Since May 25, styrene began to rise, prices broke through the 10,000 yuan / ton mark, once reaching 10,500 yuan / ton near. After the festival, styrene futures rose sharply again to the 11,000 yuan/ton mark, hitting a new high since the species was listed.

The spot market is not willing to show weakness, in the supply side of the obvious reduction and cost side of the strong support, June 7 East China market average price of styrene reached 10,950 yuan / ton, refreshing the year’s high!

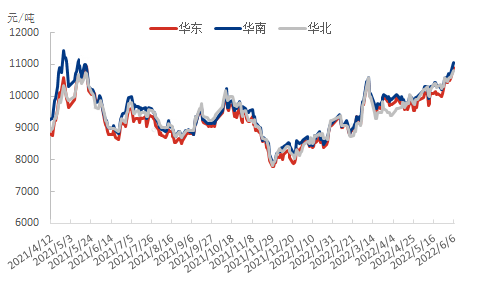

Styrene price trend in major markets across the country

Since late May, domestic styrene plants within the plan, outside the overhaul heard, Shandong Wanhua, Sinochem Quanzhou, Huatai Shengfu, Qingdao Bay and other devices are in this period of time to stop the overhaul behavior, although there are Shandong Yuhuang, Northern China Jin to resume production during this period, but the overall view of the overhaul more than recovery, resulting in domestic styrene weekly capacity utilization rate gradually lower, as of June 2 statistics, capacity utilization rate fell to 69.02%, a new low in recent years, and this week there is still the possibility of continued downward movement.

With the reduction of domestic styrene weekly capacity utilization rate, domestic styrene weekly production synchronously reduced, factory inventory is also at a low level in recent years, although the terminal demand is not good, but the styrene plant start-up synchronously reduced at the same time, the contract is relatively normal, it seems that sales and inventory pressure is not much, giving styrene prices part of the support.

In addition to styrene itself to reduce the supply side of the good, the strong rise in raw materials pure benzene in styrene rose to a high point in the year is a great credit. June before and after the East China pure benzene continue to push up, as of June 7, East China pure benzene spot closing to 9,990 yuan / ton, is also the high point of the year so far.

East China pure benzene market price trend chart

Recently, due to the peak travel season in the U.S., local toluene entered the gasoline component instead of the disproportionation unit, and the output of pure benzene dropped. Downstream ethylbenzene and isopropylbenzene can also be used in gasoline components, and the consumption of pure benzene increased, so the price of pure benzene in the U.S. rose sharply under the support of both supply and demand. Overlapping with the domestic port inventory continues to be low downward, falling to 48,000 tons, by the impact of import costs, is expected to maintain a low level of short-term port inventory oscillation in Jiangnei.

Despite the domestic pure benzene devices restarted one after another, downstream starts continue to decline, but due to the high price of foreign exchange firm, pure benzene is expected to be deliverable remains scarce, there are still traders actively buy up, pulling East China pure benzene prices continue to rise high.

In summary, strong cost support, coupled with the styrene plant overhaul caused by the supply reduction, a mix of good, styrene rose to a high point in the year, but downstream demand to follow up is not optimistic, inhibiting styrene tracking cost side up trend, in addition to the need to focus on the return of styrene profits, non-integrated devices to resume production will increase, device changes.

Post time: Jun-08-2022