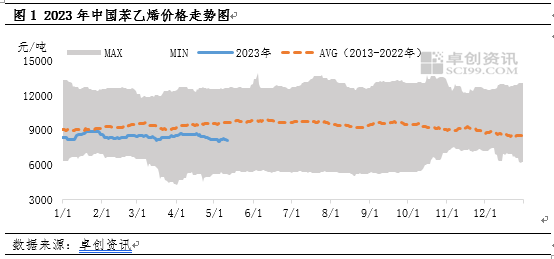

Since 2023, the market price of styrene has been operating below the 10-year average. Since May, it has increasingly deviated from the 10-year average. The main reason is that the pressure of pure benzene from providing cost boosting force to expanding the cost side has weakened the price of styrene. Overall, the price of styrene may continue to rely on cost guidance, and the blockade of supply and demand on cost transmission may be difficult to enhance.

Since 2023, styrene prices have been consistently operating below the 10-year moving average. On the one hand, the accelerated release of new styrene production has led to a sustained weakening of its supply and demand relationship; On the other hand, since Zhongyuan Oil entered the downward channel in 2022, it has stabilized and fluctuated, with no upward trend. During this period, upstream pure benzene relied on a good supply and demand relationship to support the price of styrene. However, in May, as the supply and demand relationship of pure benzene gradually weakened, styrene prices

also faced downward pressure.

Cost: It is difficult for crude oil to show a unilateral trend, but the supply and demand of pure benzene may weaken or continue to exert pressure.

As an energy product, crude oil will continue to fluctuate in the market over the next three months due to macro interest rate hikes and production cuts. There will be no mainstream conflicts, and the oil price will continue to fluctuate within a range. US crude oil is focused on $65- $85 per barrel. At present, there are three main scenarios that dominate the trend of oil prices, namely the Federal Reserve’s monetary tightening, OPEC+production adjustment, and marginal changes in global macro and Chinese economy. It is necessary to pay attention to the impact of unexpected changes on oil prices in these three major scenarios.

Since March of this year, pure benzene has relied heavily on supply and demand (with good demand for oil blending in Europe and America, and more maintenance equipment in Asia, driving up the price of pure benzene in the external market; domestic supply is relatively stable, but with the accelerated release of new downstream production, demand has increased). During the process of oil price increase and downward transmission, there was a strong upward push on styrene, while during the process of oil price decrease and downward transmission, there was a clear support for styrene price. From the price difference between pure benzene and styrene in Figure 3, it can be seen that from mid March to the end of April, pure benzene relied heavily on supply and demand, and the price difference with styrene continued to narrow, narrowing to within 1080 yuan/ton by the end of April.

However, in May, the impact of pure benzene on styrene significantly weakened, mainly due to the gradual increase in the number of downstream pure benzene maintenance units, the abundance of some raw material contracts, and the addition of domestic trade to the East China tank farm, which is expected to increase inventory. Meanwhile, the demand for oil blending in Europe and America has not increased, which is conducive to its release. However, with the return of major repairs to Asian pure benzene plants, supply has increased one after another, and external prices are under certain pressure.

Supply and demand relationship: Difficulty in cost transmission and hindering force

While there are variables on the supply and demand side, the effect of cost on styrene prices has shifted from boosting to exerting pressure, but the supply and demand relationship may be difficult to change significantly.

Firstly, in terms of supply, starting from mid May, the number of styrene maintenance equipment has increased, with a total of 8 companies starting to repair approximately 3.2 million tons of equipment production capacity. In June, styrene production is expected to decrease by 110000 tons to 1.24 million tons compared to May, a decrease of 8.15% compared to the previous month.

Secondly, in terms of demand, most downstream styrene production in June is in a seasonal off-season, and the demand for styrene may decrease. According to data from 2021 to 2022, the demand for styrene in the seven downstream regions of styrene has decreased, with a decrease of over 11% in 2022. However, it is close to the change in production in 2022, and there is adaptability between the supply and demand sides.

Overall, the supply and demand of styrene decreased in June, but with the adaptive adjustment of the supply and demand side, it may be difficult for the supply and demand relationship of styrene to change significantly, making it difficult to unilaterally drive the price of styrene. The price of styrene may continue to rely on the cost side’s change guidelines.

Post time: May-16-2023