1、 Market situation: stabilizing and rising after a brief decline

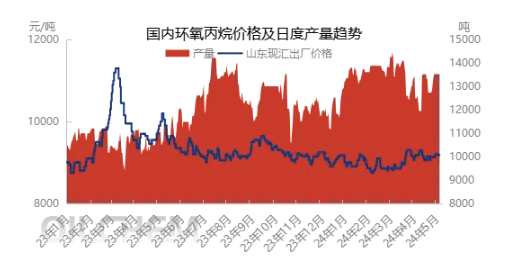

After the May Day holiday, the epoxy propane market experienced a brief decline, but then began to show a trend of stabilization and a slight upward trend. This change is not accidental, but influenced by multiple factors. Firstly, during the holiday period, logistics are restricted and trading activity decreases, leading to a stable decline in market prices. However, with the end of the holiday, the market began to recover vitality, and some production enterprises completed maintenance, resulting in a decrease in market supply and driving up prices.

Specifically, as of May 8th, the mainstream spot exchange ex factory price in Shandong region has risen to 9230-9240 yuan/ton, an increase of 50 yuan/ton compared to the holiday period. Although this change is not significant, it reflects a shift in market sentiment from being bearish to being cautious and optimistic.

2、 East China Supply: The tense situation is gradually easing

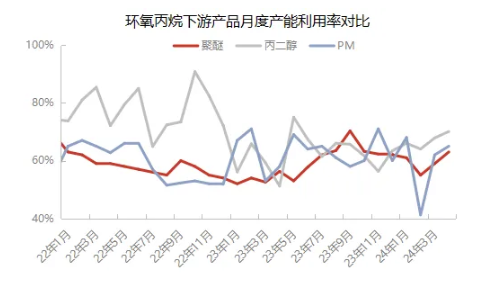

From the supply side perspective, it was originally expected that the 400000 ton/year HPPO plant of Ruiheng New Materials would resume operation after the holiday, but there was a delay in the actual situation. At the same time, the 200000 ton/year PO/SM plant of Sinochem Quanzhou was temporarily shut down during the holiday period and is expected to return to normal in mid month. The current industry capacity utilization rate is 64.24%. The East China region still faces the problem of insufficient available spot goods in the short term, while downstream enterprises have a certain degree of rigid demand after resuming work after the holiday. In the situation where there is a significant price difference between the north and south of epoxy propane, the allocation of goods from the north to the south effectively alleviated the supply pressure accumulated by factories in the north during holidays, and the market began to turn from weak to strong, with a slight increase in quotations.

In the future, Ruiheng New Materials is expected to start shipping gradually this weekend, but normal volume growth will still take some time. The restart of satellite petrochemical and the maintenance of Zhenhai Phase I are tentatively scheduled for around May 20th, and the two basically overlap, which will generate a certain supply hedging effect at that time. Although there are expected increases in the East China region in the future, the actual increase in volume is relatively limited this month. The tight spot supply and high price difference are expected to be moderately alleviated by the end of the month, and may gradually return to normal in June. During this period, the tight supply of goods in the East China region is expected to continue to support the overall epoxy propane market, with limited room for price fluctuations to decline.

3、 Raw material costs: limited fluctuations but need attention

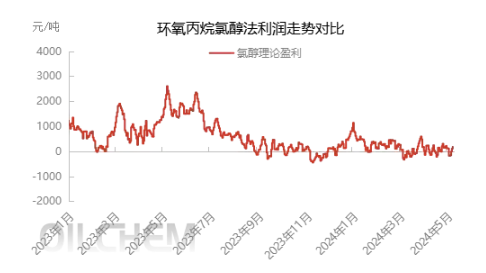

From a cost perspective, the price of propylene has maintained a relatively stable trend in recent times. During the holiday period, the price of liquid chlorine rebounded to a high level within the year, but after the holiday, due to resistance from downstream markets, the price experienced a certain degree of decline. However, due to fluctuations in individual devices on site, it is expected that the price of liquid chlorine may rebound slightly again in the second half of the week. At present, the theoretical cost of the chlorohydrin method remains within the range of 9000-9100 yuan/ton. With the slight increase in the price of epichlorohydrin, the chlorohydrin method has begun to return to a slightly profitable state, but this profit state is not yet sufficient to form strong market support.

There is a possibility of a narrow upward trend in the price of propylene in the future. Meanwhile, considering the maintenance plans for some units in the chlor alkali industry in May, it is expected that the market cost will show a certain upward trend. However, as the support for a slight increase in suppliers weakens in the middle to late months, the support for market costs may gradually increase. Therefore, we will continue to monitor the development of this trend.

4、 Downstream demand: maintaining stable growth but experiencing fluctuations

In terms of downstream demand, after the May Day holiday, feedback from the polyether industry shows that the number of new orders is temporarily limited. Specifically, the order volume in Shandong region remains at an average level, while the market demand in East China appears relatively cold due to the high price of epoxy propane, and end customers hold a cautious wait-and-see attitude towards the market. Some customers are interested in waiting for an increase in the supply of epoxy propane to seek more favorable prices, but the current market price trend is prone to rise but difficult to fall, and most essential customers still choose to follow up and purchase. At the same time, some customers have developed resistance towards high prices and choose to slightly reduce production load to adapt to the market.

From the perspective of other downstream industries, the propylene glycol dimethyl ester industry is currently in a state of comprehensive profit and loss, and the industry’s capacity utilization rate remains stable. It is reported that during the mid month period, Tongling Jintai plans to conduct parking maintenance, which may have a certain impact on overall demand. Overall, the performance of downstream demand is relatively lackluster at present.

5、 Future trends

In the short term, Ruiheng New Materials will be the main contributor to the increase in commodity volume this month, and it is expected that these increments will gradually be released into the market in the middle and late stages. At the same time, other sources of supply will generate a certain hedging effect, causing the overall peak of volume to be concentrated in June. However, due to favorable factors on the supply side, although the support in the mid to late months may weaken, it is still expected to maintain a certain level of support in the market. In addition, with the relatively stable and strong cost side, it is expected that the price of epoxy propane will mainly operate in the range of 9150-9250 yuan/ton in May. On the demand side, it is expected to present a passive and rigid demand follow-up trend. Therefore, the market should closely monitor the volatility and redemption of key devices such as Ruiheng, Satellite, and Zhenhai to evaluate further market trends.

When evaluating future market trends, special attention should be paid to the following risk factors: firstly, there may be uncertainty in the timing of device surface increment, which may have a direct impact on market supply; Secondly, if there is pressure on the cost side, it may reduce the enthusiasm of enterprises to start production, thereby affecting the supply stability of the market; The third is the implementation of actual consumption on the demand side, which is also one of the key factors determining market price trends. Market participants should closely monitor changes in these risk factors in order to make timely adjustments.

Post time: May-10-2024