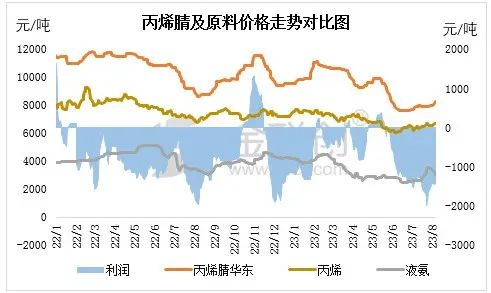

Due to the increase in domestic acrylonitrile production capacity, the contradiction between supply and demand is becoming increasingly prominent. Since last year, the acrylonitrile industry has been losing money, adding up to a profit in less than a month. In the first quarter of this year, relying on the collective rise of the chemical industry, the losses of acrylonitrile were significantly reduced. In mid July, the acrylonitrile factory attempted to break through the price by taking advantage of centralized equipment maintenance, but ultimately failed, with an increase of only 300 yuan/ton at the end of the month. In August, factory prices once again increased significantly, but the effect was not ideal. Currently, prices in some regions have slightly declined.

Cost side: Since May, the market price of acrylonitrile raw material propylene has continued to decline significantly, leading to a comprehensive bearish fundamentals and a significant decrease in acrylonitrile costs. But starting from mid July, the raw material end began to rise significantly, but the weak acrylonitrile market led to a rapid expansion of profits to below -1000 yuan/ton.

Demand side: In terms of downstream main product ABS, the price of ABS continued to decline in the first half of 2023, leading to a decrease in factory production enthusiasm. From June to July, manufacturers concentrated on reducing production and pre-sales, resulting in a significant decrease in construction volume. Until July, the construction load of the manufacturer increased, but the overall construction is still below 90%. Acrylic fiber also has the same problem. In the middle of the second quarter of this year, before entering the hot weather, the off-season atmosphere in the terminal weaving market arrived earlier, and the overall order volume of weaving manufacturers decreased. Some weaving factories began to shut down frequently, leading to another decrease in acrylic fibers.

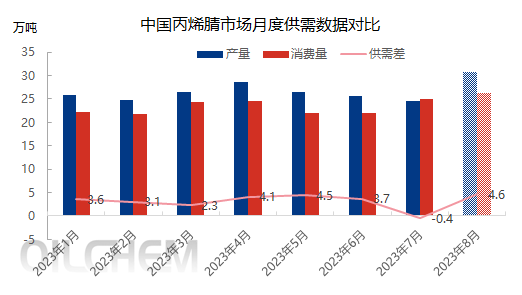

Supply side: In August, the overall capacity utilization rate of the acrylonitrile industry increased from 60% to around 80%, and the significantly increased supply will gradually be released. Some low-priced imported goods that were negotiated and traded in the early stage will also arrive in Hong Kong in August.

Overall, the oversupply of acrylonitrile will gradually become prominent again, and the market’s continued upward rhythm will be gradually suppressed, making it difficult for the spot market to ship. The operator has a strong wait-and-see attitude. After the commencement of the acrylonitrile plant has improved, operators lack confidence in the market prospects. In the medium to long term, they still need to pay attention to changes in raw materials and demand, as well as the determination of manufacturers to increase prices.

Post time: Aug-10-2023