Since February, the domestic MIBK market has changed its early sharp upward pattern. With the continuous supply of imported goods, the supply tension has been eased, and the market has turned around. As of March 23, the mainstream negotiation range in the market was 16300-16800 yuan/ton. According to monitoring data from the commercial community, the national average price on February 6th was 21000 yuan/ton, a record high for the year. As of March 23, it had fallen to 16466 yuan/ton, down 4600 yuan/ton, or 21.6%.

The supply pattern has changed and the import volume has been replenished sufficiently. Since the shutdown of the 50000 ton/year MIBK plant in Zhenjiang, Li Changrong, on December 25, 2022, the domestic MIBK supply pattern has significantly changed in 2023. The expected output in the first quarter is 290000 tons, a year-on-year decrease of 28%, and the domestic loss is significant. However, the pace of replenishing imported goods has accelerated. It is understood that China’s imports from South Korea increased by 125% in January, and the total import volume in February was 5460 tons, a year-on-year increase of 123%. The sharp rise in the last two months of 2022 was mainly affected by the expected tight domestic supply, which continued until early February, with market prices soaring to 21000 yuan/ton as of February 6. However, with the phased increase in the supply of imported goods in January, and a small amount of replenishment after the production of devices such as Ningbo Juhua and Zhangjiagang Kailing, the market continued to decline in mid February.

Poor demand has limited support for raw material procurement, limited downstream demand for MIBK, sluggish terminal manufacturing industry, limited acceptance of high-priced MIBK, gradual decline in transaction prices, and high shipping pressure on traders, making it difficult to improve expectations. The actual orders in the market continue to decline, and most transactions are only small orders that need to be followed up.

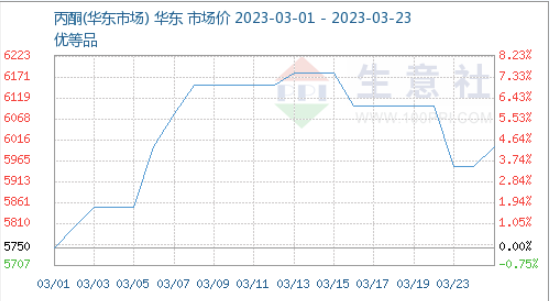

Short-term demand is difficult to significantly improve, cost side acetone support has also been relaxed, and the supply of imported goods continues to increase. In the short term, the domestic MIBK market will continue to decline, expected to fall below 16000 yuan/ton, with a cumulative decline of over 5000 yuan/ton. However, under the pressure of high inventory prices and shipping losses for some traders in the early stage, market quotations are uneven. It is expected that the East China market will discuss 16100-16800 yuan/ton in the near future, focusing on changes in the demand side.

Post time: Mar-24-2023