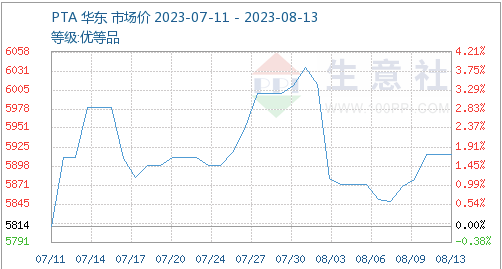

Recently, the domestic PTA market has shown a slight recovery trend. As of August 13th, the average price of PTA in the East China region reached 5914 yuan/ton, with a weekly price increase of 1.09%. This upward trend is to some extent influenced by multiple factors, and will be analyzed in the following aspects.

In the context of low processing costs, the recent increase in unexpected maintenance of PTA devices has led to an increasingly significant reduction in supply. As of August 11th, the industry’s operating rate has remained at around 76%, with Dongying Weilian PTA’s total production capacity of 2.5 million tons/year temporarily shut down due to reasons. The production capacity of Zhuhai Ineos 2 # unit has decreased to 70%, while Xinjiang Zhongtai’s 1.2 million tons/year unit is also undergoing shutdown and maintenance. It is planned to restart around August 15th. The shutdown maintenance and load reduction operation of these devices have led to a decrease in market supply, providing a certain driving force for the increase in PTA prices.

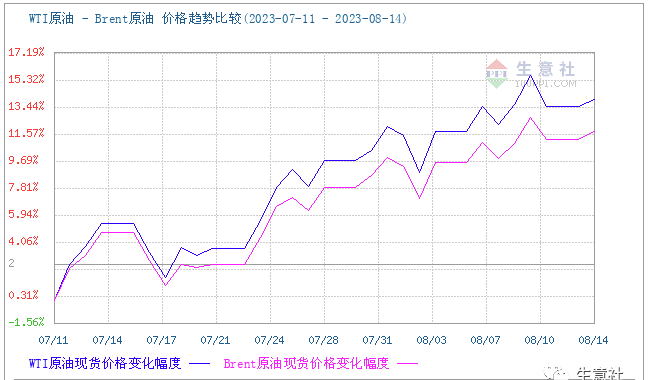

Recently, the overall crude oil market has shown a volatile and upward trend, with supply tightening leading to an increase in oil prices, which has provided favorable support for the PTA market. As of August 11th, the settlement price of the WTI crude oil futures main contract in the United States was $83.19 per barrel, while the settlement price of the Brent crude oil futures main contract was $86.81 per barrel. This trend has led to an increase in PTA production costs, indirectly driving up market prices.

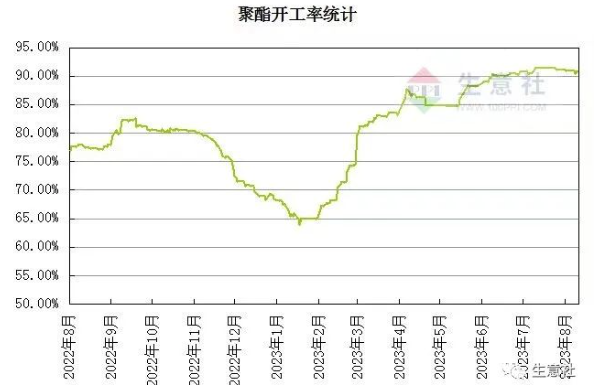

The operating rate of the downstream polyester industry remains at a relatively high level of about 90% this year, continuing to maintain a rigid demand for PTA. At the same time, the atmosphere of the terminal textile market has slightly warmed up, with some textile and clothing factories holding high expectations for future raw material prices and gradually starting the inquiry and sampling mode. The capacity utilization rate of most weaving factories remains strong, and currently the weaving start-up rate in the Jiangsu and Zhejiang regions is over 60%.

In the short term, cost support factors still exist, coupled with low inventory of downstream polyester and stable production load, the current fundamentals of the PTA market are relatively good, and prices are expected to continue to rise. However, in the long run, with the gradual restart of PX and PTA devices, market supply will gradually increase. In addition, the performance of terminal orders is average, and the stocking of weaving links is generally concentrated in September. There is insufficient willingness to replenish inventory at high prices, and the expectation of weak polyester production, sales, and inventory may pose a certain drag on the PTA market, which may limit further price increases. Therefore, investors need to fully consider the impact of these factors when considering market conditions in order to formulate reasonable investment strategies.

Post time: Aug-14-2023