Entering June, styrene rose in a wave of strong highs after the Dragon Boat Festival, hitting a new high of 11,500 yuan/ton in two years, refreshing the highest point on May 18 last year, a new high in two years. With the push up of styrene prices, styrene industry profits were significantly repaired, corporate profits from deep losses gradually turned positive, driven by the cost of styrene a wave of high rise, but with the high price pressure, energy and pure benzene is also a high fall, styrene market gradually cooled down to the middle of the East China market back down to 10,500 yuan / ton near the high point down about 1,000 yuan / ton.

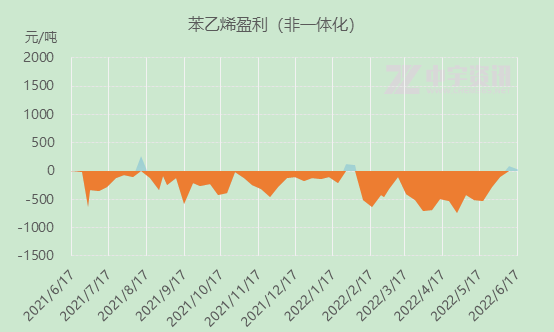

Styrene industry profit

As can be seen from the profit curve, since last year, the styrene industry profit margin has been in negative territory for a long time, non-integrated producers profit is more by the cost of the heavy setback, according to data measured in the average profit of styrene to go line, the average profit in January-May this year at -372 yuan / ton, but into June as prices surged, styrene business profits finally turned positive, the first half of the styrene industry since the start rate declined. Because of the poor profitability, some external refinery maintenance has been postponed restart, and now with the improvement of profitability, companies have gradually resumed production, the industry’s start-up rate has a slight rebound trend. However, the overall start-up rate is limited due to the fact that there are still some plant maintenance and accidents, and the new capacity is not enough to start the load.

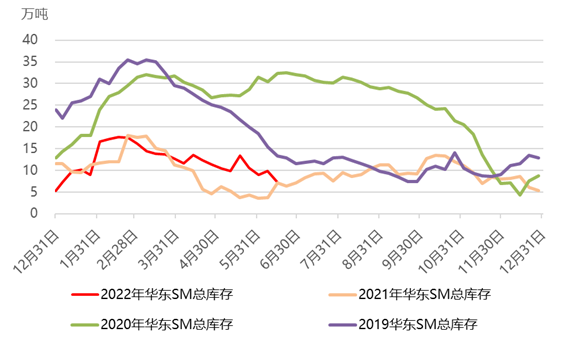

Inventory

Styrene East China inventory, as of June 8, East China (Jiangsu) main warehouse area styrene total inventory at 98,500 tons, an increase of 0.83 million tons, compared with the highest inventory in the first half of the year near mid-February 177,000 tons drop 78,500 tons or 44.3.5%, this cycle inventory has a slight rebound, due to high prices, the terminal cautious intention to receive goods, some downstream procurement in general, and The downstream work rate fluctuates, and the local downstream load slightly decreases, and the amount of cargoes going to the terminal is not high, and the recent arbitrage overseas is not very operable, and the interest of the production negotiation decreases. The de-stocking of inventory may still continue, but by the price is too high, the flow of volume is slow.

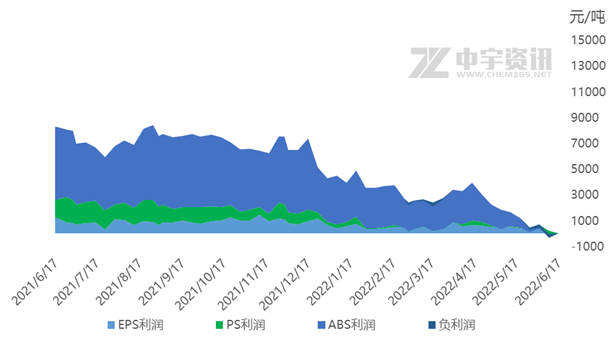

Downstream profit

The three major downstream EPS, PS, ABS profits continue to reduce, styrene prices after rushing to more than 10,000 yuan, the terminal’s profit margin began to be seriously eroded, high costs are difficult to convert, due to the impact of this year’s epidemic end consumption links, this year’s home appliances, automotive and real estate industry is weak, 1-2 quarter epidemic on demand has inhibited, the terminal performance is weak, business orders reduced, after the gradual recovery of the epidemic in East China Time has entered June, countries orderly promote the process of resumption of work and production, after the epidemic has been effectively controlled, a package of policies to stabilize the economy is expected to take effect centrally, the stage of the greatest pressure of overseas disturbances has passed and began to gradually ease, the main market of medium-term repair staged. Throughout the entire industry chain, the raw material side of the rise is greater, near the end of the product price conduction ability becomes poor, so the profits of the industry chain is still unbalanced, pure benzene end of the profit is abundant, styrene profits were repaired to positive cash flow, but the downstream profits are squeezed, profit margins fell sharply. Due to the high cost pressure, the main downstream such as PS has gradually loss, long years to maintain high profits in the ABS industry profits are compressed to near the cost line. This has led to strong resistance from some downstream companies to reduce their procurement of raw materials, and excessive raw materials have inhibited end demand and consumption, and the overall industry is expected to maintain a healthy operating environment, with the decline in overall downstream profits also putting negative pressure on upstream prices. Downstream under the pressure of high costs, passive adjustment of load and shift production and the arrival of high temperatures in the summer, also has a negative impact on demand.

Post time: Jun-23-2022