In September 2023, driven by the rise in crude oil prices and the strong cost side, the phenol market price rose strongly. Despite the price increase, downstream demand has not increased synchronously, which may have a certain restraining effect on the market. However, the market remains optimistic about the future prospects of phenol, believing that short-term fluctuations will not change the overall upward trend.

This article will analyze the latest developments in this market, including price trends, transaction status, supply and demand situation, and future prospects.

1.Phenol prices hit a new high

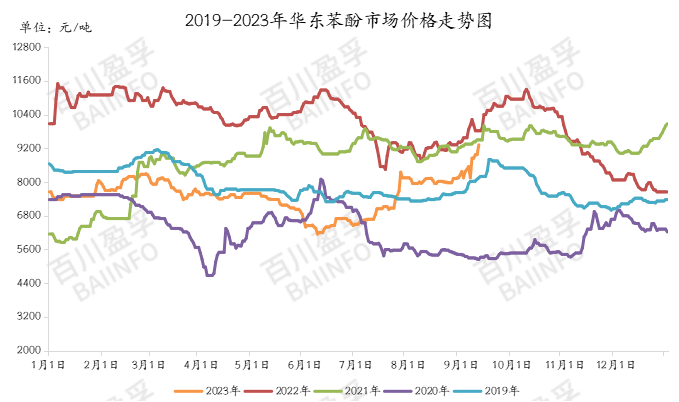

As of September 11, 2023, the market price of phenol has reached 9335 yuan per ton, an increase of 5.35% compared to the previous working day, and the market price has reached a new high for the current year. This upward trend has attracted widespread attention as market prices have returned to levels above the average for the same period from 2018 to 2022.

2.Strong support on the cost side

The price increase in the phenol market is attributed to multiple factors. Firstly, the continuous rise in crude oil prices provides support for the upstream pure benzene market price, as the production of phenol is closely related to crude oil prices. High costs provide a strong guiding effect on the phenol market, and the strong rise in costs is a key driving factor for price increases.

The strong cost side has pushed up the market price of phenol. The phenol factory in Shandong region is the first to announce a price increase of 200 yuan/ton, with a factory price of 9200 yuan/ton (including tax). Following closely, East China cargo holders also raised the outbound price to 9300-9350 yuan/ton (including tax). At noon, the East China Petrochemical Company once again announced a 400 yuan/ton increase in the listing price, while the factory price remains at 9200 yuan/ton (including tax). Despite the price increase in the morning, the actual transaction in the afternoon was relatively weak, with the transaction price range concentrated between 9200 to 9250 yuan/ton (including tax).

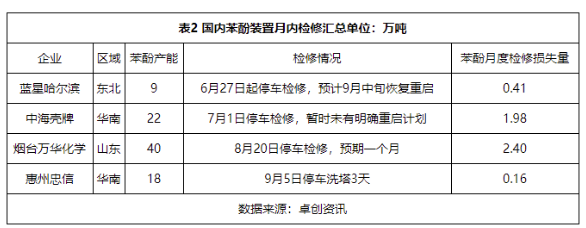

3.Limited supply side changes

According to the tracking calculation of the current domestic phenol ketone plant operation, it is expected that the domestic phenol production in September will be approximately 355400 tons, which is expected to decrease by 1.69% compared to the previous month. Considering that the natural day in August will be one more day than September, overall, the change in domestic supply is limited. The main focus of the operators will be on changes in port inventory.

4.Demand side profit challenged

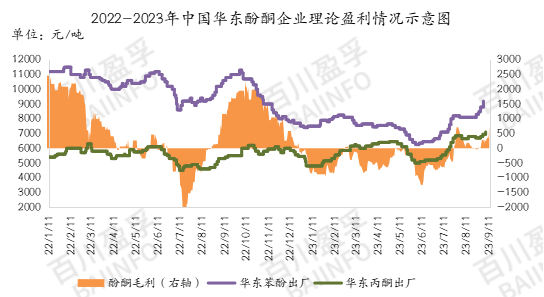

Last week, there were large buyers of bisphenol A and phenolic resin restocking and purchasing in the market, and last Friday, there was a new production capacity of phenolic ketone purchasing test materials in the market. Phenol prices soared, but downstream did not fully follow the rise. A 240000 ton bisphenol A plant in the Zhejiang region has been restarted over the weekend, and the August maintenance of the 150000 ton bisphenol A plant in Nantong has basically resumed normal production load. The market price of bisphenol A remains at a quoted level of 11750-11800 yuan/ton. Amidst the strong rise in prices of phenol and acetone, the profits of the bisphenol A industry have been swallowed up by the rise in phenol.

5.Profitability of Phenol Ketone Factory

The profitability of the phenol ketone factory has improved this week. Due to the relatively stable prices of pure benzene and propylene, the cost remains unchanged, and the selling price has increased. The profit per ton of phenolic ketone products is as high as 738 yuan.

6.Future outlook

For the future, the market remains optimistic about phenol. Although there may be consolidation and correction in the short term, the overall trend is still upward. The focus of market attention includes the impact of the Hangzhou Asian Games on the transportation of phenol in the market, as well as when the wave of stocking up will arrive before the 11th holiday. It is expected that the shipping price of phenol at the East China Port will be between 9200-9650 yuan/ton this week.

Post time: Sep-12-2023