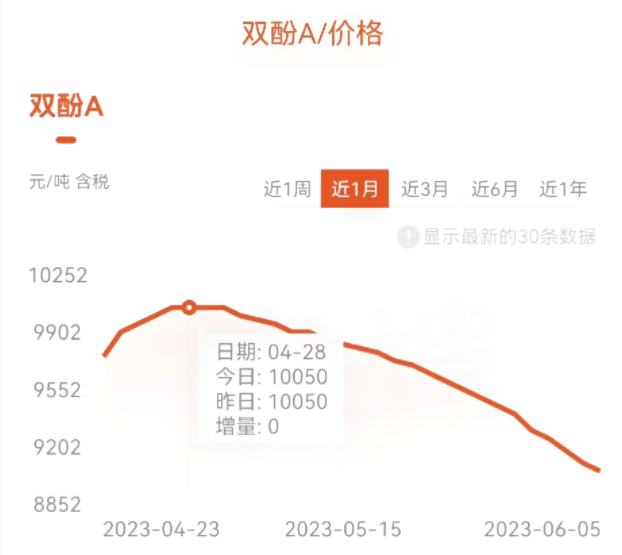

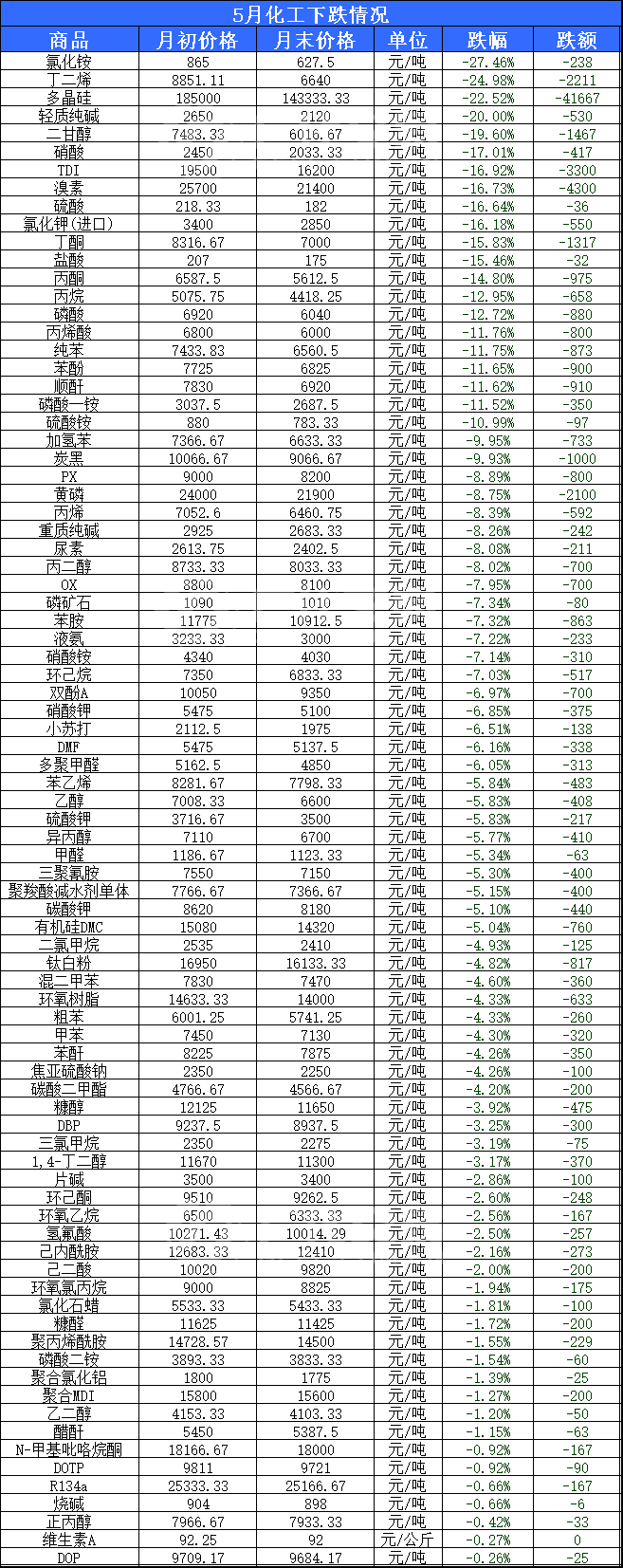

Since May, the demand for chemical products in the market has fallen short of expectations, and the periodic supply-demand contradiction in the market has become prominent. Under the transmission of the value chain, the prices of the upstream and downstream industries of bisphenol A have collectively declined. With the weakening of prices, the utilization rate of industry capacity has decreased, and profit contraction has become the main trend for most products. The price of bisphenol A has continued to decline, and recently it has fallen below the 9000 yuan mark! From the price trend of bisphenol A in the figure below, it can be seen that the price has dropped from 10050 yuan/ton at the end of April to the current 8800 yuan/ton, a year-on-year decrease of 12.52%.

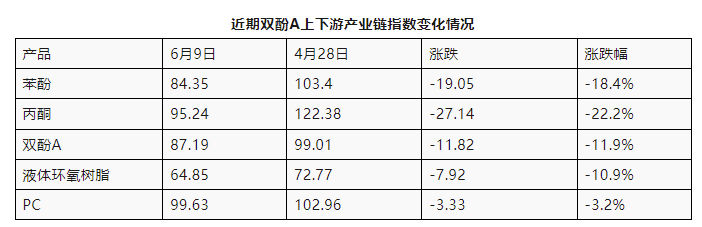

Severe decline in the index of upstream and downstream industrial chains

Since May 2023, the phenolic ketone industry index has dropped from a high of 103.65 points to 92.44 points, a decrease of 11.21 points, or 10.82%. The downward trend of the bisphenol A industry chain has shown a trend from large to small. The single product index of phenol and acetone showed the largest decline, at 18.4% and 22.2%, respectively. Bisphenol A and downstream liquid epoxy resin took the second place, while PC showed the smallest decline. The product is at the end of the industry chain, with little impact from upstream, and downstream end industries are widely distributed. The market still needs support, and it still shows strong resistance to decline on the basis of production capacity and output growth in the first half of the year.

Continuous release of bisphenol A production capacity and accumulation of risks

Since the beginning of this year, the production capacity of bisphenol A has continued to be released, with two companies adding a total of 440000 tons of annual production capacity. Affected by this, the total annual production capacity of bisphenol A in China has reached 4.265 million tons, with a year-on-year increase of about 55%. The average monthly production is 288000 tons, setting a new historical high.

