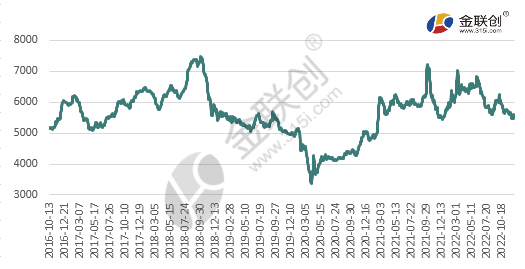

In 2022, chemical bulk prices will fluctuate widely, showing two waves of rising prices from March to June and from August to October respectively. The rise and fall of oil prices and the demand boost in the golden nine silver ten peak seasons will become the main axis of chemical price fluctuations throughout 2022.

Under the background of the Russia Ukraine war in the first half of 2022, the international crude oil runs at a super high level, the overall price level of chemical bulk continues to rise, and most chemical products hit a new high in recent years. According to the Jinlianchuang Chemical Index, from January to December 2022, the trend of the chemical industry index is highly positively correlated with the trend of the international crude oil WTI, with a correlation coefficient of 0.86; From January to June 2022, the correlation coefficient between the two is as high as 0.91. This is because the logic of the domestic chemical market’s surge in the first half of the year is completely dominated by the rise of international crude oil. However, as the epidemic curbed demand and logistics, the transaction was frustrated after the price rose. In June, with the high crude oil price diving, the chemical bulk price fell sharply, and the market highlights in the first half of the year came to an end.

In the second half of 2022, the leading logic of the chemical industry market will shift from raw materials (crude oil) to fundamentals. From August to October, relying on the demand of the golden nine silver ten peak season, the chemical industry has a significant upward trend again. However, the contradiction between high upstream costs and weak downstream demand has not been significantly improved, and the market price is limited compared with the first half of the year, and then declines immediately after a flash in the pan. In November December, there was no trend to guide the wide fluctuation of international crude oil, and the chemical market ended weak under the guidance of weak demand.

Trend Chart of Jinlianchuang Chemical Index 2016-2022

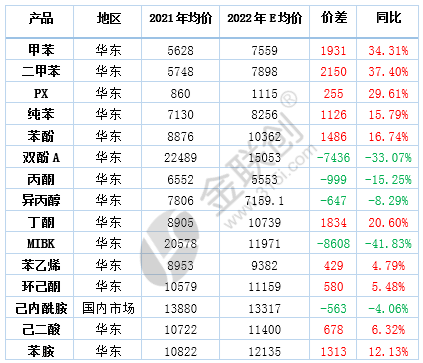

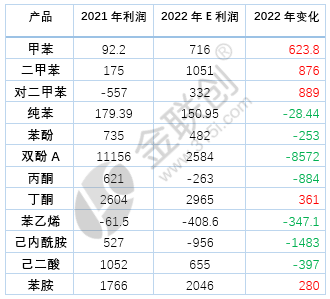

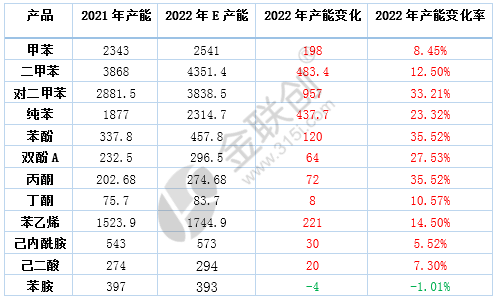

In 2022, the aromatics and downstream markets will be stronger in the upstream and weaker in the downstream

In terms of price, toluene and xylene are close to the raw material (crude oil) end. On the one hand, the crude oil has risen sharply, and on the other hand, it is driven by export growth. In 2022, the price increase will be the most prominent in the industrial chain, both more than 30%. However, BPA and MIBK in the downstream phenol ketone chain will gradually ease in 2022 due to the shortage of supply in 2021, and the overall price trend of the upstream and downstream phenol ketone chains is not optimistic, with the largest year-on-year drop of more than 30% in 2022; In particular, MIBK, which has the highest price increase in chemicals in 2021, will almost lose its share in 2022. Pure benzene and downstream chains will not be hot in 2022. As the supply of aniline continues to tighten, the sudden situation of the unit and the continuous increase of exports, the relative price increase of aniline can match that of the raw material pure benzene. In the campaign of substantial increase in production of other downstream styrene, cyclohexanone and adipic acid, the price increase is relatively moderate, especially caprolactam is the only one in the pure benzene and downstream chain where the price drops year-on-year.

In terms of profit, toluene, xylene and PX close to the raw material end will have the largest profit increase in 2022, all of which will be more than 500 yuan/ton. However, BPA in the downstream phenol ketone chain will have the largest profit drop in 2022, more than 8000 yuan/ton, driven by the increase of its own supply and poor demand and the decline of upstream phenol ketone. Among pure benzene and downstream chains, aniline will be out of cost in 2022 due to the difficulty of obtaining a single product, with the largest year-on-year growth in profits. Other products, including raw material pure benzene, will all have lower profits in 2022; Among them, due to overcapacity, market supply of caprolactam is sufficient, downstream demand is weak, market decline is large, enterprise losses continue to intensify, and profit decline is the largest, nearly 1500 yuan/ton.

In terms of capacity, in 2022, the large-scale refining and chemical industry has entered the end of capacity expansion, but the expansion of PX and by-products such as pure benzene, phenol and ketone is still in full swing. In 2022, except for the withdrawal of 40000 tons of aniline from the aromatic hydrocarbon and downstream chain, all other products will grow. This is also the main reason why the annual average price of aromatics and downstream products in 2022 is still not ideal year on year, although the price trend of aromatics and downstream products is driven by the surge of crude oil in the first half of the year.

Post time: Jan-03-2023