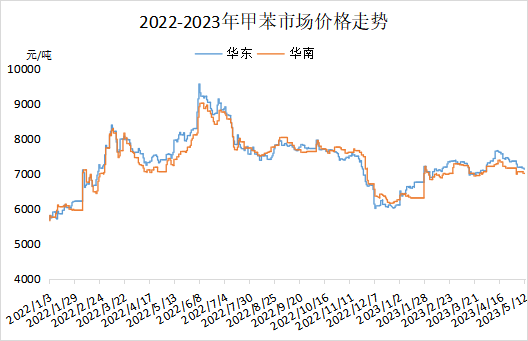

Recently, crude oil has increased first and then decreased, with limited boost to toluene, coupled with poor upstream and downstream demand. The mentality of the industry is cautious, and the market is weak and declining. Moreover, a small amount of cargo from East China ports has arrived, resulting in insufficient consumption and a slight decrease in inventory; Some refineries have heated up and restarted, resulting in a small amount of export sales and an increase in production, resulting in an overall increase in domestic toluene supply; The traditional downstream TDI part of the refinery is shut down, and procurement is just needed; The current decline in raw materials has dragged down the toluene market, while downstream demand is poor, resulting in low actual transaction volume.

Oil price situation

As of the 11th, the number of initial claims for unemployment benefits in the United States has increased, and the debt ceiling issue continues to raise market concerns, leading to a decline in international oil prices. The NYMEX crude oil futures 06 contract fell by $1.69 per barrel, or 2.33%, at 70.87; ICE oil futures contract 07 fell by $1.43 per barrel, or 1.87%, at 74.98. The main contract for China INE crude oil futures, 2306, fell 2.1 to 514.5 yuan/barrel, while it fell 13.4 to 501.1 yuan/barrel in overnight trading.

Device situation

Analysis of market influencing factors

The current market bottom support is good, and the supply of automobile transportation has decreased. However, port inventory consumption has slowed down, and downstream terminal demand remains sluggish; The attitude of the business owner is mainly wait-and-see.

Future Market Forecast

At present, the procurement of the gasoline industry remains an important support for the toluene market. Secco, Taizhou, Luoyang and other devices are scheduled to be shut down for maintenance in the middle and later stages, resulting in a decrease in supply. There is also instability in the procurement of gasoline, resulting in a slowdown in the toluene market and a sluggish downstream demand. Therefore, the positive support from the supply side is offset, with an expected operating range of 7000 to 7200 yuan/ton.

Post time: May-15-2023