Recently, many chemical products in China have experienced a certain degree of increase, with some products experiencing an increase of over 10%. This is a retaliatory correction after a cumulative decline of nearly a year in the early stage, and has not corrected the overall trend of market decline. In the future, the Chinese chemical product market will remain relatively weak for a long time.

Octanol uses acrylic acid and synthesis gas as raw materials, vanadium as catalyst to generate mixed butyraldehyde, through which n-butyraldehyde and Isobutyraldehyde are refined to obtain n-butyraldehyde and isobutyraldehyde, and then the octanol product is obtained through shrinkage hydrogenation, distillation, rectification and other processes. The downstream is mainly used in the field of plasticizers, such as dioctyl terephthalate, dioctyl Phthalic acid, isooctyl acrylate, etc. TOTM/DOA and other fields.

The Chinese market has a high level of attention to octanol. On the one hand, the production of octanol is accompanied by the production of products such as butanol, which belongs to a series of products and has a wide market impact; On the other hand, as an important product of plasticizers, it has a direct impact on the downstream plastic consumer market.

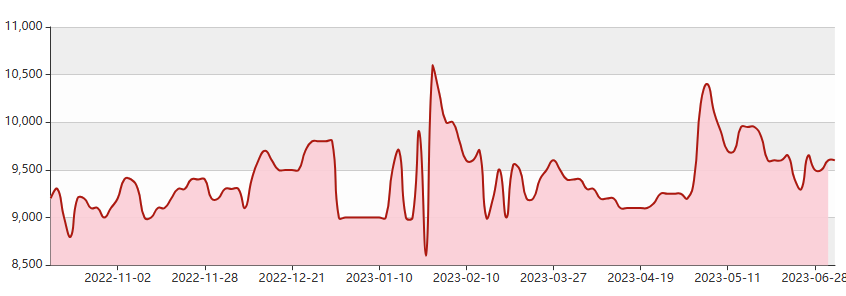

In the past year, the Chinese octanol market has experienced significant price fluctuations, ranging from 8650 yuan/ton to 10750 yuan/ton, with a range of 24.3%. On June 9, 2023, the lowest price was 8650 yuan/ton, and the highest price was 10750 yuan/ton on February 3, 2023.

In the past year, the market price of octanol has fluctuated greatly, but the maximum amplitude is only 24%, which is significantly lower than the decline in the mainstream market. In addition, the average price in the past year was 9500 yuan/ton, and currently the market has exceeded the average price, indicating that the overall performance of the market is stronger than the average level in the past year.

Figure 1: Price Trend of Octanol Market in China in the Last Year (Unit: RMB/ton)

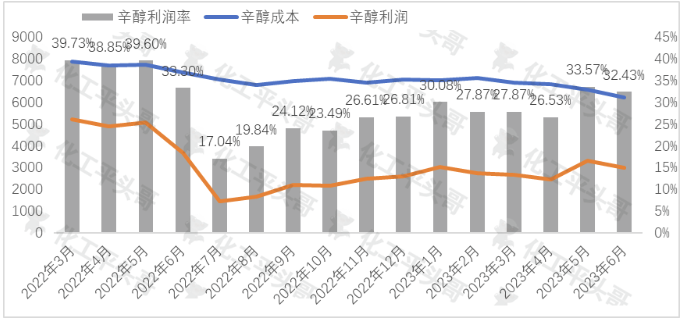

Meanwhile, due to the strong market price of octanol, the overall production profit of octanol is ensured to be at a high level. According to the cost formula for propylene, the Chinese octanol market has maintained a high profit margin in the past year. The average profit margin of the Chinese octanol market industry is 29%, with a maximum profit margin of around 40% and a minimum profit margin of 17%, from March 2022 to June 2023.

It can be seen that although market prices have decreased, octanol production is still at a relatively high level. Compared with other products, the profit level of octanol production in China is higher than the average level of bulk chemical products.

Figure 2: Profit Changes of Octanol in China over the Past Year (Unit: RMB/ton)

The reasons for the consistently high level of octanol production profit are as follows:

Firstly, the decrease in raw material costs is significantly greater than that of octanol. According to statistics, propylene in China decreased by 14.9% from October 2022 to June 2023, while octanol prices increased by 0.08%. Therefore, the decrease in raw material costs has led to more production profits for octanol, which is also a key reason to ensure that octanol profits remain high.

