Since the second half of the year, there has been a significant deviation in the trend of n-butanol and its related products, octanol and isobutanol. Entering the fourth quarter, this phenomenon continued and triggered a series of subsequent impacts, indirectly benefiting the demand side of n-butanol, providing positive support for its transition from a unilateral decline to a sideways trend.

In our daily research and analysis of n-butanol, related products are key reference indicators. Among the existing related products, octanol and isobutanol have a particularly significant impact on n-butanol. In the second half of the year, there was a significant price difference between octanol and n-butanol, while isobutanol remained consistently higher than n-butanol. This phenomenon has had a significant impact on the supply and demand structure of n-butanol, and has had an impact on the trend of n-butanol in the fourth quarter.

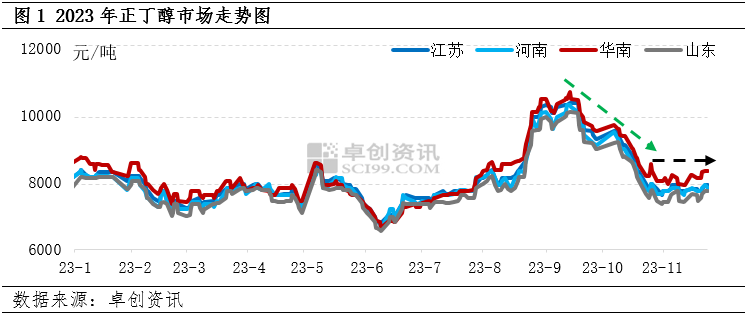

Since the fourth quarter, based on monitoring of downstream operating data, we have found that the operating rate of the largest downstream product, butyl acrylate, has significantly decreased, leading to a significant downward trend in demand for n-butanol. However, against the backdrop of increasing supply, the market expects the n-butanol industry chain to quickly accumulate inventory in the future, triggering a fermentation of bearish sentiment. In this context, the n-butanol market has experienced a decline of over 2000 yuan/ton. However, weak expectations in reality have encountered strong reality, and the actual performance of the n-butanol market in November deviated significantly from previous expectations. In fact, despite the lack of high operating support from the largest downstream butyl acrylate, the increase in operating rates of other downstream products such as butyl acetate and DBP is very significant, which supports the current trend of n-butanol from unilateral decline to sideways operation. As of the close on November 27th, the price of Shandong n-butanol was between 7700-7800 yuan/ton, and has been trading sideways near this level for three consecutive weeks.

There are multiple interpretations of changes in downstream consumption by the market, but the increase in operating rates of downstream plasticizer DBP industry and the persistent low inventory situation do contradict the traditional performance of the industry during the off peak season. We believe that the occurrence of the above phenomenon is closely related not only to the phased replenishment of downstream, but also to related products, and has a sustained impact on the n-butanol market.

The widening price difference between octanol and n-butanol indirectly increases the demand for n-butanol

In the past five years (2018-2022), the average price difference between octanol and n-butanol was 1374 yuan/ton. When this price difference exceeds this value for a long time, it may lead to switchable devices choosing to increase octanol production or reduce n-butanol production. However, since 2023, this price difference has continued to widen, reaching 3000-4000 yuan/ton in the third and fourth quarters. This extreme high price difference has attracted switchable devices to choose to produce n-butanol, thereby affecting the demand side of n-butanol.

With the expansion of the price difference between octanol and n-butanol, significant substitution phenomena have emerged in the downstream plasticizer field. Although the proportion of DBP in the field of plasticizers is not significant, as the price difference between octanol and n-butanol expands, the price difference between DBP and octanol plasticizers is also constantly expanding. Based on cost considerations, some end customers have moderately increased the usage of DBP, indirectly increasing the consumption of n-butanol, while the corresponding amount of octanol plasticizers has decreased.

Isobutanol continues to be higher than n-butanol, with some demand shifting towards n-butanol

Since the third quarter, the price difference between n-butanol and isobutanol has undergone significant changes. With its strong fundamental support, isobutanol has gradually changed from being lower than n-butanol to being higher than n-butanol as usual, and the price difference between the two has reached a new high in recent years. This price fluctuation has had a significant impact on the consumption of isobutanol/n-butanol. As the cost advantage of isobutanol plasticizers decreases, some downstream customers are adjusting their production formulas and turning to DBP with greater cost advantages. Since the third quarter, several isobutanol plasticizer factories in the north and east of China have experienced varying degrees of decline in operating rates, with some factories even turning to producing n-butanol plasticizers, indirectly boosting the consumption of n-butanol.

Post time: Nov-30-2023