Since October 2022, the domestic bisphenol A market has declined sharply, and remained depressed after the New Year’s Day, making the market difficult to fluctuate. As of January 11, the domestic bisphenol A market fluctuated sideways, the wait-and-see attitude of market participants remained unchanged, the fundamentals of the market changed little, the buying sentiment of operators was cautious, and the short-term market fluctuated in a narrow range. The downward trend is mainly affected by the contradiction between supply and demand, and it is difficult to support the upstream and downstream of the industrial chain.

The production capacity of bisphenol A continues to expand, and the supply pressure still exists

Since October 2022, the domestic supply of bisphenol A has increased significantly, including 200000 tons/year of Luxi Chemical Group Co., Ltd., 240000 tons/year of Wanhua Chemical Group Co., Ltd., and 680000 tons/year of Jiangsu Ruiheng New Material Technology Co., Ltd. However, the domestic equipment was only maintained for several times in November, the loss was significantly lower than the production growth, and the domestic supply of bisphenol A increased significantly. Compared with the average monthly output of 1.82 million tons in the previous period, the overall supply in the fourth quarter increased significantly.

In 2023, China’s bisphenol A still has new capacity growth. It is understood that bisphenol A production capacity will increase by 610000 tons in 2023, including 200000 tons/year for Guangxi Huayi, 170000 tons/year for South Asia Plastics, 240000 tons/year for Wanhua, and 680000 tons in the fourth quarter of 2022. It is estimated that the capacity base will reach 5.1 million tons/year in 2023, with a year-on-year increase of about 38%. At present, the economy is in the recovery period, and there are still various uncertainties in the first half of the year, and the supply pressure caused by the continuous expansion of production capacity still exists.

A number of policies have boosted the market, and terminal demand has gradually recovered

Public health events still have a great impact on domestic economic development and the recovery of demand for terminal factories, especially in the first half of 2023, which will remain the focus of market recovery. Although various policies have been introduced to boost the market, the recovery of demand still needs a period of digestion. Downstream demand and consumption are declining. From November to New Year’s Day, most of the PC products digested the raw materials in stock, and the purchase intention weakened. With the decrease of terminal orders, downstream epoxy resin and other products also declined. According to the monitoring of business institutions, the liquid epoxy resin in East China has dropped by 25% since the fourth quarter, and PC products have dropped by 8%. After the New Year’s Day, the material preparation of the downstream wind power industry has improved, but the market fluctuation is not obvious.

The price of bisphenol A decreased more than that of raw materials, and the profit margin decreased

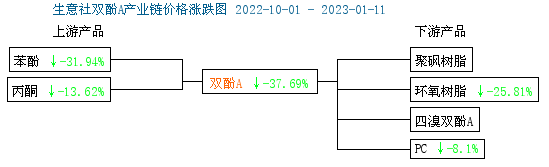

From the bisphenol A industry chain diagram, it can be seen that the decline of bisphenol A is greater than that of raw phenol and acetone, and the profit margin of bisphenol A decreases. Especially with the rebound of the phenol/acetone market in December, bisphenol A did not rise under the support of cost, but remained depressed under supply pressure, and the industry profit entered a loss state.

In the two downstream regions, the decline of epoxy resin was not much different from that of raw materials, while the decline of PC products was much lower than that of raw materials due to the impact of their own supply and demand. Previously, PC was in a loss state due to the impact of high-priced raw material bisphenol A, and the downstream PC turned into profit in the two months at the end of the year, and the gross profit of the industry increased. With the continuous release of top-down capacity and profit redistribution of bisphenol A industry, the capacity of each node will increase significantly in 2023. The changes of supply and demand side and profit at each node can be focused on.

Market growth oversupply, BPA under pressure in the future

As the Spring Festival approaches, the market demand is sluggish, the market negotiation atmosphere of bisphenol A is quiet, and the demand side of epoxy resin in the downstream wind power industry has improved slightly, but the demand growth is less than the expansion of supply side, which is difficult to form the support of raw material bisphenol A. The overall decline of phenol and acetone at the cost side is greater than the rise. The market has stopped falling and rebounded recently, but it is difficult to form a strong cost support. It is expected that bisphenol A will maintain impact operation in the short term. With the gradual release of new production capacity, the supply side is loose, and the market pressure is still large.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Jan-12-2023