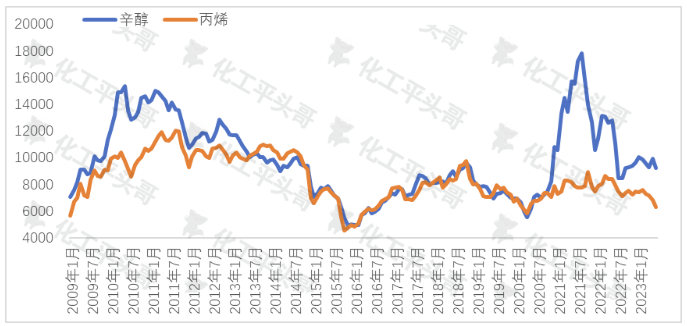

From 2009 to 2023, the price fluctuations of propylene and octanol in China showed a consistent trend, but the octanol market had a larger amplitude and the volatility of the propylene market was relatively conservative. According to the validity test of the data, the fitting degree of price fluctuations in the propylene and octanol markets is 68.8%, and there is a certain correlation between the two, but the correlation is weak.

From the figure below, it can be seen that from January 2009 to December 2019, the fluctuation trend and amplitude of propylene and octanol were basically consistent. From the data fit during this period, the fit between the two is around 86%, indicating a strong correlation. But since 2020, octanol has significantly increased, which is significantly different from the fluctuation trend of propylene, which is also the main reason for the decrease in fitting between the two.

From 2009 to June 2023, the price trend of octanol and propylene in China fluctuated (unit: RMB/ton)

Secondly, in recent years, the new production capacity in the octanol market in China has been limited. According to relevant data, since 2017, there have been no new octanol equipment in China, and the overall production capacity has remained stable. On the one hand, the expansion of octanol scale requires participation in Forming gas, which limits many new enterprises. On the other hand, the slow growth of downstream consumer markets has resulted in the supply side of the octanol market not being driven by demand.

On the premise that China’s octanol production capacity does not increase, the supply and demand atmosphere in the octanol market has eased, and market conflicts are not prominent, which also supports the production profits of the octanol market.

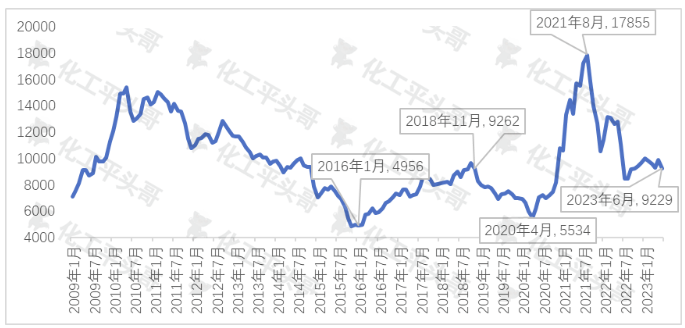

The price trend of octanol market from 2009 to present has fluctuated from 4956 yuan/ton to 17855 yuan/ton, with a huge fluctuation range, which also indicates the huge uncertainty of octanol market prices. From 2009 to June 2023, the average price of octanol in the Chinese market ranged from 9300 yuan/ton to 9800 yuan/ton. The emergence of several inflection points in the past also indicates the support or resistance of octanol average prices to market fluctuations.

By June 2023, the average market price of octanol in China was 9300 yuan per ton, which is basically within the average market price range of the past 13 years. The historical low point of the price is 5534 yuan/ton, and the inflection point is 9262 yuan/ton. That is to say, if the octanol market price continues to decline, the low point may be the support level for this downward trend. With the rebound and rise of prices, its historical average price of 9800 yuan/ton may become a resistance level to price increase.

From 2009 to 2023, the price trend of octanol in China fluctuated (unit: RMB/ton)

In 2023, China will add a new set of octanol devices, which will break the record of no new octanol devices in the past few years and is expected to exacerbate the negative hype atmosphere in the octanol market. Moreover, in the expectation of long-term weakness in the chemical market, it is expected that the prices of octanol in China will remain relatively weak for a long time, which may put some pressure on profits at a higher level.

Post time: Jul-11-2023