Foam materials mainly include polyurethane, EPS, PET and rubber foam materials, etc., which are widely used in the application fields of heat insulation and energy saving, weight reduction, structural function, impact resistance and comfort, etc., reflecting functionality, covering a number of industries such as building materials and construction, furniture and home appliances, oil and water transmission, transportation, military and logistics packaging. Because of the wide range of uses, the current annual market size of foam materials to maintain a high growth rate of 20%, is the current application of new materials in the field of rapid growth, but also triggered the industry’s great concern. Polyurethane (PU) foam is the largest proportion of China’s foam products.

According to statistics, the global market size of foaming materials is about $93.9 billion, growing at a rate of 4%-5% per year, and it is estimated that by 2026, the global market size of foaming materials is expected to grow to $118.9 billion.

With the shift in global economic focus, rapid changes in science and technology, and the continuous development of the industrial foaming sector, the Asia-Pacific region has accounted for the largest share of the global foaming technology market. 2020 China’s plastic products production reached 76.032 million tons, down 0.6% year-on-year from 81.842 million tons in 2019. 2020 China’s foam production reached 2.566 million tons, down 0.62% year-on-year from 0.62% year-on-year decline in 2019.

Among them, Guangdong Province ranks first in foam production in the country, with an output of 643,000 tons in 2020; followed by Zhejiang Province, with an output of 326,000 tons; Jiangsu Province ranks third, with an output of 205,000 tons; Sichuan and Shandong ranked fourth and fifth in turn, with an output of 168,000 tons and 140,000 tons respectively. From the proportion of total national foam production in 2020, Guangdong accounts for 25.1%, Zhejiang accounts for 12.7%, Jiangsu accounts for 8.0%, Sichuan accounts for 6.6% and Shandong accounts for 5.4%.

At present, Shenzhen, as the core of the Guangdong-Hong Kong-Macao Bay Area city cluster and one of the most developed cities in China in terms of comprehensive strength, has gathered a complete industrial chain in the field of Chinese foam technology from raw materials, production equipment, various manufacturing plants, and various end-use markets. In the context of the global advocacy of green and sustainable development and China’s “double carbon” strategy, the polymer foam industry is bound to face technological and process changes, product and R&D promotion, and supply chain restructuring, etc. After several successful editions of FOAM EXPO in North America and Europe, the organizer TARSUS Group, with its brand, will hold the “FOAM EXPO China” from December 7-9, 2022 at the Shenzhen International Convention and Exhibition Center (Baoan New Hall). EXPO China”, linking from polymer foam raw material manufacturers, foam intermediates and product manufacturers, to various end-use applications of foam technology, to comply with and serve the industry development!

Polyurethane in the largest proportion of foaming materials

Polyurethane (PU) foam is the product that accounts for the largest proportion of foaming materials in China.

The main component of polyurethane foam is polyurethane, and the raw material is mainly isocyanate and polyol. By adding appropriate additives, it makes a large amount of foam generated in the reaction product, so as to get polyurethane foam products. Through polymer polyol and isocyanate plus various additives to adjust the foam density, tensile strength, abrasion resistance, elasticity and other indicators, fully stirred and injected into the mold to expand the chain cross-chain reaction, a variety of new synthetic materials between plastic and rubber can be formed.

Polyurethane foam is mainly divided into flexible foam, rigid foam and spray foam. Flexible foams are used in a variety of applications such as cushioning, garment padding and filtration, while rigid foams are mainly used for thermal insulation panels and laminated insulation in commercial and residential buildings and (spray) foam roofing.

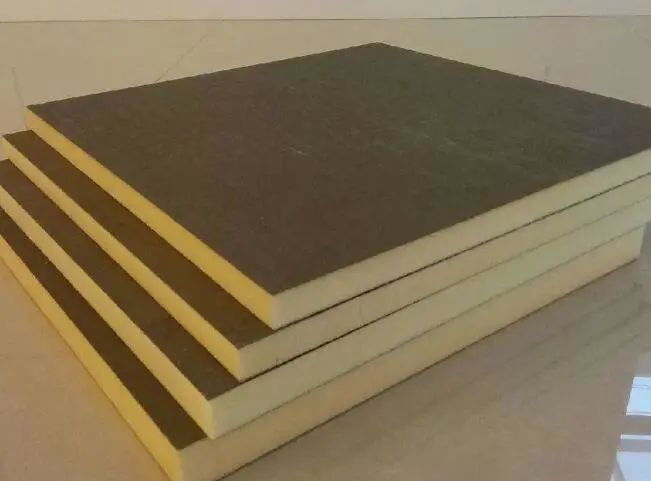

Rigid polyurethane foam is mostly closed-cell structure and has excellent properties such as good thermal insulation, light weight and easy construction.

It also has the characteristics of sound insulation, shockproof, electric insulation, heat resistance, cold resistance, solvent resistance, etc. It is widely used in the insulation layer of the box of refrigerator and freezer, the insulation material of cold storage and refrigerated car, the insulation material of building, storage tank and pipeline, and a small amount is used in non-insulation occasions, such as imitation wood, packaging materials, etc.

Rigid polyurethane foam can be used in roof and wall insulation, door and window insulation and bubble shield sealing. However, polyurethane foam insulation will continue to fight competition from fiberglass and PS foam.

