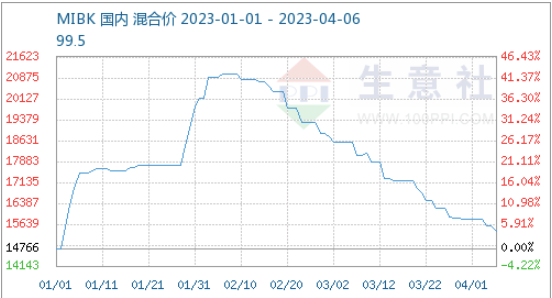

In the first quarter, the MIBK market continued to fall after a rapid rise. The tanker outgoing price rose from 14,766 yuan/ton to 21,000 yuan/ton, the most dramatic 42% in the first quarter. As of April 5, it has fallen to RMB 15,400/ton, down 17.1% YoY. The main reason for the market trend in the first quarter was the significant reduction in domestic production and the heavy speculative factor. The rapid replenishment of import volumes and the commissioning of new equipment eased the expected tightness on the supply side, and demand continued to be sluggish with limited acceptance of high-priced raw materials. In the second quarter, the MIBK market is likely to enter a weak adjustment run period.

Low demand for raw materials procurement is limited, the main downstream antioxidants may have shutdown plans. Slow resumption of downstream work, low raw material MIBK, limited acceptance of high-priced MIBK by the terminal manufacturing industry in the doldrums, and high pressure on traders to ship. With expectations difficult to improve, actual orders on site continue to decline and most deals just need to be followed up. In the second quarter, the end demand is still difficult to improve, 4020 antioxidant industry may have shutdown plans. With the long-term decline in MIBK, the downward space is narrowing, and there may also be an appropriate inventory market cyclical retracement. The spot trading strategy can be used with the help of the commercial social commodity market analysis system, in the product spot strategy will be the price of the cycle into high, medium, medium and low five levels, and according to the current price position to guide the inventory trading strategy.

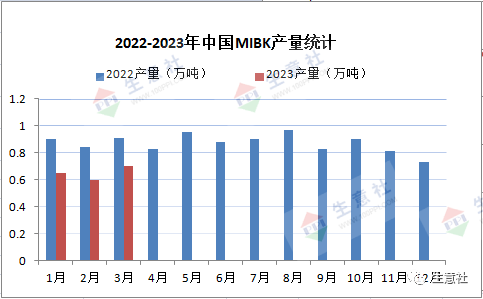

Import volumes are well replenished and MIBK fell all the way in February-March. Since the closure of Zhenjiang Li Changrong 50,000 tons/year MIBK facility on December 25, 2022, the monthly loss was 0.45 million tons. This event had a significant impact on the MIBK market, not least because of the hype factor. Domestic production in the first quarter was about 20,000 tons, down 26% year-on-year. As shown in the chart above, MIBK production declined in the first quarter. However, Ningbo Juhua, Zhangjiagang Kailing and other equipment with a total capacity of 30,000 tons put into production has been replenished, and the rate of replenishment of imported supplies has accelerated. It is understood that the import volume of MIBK increased 125% in January, and the total import volume of 5,460 tons in February, up 123% YoY. Affected by the tight domestic supply, prices rose sharply, the first quarter imports grew significantly, with a large impact on domestic supply. In the second quarter, social stocks were sufficient and the supply side remained loose.

The first quarter MIBK market rose and fell sharply, and finally due to cold demand market prices gradually returned to rational space, April domestic supply changes are limited, but there may also be short-term unexpected maintenance, the current enterprise inventory is sufficient, imports may have some decline, the overall supply fell slightly. in April, demand confidence is seriously lacking, cost factors resist high prices of raw materials, holders also changed their mindset, profits and shipments increased. But in general, downstream inventory is small, in order to maintain production demand, there may be a supplement later, the second quarter, with the price decline or bottom behavior, the second quarter demand side is difficult to improve, anti-aging agent or shutdown is expected, demand is poor, is expected in April MIBK gradually bottomed out after entering a weak adjustment period.

Post time: Apr-07-2023