In 2023, the concentrated expansion of China’s PC industry has come to an end, and the industry has entered a cycle of digesting existing production capacity. Due to the centralized expansion period of upstream raw materials, the profit of lower end PC has significantly increased, the profit of PC industry has significantly improved, and the utilization rate and output of domestic production capacity have also significantly increased.

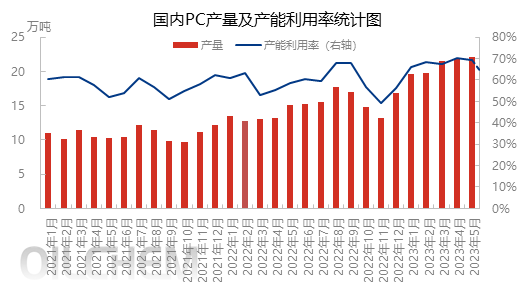

In 2023, the domestic PC production showed a monthly upward trend, far higher than the historical level of the same period. According to statistics, from January to May 2023, the total production of PC in China was about 1.05 million tons, an increase of over 50% compared to the same period last year, and the average capacity utilization rate reached 68.27%. Among them, the average production from March to May exceeded 200000 tons, which is double the annual average level in 2021.

1. The centralized expansion of domestic capacity has basically ended, and the new production capacity in the next five years is relatively limited.

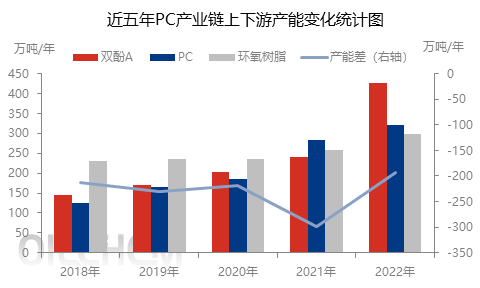

Since 2018, China’s PC production capacity has rapidly expanded. As of the end of 2022, the total domestic PC production capacity reached 3.2 million tons/year, an increase of 266% compared to the end of 2017, with a compound annual growth rate of 30%. In 2023, China will only increase production capacity by 160000 tons of Wanhua Chemical and restart production capacity by 70000 tons per year in Gansu, Hubei. From 2024 to 2027, China’s new PC production capacity is expected to only exceed 1.3 million tons, with a significantly lower growth rate than in the past. Therefore, in the next five years, digesting existing production capacity, steadily improving product quality, differentiated production, replacing imports, and increasing exports will become the main tone of China’s PC industry.

2. Raw materials have entered a period of centralized expansion, leading to a significant decrease in industrial chain costs and a gradual decline in profits.

According to the changes in raw material bisphenol A and the two major downstream production capacities in the past five years, the difference in upstream and downstream production capacity in 2022 reached the lowest level in five years, at 1.93 million tons per year. In 2022, the production capacity of bisphenol A, PC, and epoxy resin with year-on-year growth rates of 76.6%, 13.07%, and 16.56%, respectively, were the lowest in the industrial chain. Thanks to the significant expansion and profitability of bisphenol A, the profit of the PC industry has significantly increased in 2023, reaching its best level in recent years.

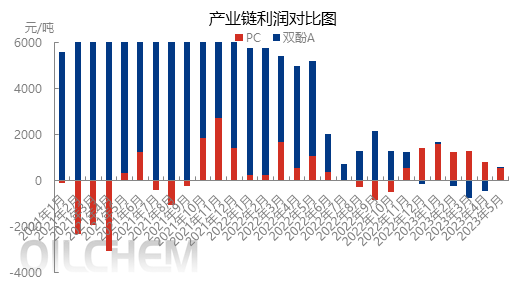

From the profit changes of PC and bisphenol A in the past three years, the industry chain profit from 2021 to 2022 is mainly concentrated in the upper end. Although PC also has significant phased profits, the margin is far lower than that of raw materials; In December 2022, the situation officially reversed and PC officially turned losses into profits, surpassing bisphenol A significantly for the first time (1402 yuan and -125 yuan respectively). In 2023, the profit of the PC industry continued to exceed that of bisphenol A. From January to May, the average gross profit levels of the two were 1100 yuan/ton and -243 yuan/ton, respectively. However, this year, the upper end raw material phenol ketone was also in a significant loss state, and PC officially turned losses.

In the next five years, the production capacity of phenolic ketones, bisphenol A, and epoxy resins will continue to expand significantly, and PC is expected to continue to be profitable as one of the few products in the industry chain.

3. The import volume has significantly decreased, while exports have made some breakthroughs.

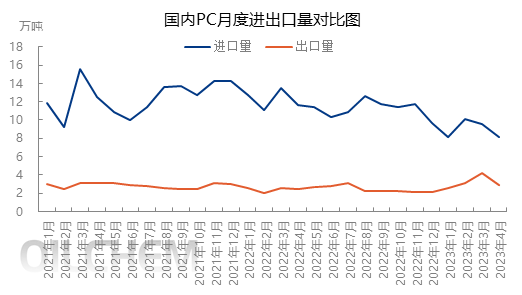

In 2023, the net import of domestic PC has significantly shrunk. From January to April, the total import volume of domestic PC was 358400 tons, with a cumulative export volume of 126600 tons and a net import volume of 231800 tons, a decrease of 161200 tons or 41% compared to the same period last year. Thanks to the active/passive withdrawal of imported materials and the growth of overseas exports, the substitutability of domestic materials among downstream users has greatly increased, which has also greatly promoted the growth of domestic PC production this year.

In June, due to the planned maintenance of two foreign-funded enterprises, the domestic PC production may have decreased compared to May; In the second half of the year, upstream raw materials continued to be affected by energy expansion, making it difficult to improve profits, while downstream PC continued to make profits. Against this backdrop, the sustained profits of the PC industry are expected to continue. Except for the large PC factories that still have established maintenance plans from August to September, which will affect the monthly production, domestic capacity utilization and production will remain at a relatively high level overall for the remaining time. Therefore, it is expected that the domestic PC production in the second half of the year will continue to grow compared to the first half.

Post time: Jun-09-2023