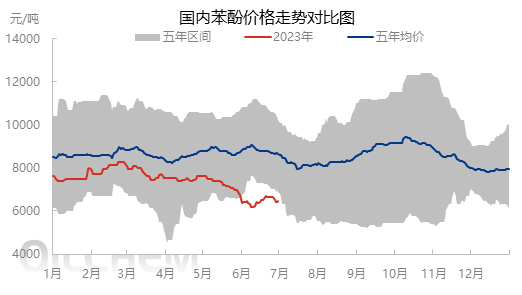

In the first half of 2023, the domestic phenol market experienced significant fluctuations, with price drivers mainly driven by supply and demand factors. Spot prices fluctuate between 6000 to 8000 yuan/ton, at a relatively low level in the past five years. According to Longzhong statistics, the average price of phenol in the East China phenol market in the first half of 2023 was 7410 yuan/ton, a decrease of 3319 yuan/ton or 30.93% compared to 10729 yuan/ton in the first half of 2022. In late February, the high point in the first half of the year was 8275 yuan/ton; The low point of 6200 yuan/ton in early June.

Review of Phenol Market in the First Half of the Year

The New Year holiday has returned to the market. Although the inventory of Jiangyin Phenol Port is as low as 11000 tons, considering the impact of new phenol ketone production, terminal procurement has slowed down, and the market decline has increased the wait-and-see of operators; Later, due to lower than expected production of new equipment, tight spot prices were beneficial, stimulating market growth. As the Spring Festival holiday approaches and regional traffic resistance increases, the market gradually shifts towards a market closed state. During the Spring Festival, the phenol market started well. In just two working days, it has increased by 400-500 yuan/ton. Considering that it will take time for terminal recovery after the holiday, the market has stopped rising and fallen. When the price drops to 7700 yuan/ton, considering high costs and average prices, the intention of the cargo holder to sell at a reduced rate weakens.

In February, the two sets of phenol ketone plants in Lianyungang operated smoothly, and the discourse power of domestic products in the phenol market increased. Terminal wait-and-see participation affected supplier shipments. Although the export shipment and negotiation operations during the same period are beneficial for phased stimulation, the support is limited, and the overall market fluctuation is significant.

In March, downstream production of bisphenol A decreased, and domestic phenolic resin competition pressure was high. The sluggish demand side led to a decline in phenol in multiple places. During this period, although high costs and average prices have supported the market to rise in stages, maintaining a high level is not easy, and the weak market intermittently intersperses among them.

From April to May, domestic phenolic ketone plants entered a centralized maintenance period, influenced by the interactive game between supply and demand. In April, the market saw mutual ups and downs. In May, the external environment was weak, the demand side performance was sluggish, and the efficiency of device maintenance was difficult to release. The declining market dominated, and low prices continued to be breached. Near mid June, downstream large players increased their participation in bidding operations, increased domestic spot circulation, eased the shipping pressure on holders, and increased their enthusiasm for pushing up. In addition, the proper replenishment of terminals before the Dragon Boat Festival has steadily increased the support center of gravity. After the Dragon Boat Festival, the market bidding operation temporarily ended, the participation of operators slowed down, the supplier shipments decreased, the focus was slightly weak, and the transaction turned to quiet.

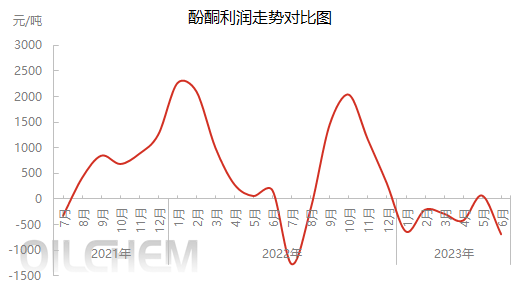

Phenol market is poor, with mostly negative profits

In the first half of 2023, the average profit of phenolic ketone enterprises was -356 yuan/ton, a year-on-year decrease of 138.83%. The highest profit after mid May was 217 yuan/ton, and the lowest profit in the first half of June was -1134.75 yuan/ton. In the first half of 2023, the gross profit of domestic phenolic ketone plants was mostly negative, and the overall profit time was only one month, with the highest profit not exceeding 300 yuan/ton. Although the price trend of dual raw materials in the first half of 2023 is not as good as the same period in 2022, the price of phenolic ketones is also the same, and even worse than the performance of raw materials, making it difficult to alleviate profit losses.

Prospects for Phenol Market in the Second Half of the Year

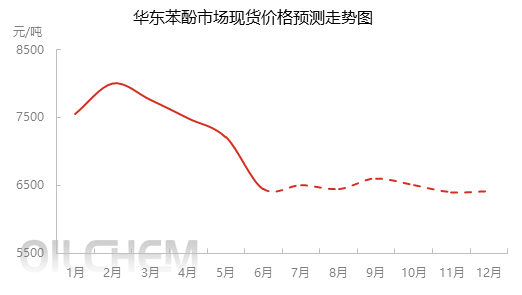

In the second half of 2023, with the expected production of new equipment for domestic phenol and downstream bisphenol A, the supply and demand model remains dominant, and the market is either highly variable or normal. Affected by the production plan of new equipment, the competition between domestic products and imported products, as well as between domestic products and domestic products, will further intensify. There are variables in the start and stop status of domestic phenolic ketone equipment. Whether the export and domestic competition situation in some downstream fields can be alleviated, the new production pace of bisphenol A and the start-up of new equipment are particularly crucial. Of course, in the case of continuous losses in profits for phenolic ketone enterprises, attention should also be paid to cost and price trends. Comprehensively assess the losses and current profits that the supply and demand fundamentals will face. It is expected that there will be no significant fluctuations in the domestic phenol market in the second half of the year, with material prices fluctuating between 6200 and 7500 yuan/ton.

Post time: Jul-17-2023