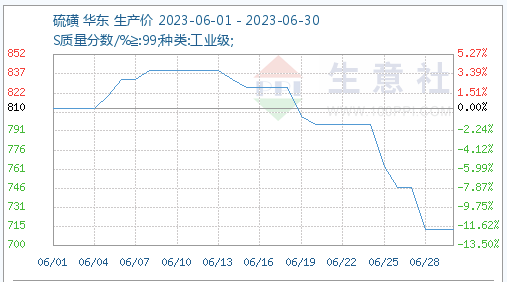

In June, the sulfur price trend in East China rose first and then fell, resulting in a weak market. As of June 30th, the average ex factory price of sulfur in the East China sulfur market is 713.33 yuan/ton. Compared to the average factory price of 810.00 yuan/ton at the beginning of the month, it decreased by 11.93% during the month.

This month, the sulfur market in East China has been sluggish and prices have dropped significantly. In the first half of the year, market sales were positive, manufacturers shipped smoothly, and sulfur prices increased; In the second half of the year, the market continued to decline, mainly due to weak downstream follow-up, poor factory shipments, sufficient market supply, and an increase in negative market factors. Refinery enterprises continued to decline in market trading centers in order to promote shipment price reductions.

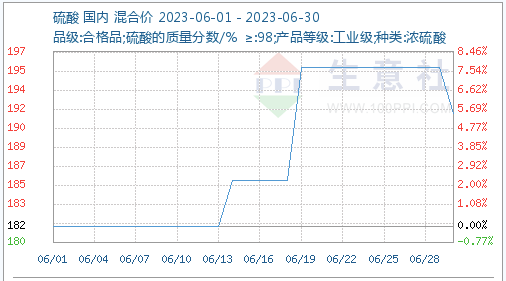

The downstream sulfuric acid market rose first and then fell in June. At the beginning of the month, the market price of sulfuric acid was 182.00 yuan/ton, and at the end of the month, it was 192.00 yuan/ton, an increase of 5.49% within the month. Domestic mainstream sulfuric acid manufacturers have low monthly inventory, resulting in a slight increase in sulfuric acid prices. The terminal market is still weak, with insufficient demand support, and the market may be weak in the future.

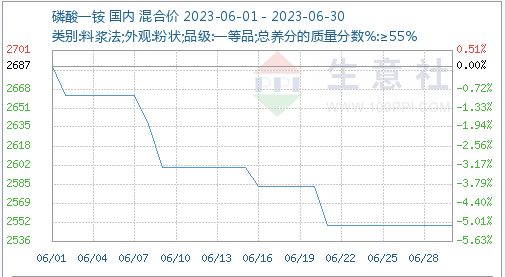

The market for monoammonium phosphate continued to decline in June, with weak downstream demand and a small number of new orders dominated by demand, lacking market confidence. The trading focus of monoammonium phosphate continued to decline. As of June 30th, the average market price of 55% powdered ammonium monohydrate was 25000 yuan/ton, which is 5.12% lower than the average price of 2687.00 yuan/ton on June 1st.

Market prospect prediction shows that the equipment of sulfur enterprises is operating normally, the market supply is stable, downstream demand is average, goods are cautious, manufacturers’ shipments are not good, and the supply-demand game predicts low consolidation in the sulfur market. Specific attention should be paid to downstream follow-up.

Post time: Jul-04-2023