In 2022, China’s acrylonitrile production capacity will increase by 520000 tons, or 16.5%. The growth point of downstream demand is still concentrated in the ABS field, but the consumption growth of acrylonitrile is less than 200000 tons, and the pattern of oversupply of acrylonitrile industry is obvious. After the price of acrylonitrile fell in 2022, due to the prominent contradiction between supply and demand and the low fluctuation, the industry profit shrank significantly. Looking forward to 2023, the capacity of the acrylonitrile industry will continue to expand, the oversupply of the industry will be difficult to alleviate temporarily, and the market price is expected to remain low.

Market trend of domestic acrylonitrile

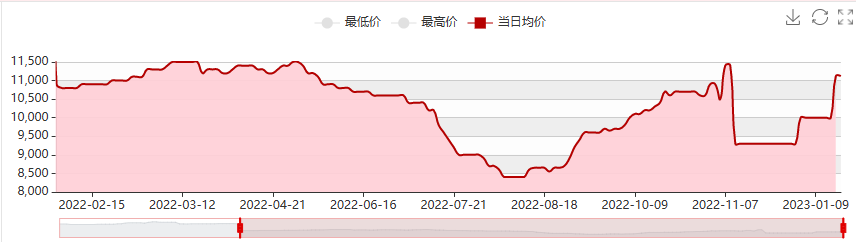

In 2022, the overall price of acrylonitrile products was below the average for the same period of the past five years. In 2022, the average annual price of the East China port market was 10657.8 yuan/ton, down 26.4% year on year. The factors affecting the fluctuation of low prices throughout the year are the continuous expansion of acrylonitrile industry capacity and the insufficient follow-up of downstream demand. In particular, in the third quarter, the price of acrylonitrile fell to a two-year low due to the high level of acrylonitrile industry in the start-up stage and the light downstream demand. Near the end of the year, the supply of acrylonitrile industry was loose, and the average market price fell below the lowest level in the same period of the past five years.

By the end of November 2022, the capacity of the top four enterprises in the industry reached 2.272 million tons, accounting for 59.6% of the total capacity of the country. As far as the production process is concerned, the propylene ammoxidation process is adopted. In terms of geographical distribution, East China and Northeast China are the main regions, with a real estate capacity of 3.304 million tons, accounting for 86.7%.

In 2022, China’s total annual output of acrylonitrile will be 3 million tons, up 17.8% month-on-month, and the average monthly output will increase to about 250000 tons. According to the change of production, the peak of production in the first half of the year occurred in March, mainly due to the release of 650000 tons of new production capacity by Lihuayi, Srbang Phase III and Tianchen Qixiang. In April, the output fell sharply, and Shandong equipment was shut down for maintenance. In May, the output recovered to more than 260000 tons, but then the monthly output gradually decreased, mainly due to the decline in demand. In the case of losses, acrylonitrile plants were passively limited in production, and the production fell to about 220000 tons in September. In the fourth quarter, with the increase of production, propylene was still increasing at the same time.

Compared with 2022, China’s acrylonitrile capacity growth is expected to reach 26.6% in 2023. Although the downstream ABS industry also has the expectation of capacity expansion, the consumption increment of acrylonitrile is still less than 600000 tons, the pattern of oversupply of acrylonitrile industry is difficult to quickly reverse, and the market price is expected to remain low.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Jan-29-2023