The overall supply of glacial acetic acid market in August is high, and some downstream is in the off-season, so the demand for acetic acid may be limited. As there are fewer overhaul enterprises this month, only Shanghai Huayi and Dalian Hengli have overhaul plans, the supply remains high, and the factory inventory is at a medium-high level. It is difficult to support the price increase because there are many negative aspects in the short-term glacial acetic acid market.

In recent years, the production capacity of glacial acetic acid and its main downstream industries has shown a growing trend. However, the profit transmission in the industry chain is not balanced. In the future, it will remain one of the drivers of profit and demand expansion. The supply capacity of glacial acetic acid is bound to go up even more. At that time, the balance between supply and demand will be broken.

Although glacial acetic acid production capacity is gradually increasing, consumption is also showing a growth trend, but the profit transmission in the industry chain is not balanced, and the profit situation in some downstream can hardly be said to be ideal.

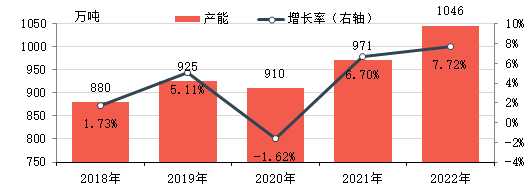

Glacial acetic acid production capacity is gradually expanding

During 2018-2022, glacial acetic acid production capacity in China steadily increased, supported by the development of downstream demand and good profitability. As of 2022, the effective annual capacity of glacial acetic acid is 10.46 million tons, up 18 t.86% from 2018.

Over the past five years, the overall price of glacial acetic acid has been on an upward trend, supported by increasing domestic demand and an active export market. At the same time, it has maintained a large price differential with raw material methanol most of the time, resulting in a strong profitability and a long profitability time.

In 2017-2018, foreign glacial acetic acid plant starts were unstable, and the export market provided support for the domestic market. In addition, with the slowdown of domestic glacial acetic acid capacity and downstream capacity expansion, the demand for glacial acetic acid just increased, which together supported the rise of domestic glacial acetic acid prices. Although the trend is basically the same as that of raw material methanol, the price difference keeps expanding and the profit margin expands. in 2018, the average theoretical gross profit in the east China market was about 1,753 yuan/ton. in 2019-2020, domestic glacial acetic acid production capacity steadily rises and supply increases. Demand declines in phases due to unexpected factors. Domestic glacial acetic acid prices are volatile, and the price difference with methanol decreases to some extent. in 2020, the average theoretical gross profit in the east China market is about 504 yuan/ton. in 2021, although both methanol and glacial acetic acid prices are on an upward trend, the price of glacial acetic acid rises more due to the increase in domestic and foreign demand and the phased decrease in supply, making the price difference between the two continue to expand. The annual average gross margin in the East China market was around RMB399/ton.41%.

Although the profit was quite substantial, downstream demand showed continued growth, causing existing producers and new market players to develop new glacial acetic acid project plans, most of which were also implemented.

Future downstream demand is still increasing

There are still plans for new capacity for most downstream products in the future, driving continued growth in glacial acetic acid supply capacity.

From 2021 to 2022, EVA production capacity is rapidly expanding and products are also approaching high growth VA vinyl acetate content, with a significant increase in demand for vinyl acetate, expansion of vinyl acetate production capacity, and a prominent non-calcium carbide supply shortage. Since 2022, some calcium carbide supply has been supplemented to the original ethylene supply users, China’s ethylene acetate supply pattern has changed from a structural surplus to structural tension. EVA is partially considering self-built ethylene acetate due to the increased difficulty and cost of purchase by users. Until then, a number of projects under construction are underway and ethylene vinyl acetate production capacity will be released in 2023.

Ethyl acetate is also one of the major downstream products of glacial acetic acid. In recent years, the contradiction between supply and demand of ethyl acetate has been prominent, and the growth rate of capacity is relatively slow. 2022-2023, new capacity is still mainly found in existing companies, mostly to expand industry share, further reduce costs and improve efficiency. In addition, with the current trend of integration in the petrochemical industry becoming more and more obvious, some companies plan to build new ethyl acetate plants to expand the industrial chain. However, due to the simple production process of ethyl acetate, fast change of domestic equipment and flexible production, mostly based on cost and demand changes, the output growth rate has been slow in recent years.

In terms of acetic anhydride, in recent years, new equipment and obsolete equipment co-exist, and the overall supply shows a growth trend. From the perspective of consumption structure, it is mainly used in the production of acetate fiber, pharmaceutical intermediates, pesticide intermediates, spices, dyes, food additives, chemical dehydration agents and other fields. Some domestic acetic fiber plants are equipped with acetic anhydride plants, and the integration in other fields is not high. In the future, acetic anhydride plants will still be under construction. Ningxia Donghe plans to put 150,000 tons into operation in the second half of this year. Henan Ruibai also plans to build a new acetic anhydride plant, and the production capacity of the industry is expected to continue to expand. Acetic anhydride has a wide range of downstream areas and there is still some room for growth on the demand side, but with the increase in production capacity, the industry will become increasingly competitive.

More new projects for glacial acetic acid in the future, the balance of supply and demand may be broken

The better profit performance in recent years, as well as the continuous increase in downstream demand, make glacial acetic acid supply also keep increasing momentum, and the next three years are no exception.

The above table shows some of the new capacity plans for glacial acetic acid in the next three years, in addition to some companies also have new construction and expansion plans, it can be seen that glacial acetic acid future capacity growth is still expected to be relatively large. Although the downstream demand will also have a sustained had rise, but whether it can completely absorb the incremental glacial acetic acid supply remains to be further observed, and it cannot be ruled out that glacial acetic acid in China will have overcapacity.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Aug-16-2022