On the other hand, factors such as low inventory, rising purchasing power, and accumulated export orders will also provide support for market prices. Therefore, it is expected that the phenol and acetone markets will exhibit a volatile consolidation trend.

Post time: May-15-2024