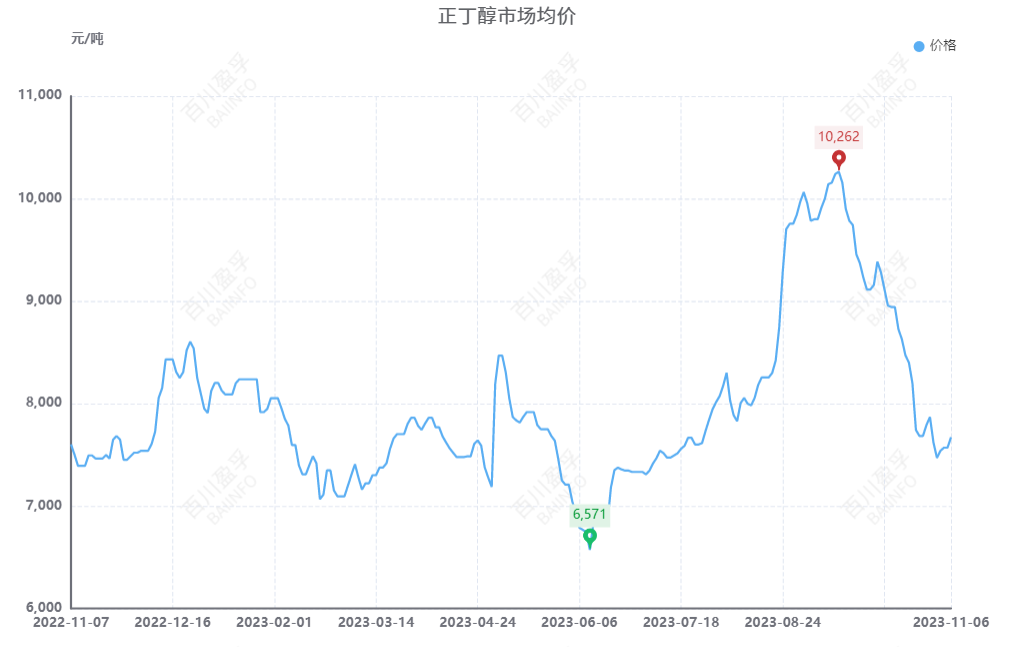

On November 6th, the focus of the n-butanol market shifted upwards, with an average market price of 7670 yuan/ton, an increase of 1.33% compared to the previous working day. The reference price for East China today is 7800 yuan/ton, the reference price for Shandong is 7500-7700 yuan/ton, and the reference price for South China is 8100-8300 yuan/ton for peripheral delivery. However, in the n-butanol market, negative and positive factors are intertwined, and there is limited room for price increases.

On the one hand, some manufacturers have temporarily stopped for maintenance, resulting in a relative decrease in market spot prices. Operators are selling at high prices, and there is room for an increase in the market price of n-butanol. On the other hand, a butanol and octanol plant in Sichuan has been restarted, and the regional supply gap has been replenished due to the sunrise of products in the future. In addition, the recovery of butanol plants in Anhui on Wednesday has led to an increase in on-site operations, which has a certain negative impact on market growth.

On the demand side, the DBP and butyl acetate industries are still in a profitable state. Driven by the supply side of the market, manufacturers’ shipments are still acceptable, and enterprises have a certain demand for raw materials. The main downstream C-D factories still face cost pressure, with most enterprises in a state of parking and the overall market operating at a low level, making it difficult for demand to significantly increase. Overall, the enthusiasm for downstream low-priced and just needed procurement is relatively good, while the factory’s pursuit of high prices is weak, and the demand side has moderate support for the market.

Although the market is facing some unfavorable factors, the n-butanol market may still remain stable in the short term. Factory inventory is controllable, and market prices are stable and rising. The price difference between the main downstream polypropylene and propylene is relatively narrow, at the edge of profit and loss. Recently, the price of propylene has continued to rise, and the enthusiasm for the downstream market to gradually weaken has limited support for the propylene market. However, the inventory of propylene factories is still in a controllable state, which still provides some support for the market. It is expected that the short-term propylene market price will stabilize and rise.

Overall, the raw material propylene market is relatively strong, and downstream low-priced procurement companies are weak in their pursuit of high prices. The Anhui n-butanol unit briefly stopped, and short-term operators have a strong mentality. However, when the supply side units are restored, the market may face the risk of decline. It is expected that the n-butanol market will rise first and then fall in the short term, with price fluctuations of around 200 to 400 yuan/ton.

Post time: Nov-07-2023