In October, the phenol and ketone industry chain was in a strong shock as a whole. Only the MMA of downstream products declined in the month. The rise of other products was different, with MIBK rising most prominently, followed by acetone. In the month, the market trend of raw material pure benzene continued to decline after surging, and the highest level of East China negotiation reached 8250-8300 yuan/ton in the first ten days. In the middle and late ten days of the year, the market has concentrated negative effects. Downstream manufacturers have difficulty digesting the increase in raw materials. The pure benzene market has turned downward, which has much to do with the trend of the phenol market. In terms of phenol, the market in the month was affected by the energy atmosphere, cost side and supply and demand pattern. Considering the lack of cost support, bisphenol A market sentiment is not high, the industry is pessimistic about the future market, and trading and investment are weakening. At the same time, although the price of bisphenol A rose on a month on month basis in October, the overall focus was not strong, and the supply was expected to increase. However, downstream PC and epoxy resin continued to decline, mainly because of consumption contracts. The market of bisphenol A was lack of momentum to boost. Other products are also guided by the overall trend of the industrial chain.

Table 1 Ranking List of Rise and Fall of Phenol Ketone Industry Chain in October

Image data source: Jin Lianchuang

Analysis on the rise and fall of phenol ketone industry chain in October

Data source: Jin Lianchuang

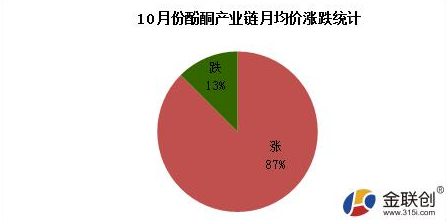

As shown in the figure above, according to the statistics of the monthly average price rise and fall of phenol and ketone industry chain in October, eight products rose by seven and fell by one.

Data source: Jin Lianchuang

In addition, according to the month on month average price statistics of phenol and ketone industry chain in October, the increase of each product is controlled within 15%. Among them, the rise of MIBK, a downstream product, is the most prominent, while the rise of pure benzene, an upstream product, is relatively narrow; In the month, only the MMA market fell, and the monthly average price fell 11.47% month on month.

Pure benzene: After the general trend of domestic pure benzene market rose in October, it continued to decline. During the month, Sinopec’s listed price of pure benzene increased by 350 yuan/ton to 8200 yuan/ton, and then decreased by 750 yuan/ton to 7450 yuan/ton from October 13 to the end of this month. In the first ten days, the international crude oil continued to rise, and the downstream styrene was mainly sorted out. The downstream merchants just needed to stock up and provided market support. The pure benzene market rose in price, and the East China market negotiated that the highest price would rise to 8250-8300 yuan/ton, but the market upward trend did not continue. In the middle and late ten days, the international crude oil fell, the pure benzene external market operated weakly, and the downstream styrene fell in shock, making the East China market talk back to – yuan/ton, and the pure benzene market began to decline continuously. As of October 28, the East China pure benzene market negotiation reference is 7300-7350 yuan/ton, the mainstream market quotation in North China is 7500-7650 yuan/ton, and the downstream large order purchase intention is 7450-7500 yuan/ton.

It is expected that the pure benzene market will be weak in the first ten days of November, and the market will be volatile in the second ten days. In the first half of the year, the external plate of pure benzene was weak, and the operation of downstream styrene was weak. The inventory of pure benzene in East China Port was accumulated, and the new unit Shenghong Petrochemical had been put into operation. The supply of pure benzene in the market will increase, and the planned maintenance of some downstream units will increase. The demand for pure benzene will decrease compared with the previous period. The supply and demand fundamentals are weak. The domestic pure benzene market is expected to remain weak. In the middle and late ten days, if new domestic pure benzene devices are launched as scheduled, the market supply will rise steadily and the market competition will become more intense. At the same time, some downstream devices are planned to restart and increase, the demand for pure benzene will further increase, the supply and demand fundamentals will be improved, and the domestic pure benzene market will be shaken and reorganized in the short term. At the same time, the market also needs to pay attention to the trend of international crude oil, and the profit and loss changes of the downstream industrial chain.

