Since 2023, the recovery of terminal consumption has been slow, and downstream demand has not followed up enough. In the first quarter, a new production capacity of 440000 tons of bisphenol A was put into operation, highlighting the supply-demand contradiction in the bisphenol A market. The raw material phenol fluctuates repeatedly, and the overall center of gravity decreases, but the decrease is smaller than that of bisphenol A. Therefore, the loss of bisphenol A industry has become the norm, and the cost pressure on manufacturers is obvious.

Since March, the bisphenol A market has risen and fallen repeatedly, but the overall market price fluctuation range is limited, between 9250-9800 yuan/ton. After April 18th, the atmosphere of the bisphenol A market “suddenly” improved, with an increase in downstream market inquiries, and the dull

situation of the bisphenol A market was broken.

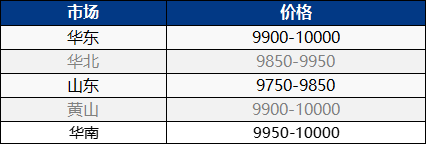

On April 25th, the bisphenol A market in East China continued to strengthen, while the domestic bisphenol A market rose. The spot supply in the market has tightened, and the offer from the cargo holder has been pushed up. As soon as people on the market need an inquiry, they will negotiate and follow up cautiously according to their needs. In the short term, the market is operating at a high price, and the market quotation continues to rise to 10000-10100 yuan/ton!

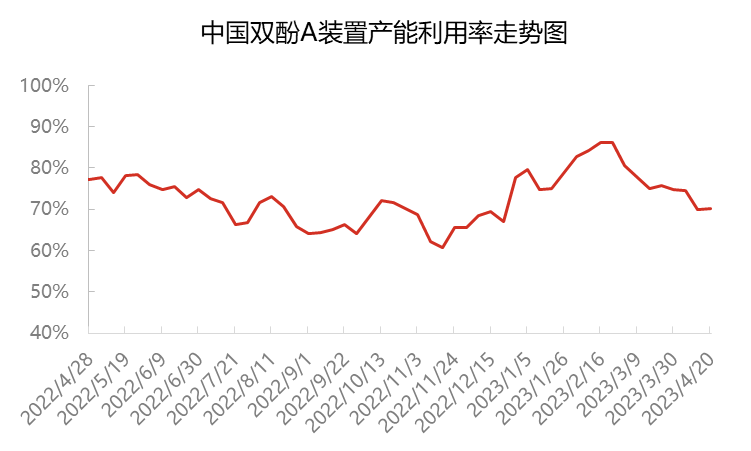

At present, the overall production capacity utilization rate of bisphenol A in China is around 70%, a decrease of about 11 percentage points compared to early March. Starting from March, the load of Sinopec Sanjing and Nantong Xingchen units decreased, the Cangzhou Dahua unit shut down, and the utilization rate of bisphenol A production capacity decreased to around 75%. Huizhou Zhongxin and Yanhua Polycarbon successively shut down for maintenance at the end of March and early April, further reducing the utilization rate of bisphenol A production capacity to around 70%. The manufacturer’s products are mainly for self use and supply to long-term customers, resulting in a decrease in spot sales. At the same time, as there is a sporadic need for restocking downstream, the spot quantity gradually consumes.

Since mid to late April, due to the domestic supply and import replenishment of bisphenol A, as well as the launch of epoxy resin and PC, the daily production demand of bisphenol A has gradually transitioned towards balance in the context of inventory reduction in April. Since February, the spot profit margin of bisphenol A has been relatively low, the enthusiasm of intermediaries to participate has decreased, and the inventory of traded products has decreased. At present, there are not many spot resources in the bisphenol A market, and holders are unwilling to sell, indicating a high intention to push up.

On the downstream side, since 2023, the recovery of downstream terminal demand has been much lower than expected, and the focus of the epoxy resin and PC markets has also been weak and fluctuating. Bisphenol A is mainly used to maintain contract consumption, and a few just need to purchase at an appropriate price. The trading volume of spot orders is limited. At present, the operating rate of the epoxy resin industry is around 50%, while the PC industry is around 70%. Recently, bisphenol A and related products ECH have increased simultaneously, resulting in an overall cost increase in epoxy resin and a narrow increase in market focus. However, there were few downstream stocking operations for PC before May Day, and industry supply and demand pressures still exist. Moreover, the raw material bisphenol A continues to rise strongly, with supply and demand conflicts and cost pressures. Businesses are mainly on a stable and wait-and-see basis, and downstream demand procurement is insufficient, resulting in scarce actual trading.

Towards the end of the month, there is no pressure on the shipment of the cargo holder, and cost pressure still exists. The cargo holder has a strong intention to push up. Although it is relatively cautious to pursue higher prices downstream, mainly for purchasing on demand, it is difficult to find a low price in the market, and the focus of the bisphenol A market is moving towards higher prices. It is expected that Bisphenol A will continue to experience strong fluctuations and pay attention to downstream demand follow-up.

Post time: Apr-26-2023