According to the statistics from January to October 2022, the import and export trade volume of MMA shows a downward trend, but the export is still larger than the import. It is expected that this situation will remain under the background that new capacity will continue to be introduced in the fourth quarter of 2022 and the first quarter of 2023.

According to the statistics of the General Administration of Customs of China, the import volume of MMA from January to October 2022 is 95500 tons, a year-on-year decrease of 7.53%. The export volume was 116300 tons, a year-on-year decrease of 27.7%.

MMA market import analysis

For a long time, China’s MMA market has been heavily dependent on imports, but since 2019, China’s production capacity has entered the centralized production period, and the self-sufficiency rate of the MMA market has gradually increased. Last year, the import dependence dropped to 12%, and is expected to continue to decline by 2 percentage points this year. In 2022, China will become the largest MMA producer in the world, and its MMA capacity is expected to account for 34% of the global total capacity. This year, China’s demand growth slowed down, so the import volume showed a downward trend.

MMA market export analysis

According to the export data of China’s MMA in recent five years, the annual average export volume before 2021 is 50000 tons. Since 2021, MMA exports have increased significantly to 178700 tons, an increase of 264.68% over 2020. On the one hand, the reason is the increase of domestic production capacity; On the other hand, it was also affected by the closure of two sets of foreign equipment last year and the cold wave in the United States, which made it possible for China’s MMA manufacturers to quickly open the export market. Due to the lack of force majeure last year, the overall export data in 2022 is not as eye-catching as last year. It is estimated that the export dependency of MMA will be 13% in 2022.

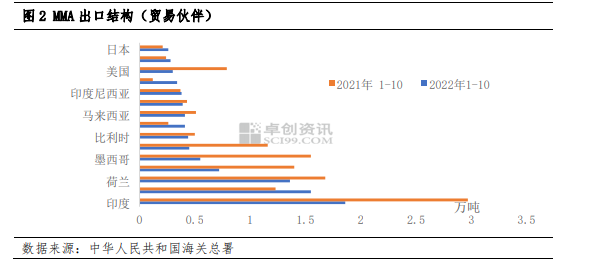

China’s MMA export flow is still dominated by India. From the perspective of export trading partners, China’s MMA exports from January to October 2022 are mainly India, Taiwan and the Netherlands, accounting for 16%, 13% and 12% respectively. Compared with last year, the export volume to India dropped by 2 percentage points. India is the main destination of general trade, but it is greatly affected by the inflow of Saudi Arabia’s goods into the Indian market. In the future, the demand of Indian market is the key factor for China’s export.

MMA Market Summary

By the end of October 2022, the MMA capacity that was originally planned to be put into production this year has not been fully released. The 270000 ton capacity has been delayed to the fourth quarter or the first quarter of 2023. Later, the domestic capacity has not been fully released. The MMA capacity continues to be released at an accelerated rate. MMA manufacturers are still seeking more export opportunities.

The recent devaluation of the RMB does not provide a greater advantage for the devaluation of the RMB MMA exports, because from the data in October, the increase in imports continues to decrease. In October 2022, the import volume will be 18,600 tons, a month on month increase of 58.53%, and the export volume will be 6200 tons, a month on month decrease of 40.18%. However, considering the pressure of high energy cost faced by Europe, import demand may increase. In general, future MMA competition and opportunities coexist.

Post time: Nov-24-2022