Propylene: In October, the high level of propylene market fell back, and the price center rebounded slightly compared with last month. As of the closing of the 31st day, the mainstream transactions in Shandong had reached 7000-7100 yuan/ton, down 525 yuan/ton compared with the closing of the previous month. The price fluctuation range in Shandong in the month was 7000-7750 yuan/ton, with an amplitude of 10.71%. In the first ten days of this month (1008-1014), the propylene market was dominated by first rising and then declining. At the initial stage, international crude oil continued to rise, and the main downstream market of propylene was on the strong side, with good demand performance. Fundamentals were dominated by profits. The supply and demand fundamentals were not under pressure, and the production enterprises continued to push up. Subsequently, the trend of international crude oil and polypropylene futures weakened, and local supply rebounded. The pressure on individual factories to ship increased, leading the decline and dragging down the market mentality. The enthusiasm for downstream purchasing declined, and the market weakness declined. In the middle and late ten days (1014-1021), the propylene market was mainly stabilized, with clear guidance on fundamentals and limited supply and demand. First, the propylene price continued to fall in the early stage, and the manufacturer’s attitude toward price fixing gradually rose. The downstream needs to replenish the warehouse at a lower price, and the market trading atmosphere is fair; Second, Shandong PDH’s opening and closing news is mixed, with strong uncertainty. The operators are cautious in trading, and mainly view the market rationally, with little fluctuation. At the end of the month (1021-1031), the propylene market was mainly weak. Due to the imbalance between supply and demand, local supply rebounded, shipment pressure rose, price competition continued, leading the decline to stimulate shipment, and the overall market mentality was dragged down. In addition, many places are affected by public health events, and the downstream just needs to buy, so the market trading atmosphere becomes weak.

In November, monetary policies from major European and American economies, Western Russian oil sanctions and the implementation of OPEC+production reduction agreement and other influencing factors were complicated, and the overall uncertainty was strong. It was expected that crude oil would show a trend of first restraining and then rising, focusing on cost changes and psychological impact. On the supply side, the increase is still the main trend. First, the storage and maintenance of some dehydrogenation units in Shandong is expected, but the uncertainty is strong, so it is recommended to pay close attention to it in the future; Second, with the launch of Tianhong and the restart of HSBC, the new production capacity will be significantly released, and some local refineries are expected to restart, and the supply may recover; Third, public health events occurred frequently in the main propylene production areas, which had a certain impact on transportation capacity. It is recommended to pay close attention to inventory changes. From the perspective of demand, it has entered the seasonal demand slack season, and the downstream and terminal demand of polypropylene has weakened, which has obviously restricted the demand for propylene; In the downstream of chemical industry, some propylene oxide and acrylic acid plants are expected to be put into production. If they are put into production as scheduled, the demand for propylene will be boosted. Jinlianchuang expects that the supply and demand game of propylene market will intensify in November, and the operation will be dominated by weak shocks.

Phenol: The domestic phenol market weakened at a high level in October, and the market fluctuation was affected by the energy atmosphere, cost side and supply and demand pattern. During the holiday, the international crude oil and energy and chemical commodities were generally strong, and the chemical market atmosphere was good. After the holiday, the listed price of Sinopec pure benzene was raised. Considering the continuous shortage of tradable spot goods, the main phenol producers offered high prices, and the market rose rapidly in a short time. However, immediately the crude oil price continued to fall, and the energy and chemical industry sector suffered from setbacks. The listing price of Sinopec pure benzene fell several times in the month, resulting in a relatively concentrated negative market. It was difficult for downstream manufacturers to absorb the increase in raw materials, and the market liquidity was greatly weakened. In particular, the middle and late ten days of the year entered the seasonal slack season, and the terminal new orders were not good. The poor delivery of phenol downstream plants led to a passive increase in product inventory and a sharp decrease in demand for raw materials. Considering the lack of cost support, bisphenol A market sentiment is not high, the industry is pessimistic about the future market, and trading and investment are becoming weak and deadlocked. However, the port inventory remained low, the replenishment at the port was lower than expected, and the overall operating rate of domestic phenol ketone enterprises was not high, and the tight spot supply supported the price reserve. As of October 27, the phenol market in East China had been negotiated around 10,300 yuan/ton, down 550-600 yuan/ton month on month from September 26.

