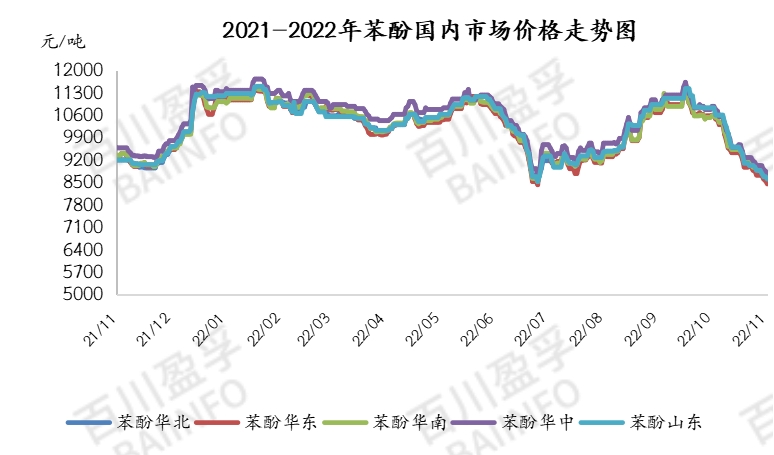

Since November, the price of phenol in the domestic market has continued to decline, with the average price of 8740 yuan/ton by the end of the week. In general, the transportation resistance in the region was still in the last week. When the shipment of the carrier was blocked, the phenol offer was cautious and low, the downstream terminal enterprises had poor buying, the on-site delivery was insufficient, and the follow-up of actual orders was limited. As of noon last Friday, the price of phenol in the mainstream market was 8325 yuan/ton, 21.65% lower than that in the same period last month.

Last week, the international market price of phenol in Europe, America and Asia weakened, while the price of phenol in Asia declined. The price of phenol CFR in China fell 55 to 1009 US dollars/ton, the price of CFR in Southeast Asia fell 60 to 1134 US dollars/ton, and the price of phenol in India fell 50 to 1099 US dollars/ton. The price of phenol in the US market remained stable, while the FOB US Gulf price stabilized to US $1051/t. The price of phenol in the European market rose, the FOB Rotterdam price fell by 243 to 1287 US dollars/ton, and the FD price in Northwest Europe rose by 221 to 1353 euros/ton. The international market was dominated by price decline.

Supply side: a 650000 t/a phenol and ketone plant in Ningbo was shut down for maintenance, a 480000 t/a phenol and ketone plant in Changshu was shut down for maintenance, and a 300000 t/a phenol and ketone plant in Huizhou was restarted, which had a negative impact on the phenol market. The specific trend continues to follow. At the beginning of last week, the inventory level of domestic phenol plants decreased compared with that at the end of last week, with the inventory of 23000 tons, 17.3% lower than that at the end of last week.

Demand side: The terminal factory’s buying is not good this week, the mentality of the cargo holders is unstable, the offer continues to weaken, and the market turnover is insufficient. By the end of this week, the average gross profit of phenol was about 700 yuan/ton less than that of the previous week, and the average gross profit of this week was about 500 yuan/ton.

Cost side: Last week, the domestic pure benzene market declined. The price of domestic pure benzene market continued to decline, styrene declined weakly, the market mentality was empty, trading in the market was cautious, and the transaction was average. On Friday afternoon, the spot closing negotiation referred to 6580-6600 yuan/ton; The price center of Shandong pure benzene market fell, the downstream demand support was weak, the refinery mentality became weak, and the local refining offer continued to decline. The mainstream reference was 6750-6800 yuan/ton. The cost is not enough to support the phenol market.

This week, a 480000 t/a phenol and ketone plant in Changshu is planned to restart, and the supply side is expected to improve; Downstream demand will continue to be just in need of purchase, which is insufficient to support the phenol market. The price of raw material pure benzene may continue to decline, the price of propylene mainstream market will continue to settle steadily, the mainstream price range will fluctuate between 7150-7400 yuan/ton, and the cost support is insufficient.

On the whole, the supply of phenol and ketone enterprises increased, but the demand side was sluggish, the negotiation atmosphere was insufficient under the weak supply and demand fundamentals, and the short-term weakness of phenol was sorted out.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Nov-28-2022