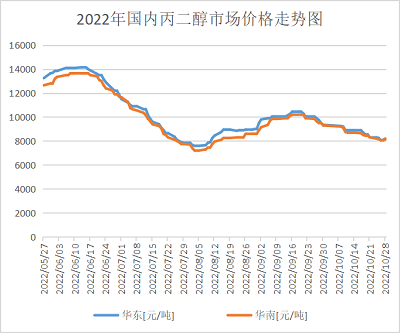

The propylene glycol price fluctuated and fell this month, as shown in the above trend chart of propylene glycol price. In the month, the average market price in Shandong was 8456 yuan/ton, 1442 yuan/ton lower than the average price last month, 15% lower, and 65% lower than the same period last year. The main reasons for the continuous decline in prices are as follows:

1. Only individual equipment stops or reduces load production within the month of equipment recovery, and the market supply is sufficient;

2. Downstream demand was lower than expected, unsaturated resin started nearly 30%, and supply and digestion were slow;

3. The raw materials propylene oxide and methanol only operated strongly a few days before the return of the National Day holiday, and then gradually weakened;

4. The export order is not sustainable. The export order was slightly better at the beginning of the month, but it will only slow down the market decline;

At the end of the month, export orders also rebounded, and prices rose by a narrow margin. As of the 28th, Shandong propylene glycol market had left the factory with the

acceptance of 8000-8300 yuan/ton, and the exchange rate was lower than 100-200 yuan/ton. Please refer to the actual discussion of market changes.

East China: The propylene glycol market price in East China fluctuated narrowly this month. At present, downstream replenishment has improved the trading atmosphere. In the East China market assessment, the delivery price is 8000-8200 yuan/ton, and the spot exchange price is lower than 100-200 yuan/ton. Please refer to the actual transaction.

South China: In this month, the propylene glycol market in South China fell at a low price. At present, the market has maintained the transaction of rigid demand, and the negotiation atmosphere is general. With the appearance of factory price intention, the market report rose by a narrow margin. The industrial supply of local main propylene glycol plants is normal. The local market evaluation refers to 8100-8200 yuan/ton spot remittance.

Supply and demand analysis

On the cost side: the subsequent raw material, propylene oxide, is expected to be weak in terms of raw materials, liquid chlorine rebounds moderately, and the cost support is slightly enhanced. The supplier’s equipment Huatai continued to maintain, the load of Zhenhai Phase II plan was reduced, and Yida or restart plan was reduced slightly overall; Downstream demanders are temporarily desolate, with limited follow-up, and the market is expected to remain in a narrow deadlock mode. Supply and demand await further guidance from the news, and pay attention to the impact of the epidemic on transportation.

Demand side: The domestic UPR market is weak, mainly due to impact operation. At present, affected by the downturn in demand, most enterprises stop to reduce production, mainly consuming inventory; Considering that it is difficult to significantly improve the terminal downstream consumption under the current environment, the number of rigid purchases is still limited, it is difficult to balance new supply, the contradiction between supply and demand is not reduced, and the market price will continue to bear pressure The supply and demand interweave multiple negative pressures, so the UPR market will remain volatile and downward in the near future.

Future market forecast

Looking into the future market, Jiangsu Haike Sipai plans to put into production at the beginning of next month, and the supply is expected to increase gradually. The raw material side runs close to the cost line, but the demand side is restrained, the shipment is not smooth, and the overall cost is deadlocked. In the short term, it is expected that the supply and cost of domestic propylene glycol market will be weak, the demand will be cautious, and the procurement enthusiasm will be poor. The propylene glycol market or deadlock will mainly discuss shipment, and continue to pay attention to the future equipment and new order dynamics.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Oct-31-2022