The domestic phenol market is expected to be weak and volatile in November. Considering the weakening of the cost side and the difficulty of improving the terminal demand in the short term, the market rebound lacks momentum, and the pattern of weak supply and demand may continue. The new phenol production capacity of Wanhua in China is expected to be put into use in November this year, increasing the wait-and-see mood of the industry. However, phenol production enterprises have limited willingness to reduce prices, and the low port inventory also has some support. Without further aggravating the contradiction between supply and demand, there is limited room for continuous price decline. The downstream bisphenol A production capacity continues to grow, and the constraints from the demand side may be alleviated. It is expected that the phenol price will fluctuate slightly in November, so it is necessary to pay attention to the follow-up of macro news, cost side, end market and downstream enterprises.

Acetone: In October, the acetone market rose first and then fell, showing an inverted V trend. By the end of this month, the market price in East China had risen 100 yuan/ton to 5650 yuan/ton compared with the end of last month. Due to the strong international crude oil during the National Day holiday, the raw material pure benzene rose sharply, and the acetone market opened higher after the holiday. In particular, the spot supply continued to be tight. The commodity holders were generally reluctant to sell at low prices, and even appeared to be in the air. The market quickly rose to 6200 yuan/ton. However, after the high price, the downstream follow-up was weak. Some merchants chose to take profits, and their shipping intentions increased. The market fell slightly, but as the port inventory continued to decline, In the middle of the year, the market sentiment continued to improve, the prices of enterprises rose in succession, and the acetone market showed a strong performance. From the end of the day, the market atmosphere became weaker. The downstream bisphenol A and isopropanol markets continued to fall back, and the confidence of some businesses became loose. In addition, the ships arriving at the port were successively unloaded. The tense situation of spot supply was alleviated, the downstream demand declined, and the market slowly declined.

It is expected that the acetone market will be weak in November. Although the 650000 t/a phenol and ketone plant of Ningbo Taihua has started to be overhauled, the 300000 t/a phenol and ketone plant in Changshu Changchun is planned to restart in mid November, and the phenol and ketone plant has good profits. There is still room for improvement in domestic supply. Most downstream products are still weak. Downstream procurement intentions are cautious. In general, it is expected that the acetone market will decline rationally in November.

Bisphenol A: In October, the domestic bisphenol A market fell first and then rose. At the beginning of the month, due to the increase of factory inventory during the holidays, the market was stable and weak. The wait-and-see mood is heavy. In the middle of this month, Zhejiang Petrochemical held a post festival auction, and the price continued to fall, which had a negative impact on the bisphenol A market. After the festival, the load of Sinopec Mitsui unit increased after restart, and the load of Pingmei Shenma unit increased. After the festival, the operating rate of bisphenol A industry increased, and the supply is expected to increase. In addition, after the festival, the price of phenol rose slightly, showing a downward trend. Downstream PC and epoxy resin continued to decline, which had a certain impact on bisphenol A, mainly falling in the middle of the month. At the end of the month, after the completion of downstream replenishment, the purchasing enthusiasm decreased, and the new contract cycle began at the end of the month. The downstream mainly consumed contracts. The turnover of new orders was insufficient, and the momentum for BPA to rush up was insufficient, and the price began to fall back. By the deadline, the reference negotiation of East China bisphenol A market was around 16300-16500 yuan/ton, and the weekly average price rose 12.94% month on month.

It is expected that the domestic bisphenol A market will continue to decline in November. The support of raw material phenol ketone for bisphenol A is relatively weak. Affected by the sharp decline in the market in October, the bearish market conditions for raw materials account for the majority, and there is no good news to support the market. The market is weak, and the probability of adjustment is large. Pay more attention to the changes in supply and demand.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Nov-07-2022