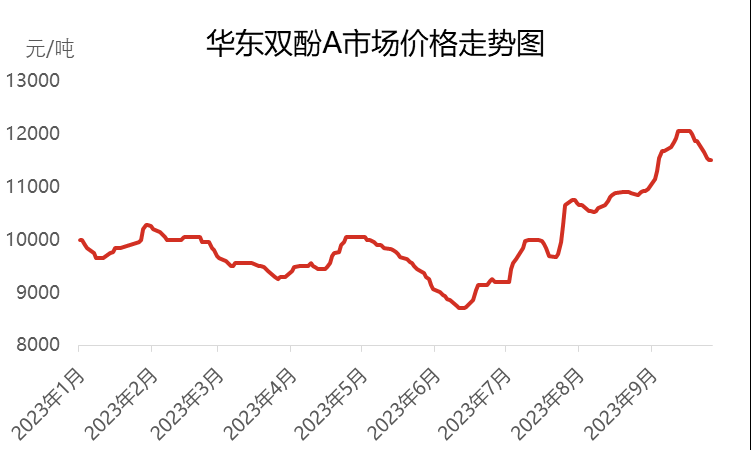

In the first and second quarters of 2023, the domestic bisphenol A market in China showed relatively weak trends and slid to a new five-year low in June, with prices dropping to 8700 yuan per ton. However, after entering the third quarter, the bisphenol A market experienced a continuous upward trend, and the market price also rose to its highest level this year, reaching 12050 yuan per ton. Although the price has risen to a high level, downstream demand has not kept up, and the market has therefore entered a period of volatility and decline again.

As of the end of September 2023, the mainstream negotiated price of bisphenol A in East China was about 11500 yuan per ton, an increase of 2300 yuan compared to early July, reaching a 25% increase. In the third quarter, the average market price was 10763 yuan per ton, an increase of 13.93% compared to the previous quarter, but in reality, it showed a downward trend compared to the same period last year, with a decrease of 16.54%.

In the first stage, the bisphenol A market showed an “N” trend in July

In early July, due to the impact of continuous destocking in the early stage, the spot circulation resources of bisphenol A were no longer abundant. In this situation, manufacturers and intermediaries actively supported the market, coupled with inquiries and restocking from some PC downstream and intermediaries, driving the market price of bisphenol A rapidly from 9200 yuan per ton to 10000 yuan per ton. During this period, Zhejiang Petrochemical’s multiple rounds of bidding have significantly increased, injecting momentum into the market’s upward trend. However, in the middle of the year, due to the high prices and the gradual digestion of downstream restocking, the trading atmosphere in the bisphenol A market began to weaken. In the middle and late stages, holders of bisphenol A began to take profits, coupled with fluctuations in the upstream and downstream markets, making spot transactions of bisphenol A sluggish. In response to this situation, some intermediaries and manufacturers began to offer profits for shipping, causing the negotiated prices in East China to fall back to 9600-9700 yuan per ton. In the latter half of the year, due to the strong increase in two raw materials – phenol and acetone -, the cost of bisphenol A was pushed up, and the cost pressure on manufacturers increased. Towards the end of the month, manufacturers are starting to raise prices, and the price of bisphenol A is also starting to rise with costs.

In the second stage, from early August to mid to late September, the bisphenol A market continued to rebound and reached the highest level of the year.

In early August, driven by the strong increase in raw materials phenol and acetone, the market price of bisphenol A remained firm and gradually rose. At this stage, the bisphenol A plant underwent centralized maintenance, such as the shutdown of Nantong Xingchen, Huizhou Zhongxin, Luxi Chemical, Jiangsu Ruiheng, Wanhua Chemical, and Zhejiang Petrochemical Phase II plants in August, resulting in a sharp drop in market supply. However, due to the impact of early destocking, downstream demand restocking has kept up with the pace, which has had a positive impact on the market. The combination of cost and supply demand benefits has made the bisphenol A market more robust and rising. After entering September, the international crude oil performance was relatively strong, driving pure benzene, phenol, and acetone to continue to rise, resulting in a surge in bisphenol A. The prices quoted by manufacturers continue to rise, and the spot supply in the market is also tight. The downstream demand for National Day stocking has also kept up with the pace, all of which have driven the market price in mid September to the highest point of 12050 yuan per ton this year.

In the third stage, from mid to late September to the end of the month, the bisphenol A market experienced a high decline

In mid to late September, as prices rise to high levels, the pace of downstream purchasing begins to slow down, and only a small number of people who just need them will make appropriate purchases. The trading atmosphere in the market has begun to weaken. At the same time, the prices of raw materials phenol and acetone have also begun to decline from high levels, weakening the cost support for bisphenol A. The wait-and-see sentiment between buyers and sellers on the market has become stronger, and downstream restocking has also become cautious. The double stocking did not meet the expected goal. With the arrival of the Mid Autumn Festival and National Day holidays, the mentality of some people who hold goods to ship has become apparent, and they mainly focus on selling at a profit. At the end of the month, the focus of market negotiations fell back to 11500-11600 yuan per ton.

The fourth quarter bisphenol A market faces multiple challenges

In terms of cost, the prices of raw materials phenol and acetone may still fall, but due to the limitations of contract average prices and cost lines, their downward space is limited, so the cost support for bisphenol A is relatively limited.

In terms of supply and demand, Changchun Chemical will undergo maintenance starting from October 9th and is expected to end in early November. South Asia Plastics and Zhejiang Petrochemical plan to undergo maintenance in November, while some units are scheduled to be shut down for maintenance in late October. However, overall, the loss of bisphenol A devices still exists in the fourth quarter. At the same time, the operation of Jiangsu Ruiheng Phase II bisphenol A plant gradually stabilized in early October, and multiple new units such as Qingdao Bay, Hengli Petrochemical, and Longjiang Chemical are also planned to be put into operation in the fourth quarter. At that time, the production capacity and yield of bisphenol A will significantly increase. However, due to the weak recovery on the demand side, the market continues to be constrained, and the supply-demand contradiction will intensify.

In terms of market mentality, due to insufficient cost support and weak supply and demand performance, the downward trend of the bisphenol A market is obvious, which makes industry insiders lack confidence in the future market. They are more cautious in their operations and mostly adopt a wait-and-see attitude, which to some extent inhibits the downstream purchasing pace.

In the fourth quarter, there was a lack of positive factors in the bisphenol A market, and it is expected that market prices will show a significant decline compared to the third quarter. The main focus of the market includes the production progress of new devices, the rise and fall of raw material prices, and the follow-up of downstream demand.

Post time: Oct-19-2023