On February 28, 2018, the Ministry of Commerce issued a notice on the final determination of the anti-dumping investigation of imported bisphenol A originating in Thailand. From March 6, 2018, the import operator shall pay the corresponding anti-dumping duty to the customs of the People’s Republic of China. PTT Phenol Co., Ltd. will levy 9.7%, and other Thai companies will levy 31.0%. The implementation period is five years from March 6, 2018.

That is to say, on March 5, the anti-dumping of bisphenol A in Thailand officially expired. What impact will the supply of bisphenol A in Thailand have on the domestic market?

Thailand is one of the main import sources of bisphenol A in China. There are two bisphenol A production enterprises in Thailand, among which the capacity of Costron is 280000 tons per year, and its products are mainly for self-use; Thailand PTT has an annual capacity of 150000 tons, and its products are mainly exported to China. Since 2018, the export of BPA from Thailand has been basically the export of PTT.

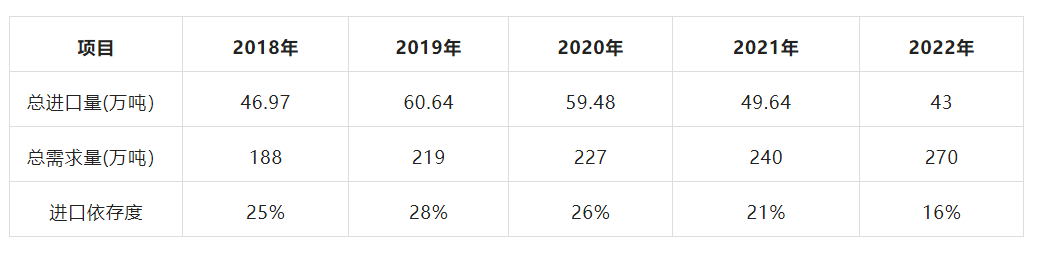

Since 2018, the import of bisphenol A in Thailand has decreased year by year. In 2018, the import volume was 133000 tons, and in 2022, the import volume was only 66000 tons, with a decline rate of 50.4%. The anti-dumping effect was obvious.

Figure 1 Change in the quantity of bisphenol A imported from Thailand by China Figure 1

The decline of import volume may be related to two aspects. First, after China imposed anti-dumping duties on Thailand’s BPA, the competitiveness of Thailand’s BPA declined and its market share was occupied by manufacturers from South Korea and Taiwan, China Province of China; On the other hand, domestic bisphenol A production capacity has increased year by year, domestic self-supply has increased, and external dependence has decreased year by year.

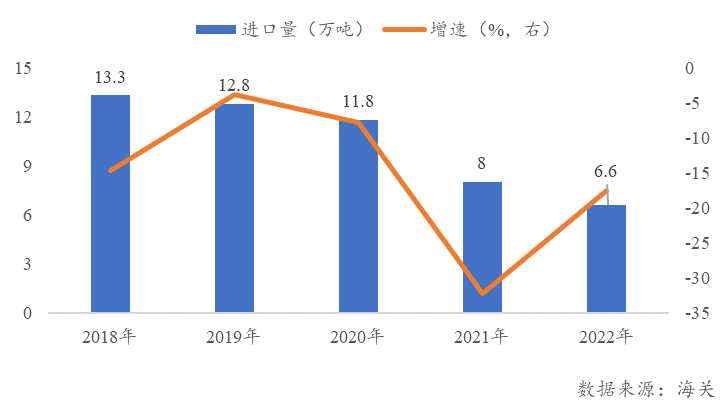

Table 1 China’s import dependence on bisphenol A

For a long time, the Chinese market is still the most important export market of BPA in Thailand. Compared with other countries, the Chinese market has the advantages of short distance and low freight. After the end of anti-dumping, Thailand BPA has neither import tariff nor anti-dumping duty. Compared with other Asian competitors, it has obvious price advantages. It is not ruled out that Thailand’s export of BPA to China will rebound to more than 100000 tons/year. The domestic bisphenol A production capacity is large, but most of the downstream PC or epoxy resin plants are equipped, and the actual export volume is far less than the production capacity. Even though the import volume of bisphenol A in Thailand dropped to 6.6 tons in 2022, it still accounted for the proportion of total domestic goods.

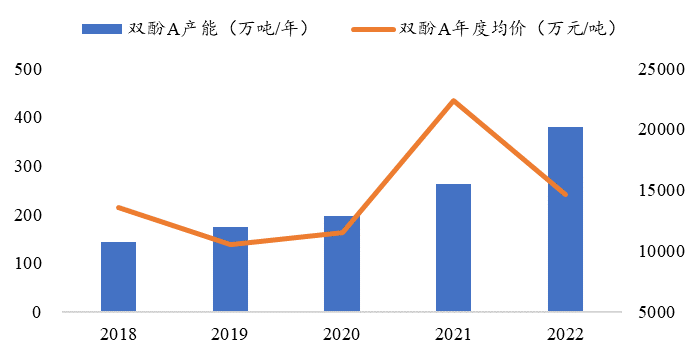

With the development trend of industrial integration, the matching rate of domestic upstream and downstream is gradually increasing, and China’s bisphenol A market will be in a period of rapid expansion of production capacity. As of 2022, there are 16 bisphenol A production enterprises in China with an annual capacity of more than 3.8 million tons, of which 1.17 million tons will be added in 2022. According to statistics, there will still be more than one million tons of new production capacity of bisphenol A in China in 2023, and the situation of oversupply of bisphenol A market will further intensify.

Figure 22018-2022 Production capacity and price changes of bisphenol A in China

Since the second half of 2022, with the continuous increase of supply, the domestic price of bisphenol A has dropped sharply, and the price of bisphenol A has hovered around the cost line in recent months. Secondly, from the perspective of raw material cost of bisphenol A, the raw material phenol imported from China is still in the anti-dumping period. Compared with the international market, the raw material cost of domestic bisphenol A is higher, and there is no cost competitive advantage. The increase of low-price BPA supply from Thailand entering China will inevitably depress the domestic price of BPA.

With the expiration of Thailand’s bisphenol A anti-dumping, the domestic bisphenol A market will have to bear the pressure of rapid expansion of domestic production capacity on the one hand, and also absorb the impact of Thailand’s low-cost import sources. It is expected that the domestic bisphenol A price will continue to be under pressure in 2023, and the homogenization and low price competition in the domestic bisphenol A market will become more intense.

Post time: Mar-14-2023