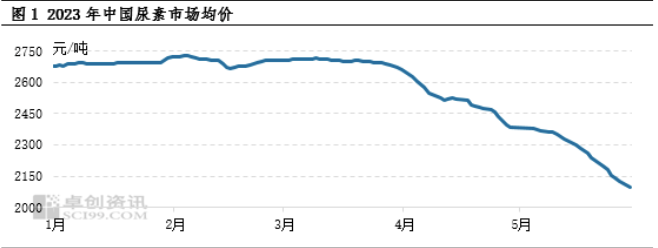

The Chinese urea market showed a downward trend in price in May 2023. As of May 30th, the highest point of urea price was 2378 yuan per ton, which appeared on May 4th; The lowest point was 2081 yuan per ton, which appeared on May 30th. Throughout May, the domestic urea market continued to weaken, and the demand release cycle was delayed, leading to increased pressure on manufacturers to ship and an increase in price decline. The difference between high and low prices in May was 297 yuan/ton, an increase of 59 yuan/ton compared to the difference in April. The main reason for this decline is the delay in rigid demand, followed by sufficient supply.

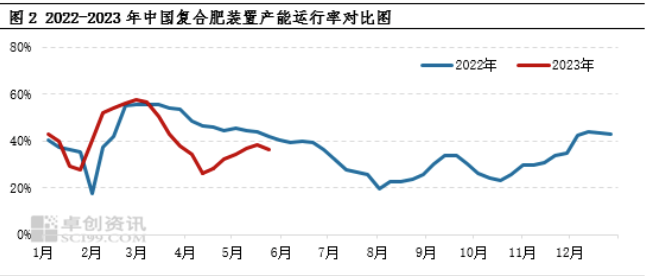

In terms of demand, downstream stocking is relatively cautious, while agricultural demand follows slowly. In terms of industrial demand, May entered the summer high nitrogen fertilizer production cycle, and the production capacity of composite fertilizers gradually resumed. However, the urea stocking situation of composite fertilizer enterprises was lower than market expectations. There are two main reasons: firstly, the recovery rate of compound fertilizer enterprises’ production capacity is relatively small, and the cycle is delayed. The operating rate of compound fertilizer production capacity in May was 34.97%, an increase of 4.57 percentage points compared to the previous month, but a decrease of 8.14 percentage points compared to the same period last year. At the beginning of May last year, the operating rate of compound fertilizer production capacity reached a monthly high of 45%, but it only reached a high point in mid May this year; Secondly, the inventory reduction of finished products in compound fertilizer enterprises is slow. As of May 25th, the inventory of Chinese compound fertilizer enterprises reached 720000 tons, an increase of 67% compared to the same period last year. The window period for releasing terminal demand for compound fertilizers has been shortened, and the procurement follow-up efforts and pace of compound fertilizer raw material manufacturers have slowed down, resulting in weak demand and increasing the inventory of urea manufacturers. As of May 25th, the company’s inventory was 807000 tons, an increase of approximately 42.3% compared to the end of April, putting pressure on prices.

In terms of agricultural demand, agricultural fertilizer preparation activities were relatively scattered in May. On the one hand, the dry weather in some southern regions has led to delays in fertilizer preparation; On the other hand, the continuous weakening of urea prices has led farmers to be cautious about price increases. In the short term, most of the demand is only rigid, making it difficult to form sustained demand support. Overall, the follow-up of agricultural demand indicates low procurement volume, delayed procurement cycles, and weak price support for May.

On the supply side, some raw material prices have decreased, and manufacturers have gained a certain profit margin. The operating load of the urea plant is still at a high level. In May, the operating load of urea plants in China fluctuated significantly. As of May 29th, the average operating load of urea plants in China in May was 70.36%, a decrease of 4.35 percentage points compared to the previous month. The production continuity of urea enterprises is good, and the decrease in operating load in the first half of the year was mainly affected by short-term shutdowns and local maintenance, but the production resumed quickly afterwards. In addition, the raw material prices in the synthetic ammonia market have decreased, and manufacturers are actively discharging urea due to the impact of synthetic ammonia reserves and transportation conditions. The follow-up level of purchasing fertilizer in the summer of June will affect the price of urea, which will increase first and then decrease.

In June, the urea market price is expected to rise first and then fall. In early June, it was during the early release of summer fertilizer demand, while prices continued to decline in May. Manufacturers hold certain expectations that prices will stop falling and begin to rebound. However, with the end of the production cycle and an increase in production shutdowns of compound fertilizer enterprises in the middle and late stages, there is currently no news of centralized maintenance of the urea plant, indicating a situation of oversupply. Therefore, it is expected that urea prices may face downward pressure in late June.

Post time: Jun-02-2023