According to incomplete statistics, from early August to August 16th, the price increase in the domestic chemical raw material industry exceeded the decline, and the overall market has recovered. However, compared to the same period in 2022, it is still at the bottom position. At present, the recovery situation in various industries in China is not ideal, and it is still a sluggish scene. In the absence of an improvement in the economic environment, the rebound in raw material prices is a short-term behavior that makes it difficult to sustain price increases.

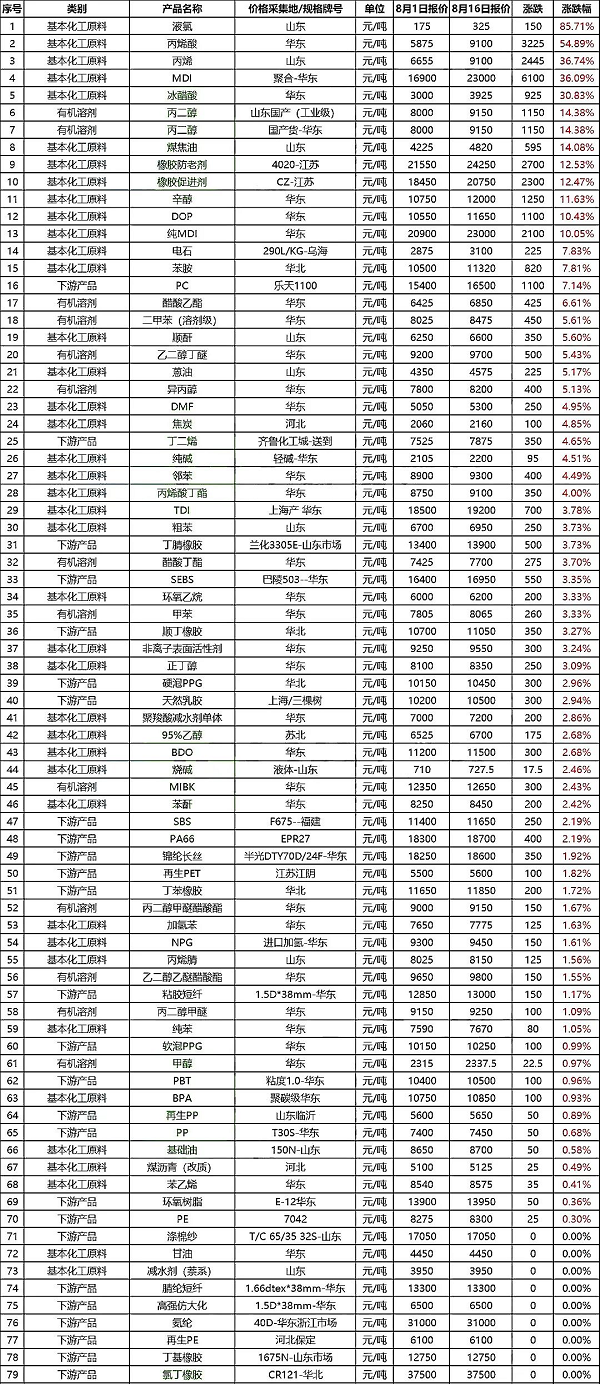

Based on market changes, we have compiled a list of over 70 material price increases, as follows:

Epoxy resin: Due to market influence, downstream customers of liquid epoxy resin in South China are currently cautious and lack confidence in the future market. The liquid epoxy resin market in the East China region is stagnant and at a high level. From the market situation, downstream users do not buy the bill, but rather have resistance, and their stocking enthusiasm is very low.

Bisphenol A: Compared to previous years, the current domestic market price of bisphenol A is still at a low level, and there is still a lot of room for improvement. Compared to the same period last year at 12000 yuan/ton, it has decreased by nearly 20%.

Titanium dioxide: August is still the off-season at the end, and many downstream enterprises replenished their rigid demand inventory last month. Currently, the willingness to purchase in bulk has weakened, leading to low market trading volume. On the supply side, mainstream manufacturers still carry out maintenance work to reduce production or adjust inventory during the off-season, resulting in relatively low output on the supply side. Recently, there has been a strong trend of fluctuations in the raw material prices of titanium dioxide, which has also supported the upward trend of titanium dioxide prices. Taking into account various market factors, the titanium dioxide market is currently in a stable stage after the rise.

Epoxy chloropropane: Most production enterprises have stable new orders, while some regions have poor sales and shipments. New orders can be negotiated, while downstream enterprises are cautious in following up. Many operators are concerned about changes in the operation of on-site devices.

Propylene: The mainstream propylene price in Shandong region remains between 6800-6800 yuan/ton. It is expected that supply will decrease, so production companies have lowered their quoted prices, and the market’s transaction focus continues to shift upwards. However, the demand for downstream polypropylene is still relatively weak, which has put some pressure on the market. The purchasing enthusiasm of factories is low, and although prices are high, acceptance is still average. Therefore, the increase in the propylene market is limited to a certain extent.

Phthalic anhydride: The price of raw material ortho benzene continues to remain high, and the industrial naphthalene market remains stable. There is still some support on the cost side, and due to the relatively low price, downstream replenishment actions gradually increase, releasing some trading volume, making the factory’s spot supply even more tense.

Dichloromethane: The overall price has remained stable, although some prices have slightly increased, the increase is relatively small. However, due to the market sentiment being biased towards bearish, despite continuous positive signals stimulating the market, the overall atmosphere remains biased towards bearish. The current sales pressure in Shandong region is high, and the inventory backlog of enterprises is fast. It is expected that there may be some pressure in the first half of next week. In Guangzhou and surrounding areas, inventory is relatively low, so price adjustments may lag slightly behind those in Shandong.

N-butanol: Following the continuous increase in butanol, due to the continued expectation of device maintenance, downstream buyers still show a positive purchasing attitude during price correction, so n-butanol is expected to maintain strong operation in the short term.

Acrylic acid and butyl ester: Stimulated by the continuous increase in the price of raw material butanol and the insufficient spot supply of most ester products, ester holders have concentrated in price increases, which has stimulated some rigid demand from downstream to enter the market, and the trading center has shifted upwards. It is expected that the raw material butanol will continue to operate stronger, and the ester market is expected to continue its upward trend. However, attention needs to be paid to the downstream acceptance of rapidly rising new prices.

Post time: Aug-21-2023