In the future, the expansion of bisphenol A production has not stopped, and it is expected that more than 1.2 million tons of new bisphenol A production capacity will be put into operation this year. If all are put into production on schedule, the annual production capacity of bisphenol A in China will expand to around 5.5 million tons, a year-on-year increase of 45%, and the risk of continued price decline continues to accumulate.

Future outlook: In the middle and late June, the phenol ketone and bisphenol A industries resumed and restarted with the maintenance devices, and the commodity circulation in the Spot market showed an increasing trend. Considering the current commodity environment, cost and supply and demand, the market bottoming operation continued in June, and the industry capacity utilization rate was expected to increase; The downstream epoxy resin industry has once again entered a cycle of reducing production, load, and inventory. Currently, the dual raw materials have reached a relatively low level, and in addition, the industry has fallen into a low level of losses and load. The market is expected to bottom out this month; Under the constraints of a sluggish consumer environment at the terminal and the influence of traditional off-season market conditions, coupled with the recent resumption of two parking production lines, spot supply may increase. Under the game between supply and demand and cost, the market still has the possibility of further decline.

Why is it difficult for the raw material market to improve this year?

The main reason is that demand always finds it difficult to keep up with the expansion speed of production capacity, resulting in overcapacity as the norm.

The “2023 Key Petrochemical Product Capacity Warning Report” released by the Petrochemical Federation this year once again pointed out that the entire industry is still in the peak period of capacity investment, and the pressure of supply and demand contradictions for some products is still significant.

China’s chemical industry is still at the middle and low end of the international division of labor industry chain and value chain, and some old and persistent diseases and new problems still plague the development of the industry, leading to low safety guarantee capabilities in some areas of the industry chain.

Compared to previous years, the significance of the warning issued by this year’s Report lies in the complexity of the current international situation and the increase in domestic uncertainties. Therefore, the issue of structural surplus this year cannot be ignored.

Post time: Jun-12-2023