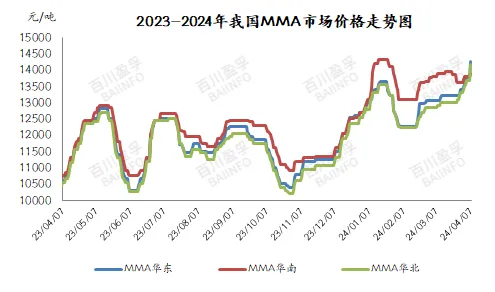

1、 Market Overview: Significant price increase

On the first trading day after Qingming Festival, the market price of methyl methacrylate (MMA) experienced a significant increase. The quotation from enterprises in East China has jumped to 14500 yuan/ton, an increase of 600-800 yuan/ton compared to before the holiday. At the same time, enterprises in Shandong region continued to raise their prices during the holiday period, with prices reaching 14150 yuan/ton today, an increase of 500 yuan/ton compared to before the holiday. Despite downstream users facing cost pressures and resistance towards high priced MMA, the scarcity of low-priced goods in the market has forced the trading focus to shift upwards.

2、 Supply side analysis: tight spot prices support prices

Currently, there are a total of 19 MMA production enterprises in China, including 13 using the ACH method and 6 using the C4 method.

In C4 production enterprises, due to poor production profits, three companies have been shut down since 2022 and have yet to resume production. Although the other three are in operation, some devices such as the Huizhou MMA device have recently undergone shutdown maintenance and are expected to resume in late April.

In ACH production enterprises, MMA devices in Zhejiang and Liaoning are still in a shutdown state; Two enterprises in Shandong have been affected by upstream acrylonitrile or equipment problems, resulting in low operating loads; Some enterprises in Hainan, Guangdong, and Jiangsu have limited overall supply due to routine equipment maintenance or incomplete release of new production capacity.

3、 Industry status: low operating load, no pressure on inventory

According to statistics, the average operating load of the MMA industry in China is currently only 42.35%, which is at a relatively low level. Due to the lack of pressure on factory inventory, the circulation of spot goods in the market appears particularly tight, further pushing up prices. In the short term, the tight spot situation is difficult to alleviate and will continue to support the upward trend of MMA prices.

4、 Downstream reactions and future prospects

Faced with high priced MMA, downstream users have difficulty transferring costs, and their ability to accept high prices is limited. It is expected that procurement will mainly focus on rigid demand. However, with the restart of some maintenance equipment in the later part of the month, the tight supply situation is expected to be alleviated, and market prices may gradually stabilize at that time.

In summary, the significant increase in current MMA market prices is mainly driven by tight spot supply. In the future, the market will still be affected by supply side factors, but with the gradual recovery of maintenance equipment, the price trend may gradually stabilize.

Post time: Apr-08-2024