During the Spring Festival holiday, most of the epoxy resin factories in China are in a state of shutdown for maintenance, with a capacity utilization rate of about 30%. Downstream terminal enterprises are mostly in a state of delisting and vacation, and there is currently no procurement demand. It is expected that after the holiday, some essential needs will support the market’s strong focus, but the sustainability is limited.

1、 Cost analysis:

1. Market trend of bisphenol A: The bisphenol A market shows narrow fluctuations, mainly due to the stability of raw material supply and the relatively stable demand side. Although changes in international crude oil prices may have a certain impact on the cost of bisphenol A, considering its wide range of uses, its price is less affected by a single raw material.

2. Market dynamics of epichlorohydrin: The epichlorohydrin market may show a trend of first rising and then falling. This is mainly due to the gradual recovery of downstream demand after the holiday and the recovery of logistics transportation. However, as supply increases and demand gradually stabilizes, prices may experience a pullback.

3. International crude oil trend prediction: There may be room for an increase in international oil prices after the holiday, which is mainly affected by OPEC’s production reduction, geopolitical tensions in the Middle East, and the upward adjustment of global economic growth forecast. This will provide cost support for the upstream raw materials of epoxy resin.

2、 Supply side analysis:

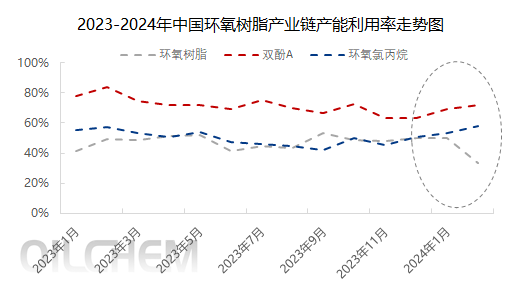

1. Capacity utilization rate of epoxy resin plant: During the Spring Festival, most epoxy resin plant units were shut down for maintenance, resulting in a significant decrease in capacity utilization rate. This is mainly a strategy adopted by enterprises to maintain supply-demand balance in the post holiday market.

2. New capacity release plan: In February, there is currently no new capacity release plan for the epoxy resin market. This means that the supply in the market will be limited in the short term, which may have a certain supportive effect on prices.

3.Terminal demand follow-up situation: After the holiday, downstream industries such as coatings, wind power, and electronics and electrical engineering may have phased replenishment of demand. This will provide certain demand support for the epoxy resin market.

3、 Market trend prediction:

Taking into account both cost and supply factors, it is expected that the epoxy resin market may experience a trend of first rising and then falling after the holiday. In the short term, the replenishment of demand in downstream industries and the slight increase in production enterprises may drive up market prices. However, as the phased replenishment ends and the supply gradually increases, the market may gradually regain rationality and prices may experience a correction.

Post time: Feb-19-2024