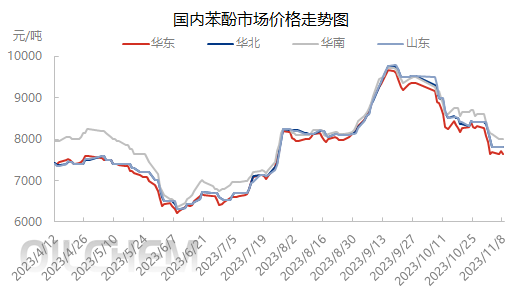

In early November, the price center of the phenol market in East China fell below 8000 yuan/ton. Subsequently, under the influence of high costs, profit losses of phenolic ketone enterprises, and supply-demand interaction, the market experienced fluctuations within a narrow range. The attitude of industry participants in the market is cautious, and the market is filled with wait-and-see sentiment.

From a cost perspective, in early November, the price of phenol in East China was lower than that of pure benzene, and the profit of phenolic ketone enterprises shifted from profit to loss. Although the industry has not responded much to this situation, due to poor demand, the price of phenol has turned to ultra pure benzene, and the market is under certain pressure. On November 8th, pure benzene was pulled down by the decline in crude oil, causing a slight setback in the mentality of phenol manufacturers. Terminal purchasing slowed down, and suppliers showed slight profit margins. However, considering high costs and average prices, there is not much room for profit margins.

In terms of supply, by the end of October, the replenishment of imported and domestic trade cargo exceeded 10000 tons. At the beginning of November, domestic trade cargo was mainly supplemented. As of November 8th, domestic trade cargo arrived at Hengyang on two ships, exceeding 7000 tons. In transit cargo of 3000 tons is expected to arrive at Zhangjiagang. Although there are expectations of new devices being put into production, there is still a need to supplement the spot supply in the market.

In terms of demand, at the end of the month and beginning of the month, downstream terminals digest inventory or contracts, and the enthusiasm for entering the market for purchasing is not high, which restricts the delivery volume of phenol in the market. It is difficult to sustain the sustainability of the market trend through phased buying and volume expansion.

The comprehensive cost and supply and demand fundamentals analysis, high costs and average prices, as well as the profit and loss situation of phenolic ketone enterprises, to some extent prevented the market from further downward. However, the trend of crude oil is unstable. Although the current price of pure benzene is higher than that of phenol, the trend is unstable, which can affect the mentality of phenol industry at any time, whether positive or negative, and needs to be treated according to the specific situation. The procurement of downstream terminals is mostly just in demand, making it difficult to form sustained purchasing power, and the impact on the market is also an uncertain factor. Therefore, it is expected that the short-term domestic phenol market will fluctuate around 7600-7700 yuan/ton, and the price fluctuation space will not exceed 200 yuan/ton.

Post time: Nov-13-2023