Since the middle of November, the price of acrylonitrile has been falling endlessly. Yesterday, the mainstream quotation in East China was 9300-9500 yuan/ton, while the mainstream quotation in Shandong was 9300-9400 yuan/ton. The price trend of raw propylene is weak, the support on the cost side is weakened, the on-site supply is reduced, the downstream demand is cautious, and the supply and demand are slightly improved, but the market is still bearish, and the acrylonitrile market price may consolidate in the short term. Specifically, we still need to pay attention to the change of downstream receiving sentiment and the manufacturer’s price trend.

At the beginning of the week, the market price of acrylonitrile was frozen, the market supply increased, the supply side support weakened, downstream demand was cautious, cost pressure remained, and the spot market price was frozen. After the week, the price decline of acrylonitrile market is hard to change. The manufacturer’s guidance price has been lowered widely. The market is bearish. Downstream demand continues to be short. Although there is still some pressure on costs, the spot market price continues to fall dominated by market negative factors.

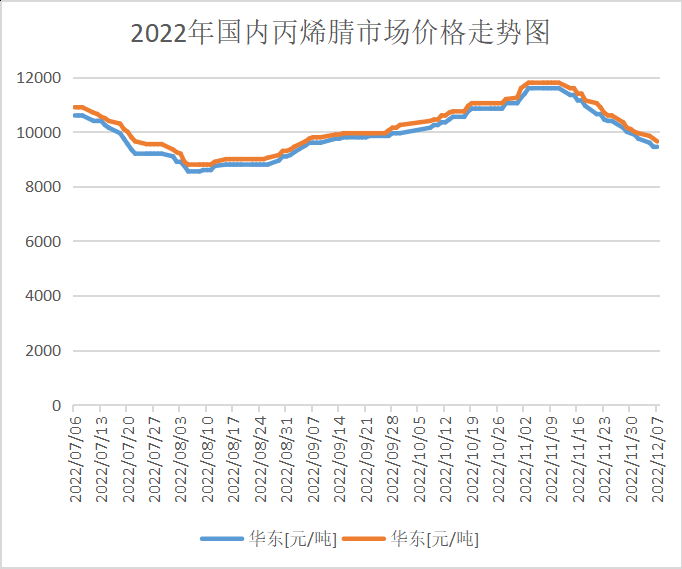

Overview of domestic acrylonitrile market

The direct cause of the price drop of acrylonitrile in this round is the increase of supply due to the restart and load increase of the unit, while the direct cause of stimulating the enthusiasm of the factory is the overall improvement of production profits. The logic of supply and demand and cost interact with each other in the market and go round and round. During the first ten days of November, the price of acrylonitrile reached a peak of 11600 yuan/ton, while the industrial capacity utilization rate was less than 70%. Later, as the capacity utilization rate gradually increased to more than 80%, the price of acrylonitrile rapidly fell to less than 10000 yuan.

At present, Shandong Haijiang acrylonitrile maintenance device is gradually restarted, the load of industrial devices continues to increase, while the downstream demand does not follow up significantly. The acrylonitrile market sees obvious air atmosphere, and the manufacturer’s offer is gradually declining. Recently, the downward channel of acrylonitrile market price has been opened, and the mentality of buying up rather than buying down in the downstream is obvious. The market transaction atmosphere is general, and the price will continue to decline.

Analysis of acrylonitrile supply and demand market

Supply side: This week, due to the rising cost of raw materials, the price decline of acrylonitrile began to be controlled, and some large factories in East China also began to release negative news. However, at present, the supply is still surplus, and the inventory of some enterprises has also risen, especially in Shandong market. The supply and demand situation of acrylonitrile market may fall into a stalemate in the short term. The operating rate of acrylonitrile in China this week was 75.4%, 0.6% lower than last week. The production capacity base is 3.809 million tons (260000 tons of new units are put into production in Liaoning Bora).

Demand side: about 90% of downstream ABS starts, acrylic fiber and acrylamide industries start stably, and the overall downstream demand is stable. The domestic ABS industry started 96.7% this week, an increase of 3.3% over the previous week. This week, the increase in the operating load of Shandong Lihuayi, a large factory in Jiangsu and Guangxi Keyuan led to the increase in the ABS output and operating rate. Crude oil and energy and chemical bulk commodities declined. It is hard for the operators to improve their expectations. The demand side is weak and difficult to change. They are cautious in trading, lacking more positive drivers. The discussion atmosphere in the mainstream market is flat. Traders tend to light positions or reduce positions. It is expected that the domestic ABS market will continue its weak consolidation trend next week, with a probability of price decline.

Future market summary

At present, the supply and demand of acrylonitrile is still unbalanced, and there is no room for growth in demand in the short term. In addition, overseas demand is weak, and it is difficult to find a good export. Therefore, changes in the supply side will determine when the market bottoms out. In the short term, the market price of acrylonitrile may consolidate and operate, but the price of propylene as raw material has risen recently, increasing the cost pressure. Specifically, we still need to pay attention to the change of downstream receiving sentiment and the manufacturer’s price trend.

Post time: Dec-09-2022