Flexible polyurethane foam

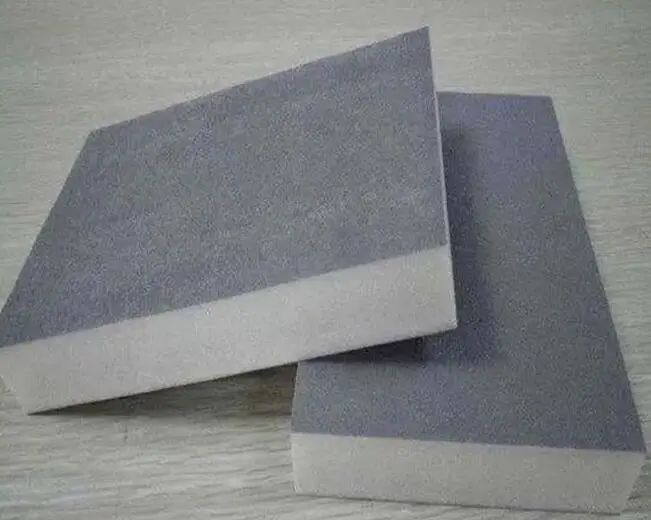

Demand for flexible polyurethane foam has gradually surpassed that of rigid polyurethane foam in recent years. Flexible polyurethane foam is a type of flexible polyurethane foam with a certain degree of elasticity, and it is the most used polyurethane product.

The products mainly include high resilient foam (HRF), block sponge, slow resilient foam, self-crusting foam (ISF), and semi-rigid energy-absorbing foam.

The bubble structure of polyurethane flexible foam is mostly open pore. Generally, it has low density, sound absorption, breathability, heat preservation and other properties, mainly used as furniture cushioning material, transportation seat cushioning material, various soft padding laminated composite materials. Industrial and civil use of soft foam as filtration materials, sound insulation materials, shockproof materials, decorative materials, packaging materials and thermal insulation materials.

Polyurethane downstream expansion momentum

China’s polyurethane foam industry is developing very rapidly, especially in terms of market development.

Polyurethane foam can be used as buffer packaging or padding buffer material for high-grade precision instruments, valuable instruments, high-grade handicrafts, etc. It can also be made into delicate and extremely protective packaging containers; it can also be used for buffer packaging of items by on-site foaming.

Polyurethane rigid foam is mainly used in adiabatic insulation, refrigeration and freezing equipment and cold storage, adiabatic panels, wall insulation, pipe insulation, insulation of storage tanks, single-component foam caulking materials, etc.; polyurethane soft foam is mainly used in furniture, bedding and other household products, such as sofas and seats, back cushions, mattresses and pillows.

Mainly have applications in: (1) refrigerators, containers, freezers insulation (2) PU simulation flowers (3) paper printing (4) cable chemical fiber (5) high-speed road (protection strip signs) (6) home decoration (foam board decoration) (7) furniture (seat cushion, mattress sponge, backrest, armrest, etc.) (8) foam filler (9) aerospace, automotive industry (car cushion, car headrest, steering wheel (10 ) high-grade sporting goods equipment (protective equipment, hand guards, foot guards, boxing glove lining, helmets, etc.) (11) synthetic PU leather (12) shoe industry (PU soles) (13) general coatings (14) special protective coatings (15) adhesives, etc. (16) central venous catheters (medical supplies).

The center of gravity of polyurethane foam development worldwide has also gradually shifted to China, and polyurethane foam has become one of the fastest growing industries in China’s chemical industry.

In recent years, the rapid development of domestic refrigeration insulation, building energy saving, solar energy industry, automobile, furniture and other industries has greatly boosted the demand for polyurethane foam.

During the “13th Five-Year Plan” period, through nearly 20 years of digestion, absorption and re-creation of polyurethane raw materials industry, MDI production technology and production capacity are among the world’s leading levels, polyether polyol production technology and scientific research and innovation capabilities continue to improve, high-end products continue to emerge, and the gap with foreign advanced levels continues to narrow. 2019 China The consumption of polyurethane products is about 11.5 million tons (including solvents), the export of raw materials is increasing year by year, and it is the world’s largest polyurethane production and consumption region, the market is further mature, and the industry is beginning to enter the technology upgrading period of high-quality development.

According to the scale of the industry, the market size of polyurethane type foaming materials accounts for the largest share, with the market size of about 4.67 million tons, of which mainly soft foam polyurethane foaming materials, accounting for about 56%. With the booming development of electrical and electronic fields in China, especially the enhancement of refrigerator and building-type applications, the market scale of polyurethane foaming materials also continues to grow.

Currently, the polyurethane industry has stepped into a new stage with innovation-led and green development as the theme. At present, the output of polyurethane downstream products such as building materials, spandex, synthetic leather and automobiles in China ranks first in the world. The country is vigorously promoting water-based coatings, implementing new policies on building energy conservation and developing new energy vehicles, which also bring huge market opportunities for the polyurethane industry. The “double carbon” target proposed by China will promote the rapid development of building energy saving and clean energy industry, which will bring new development opportunities for polyurethane insulation materials, coatings, composite materials, adhesives, elastomers, etc.

Cold chain market drives demand for polyurethane rigid foam

The General Office of the State Council issued the “Fourteenth Five-Year Plan” cold chain logistics development plan shows that in 2020, China’s cold chain logistics market size of more than 380 billion yuan, cold storage capacity of nearly 180 million cubic meters, refrigerated vehicle ownership of about 287,000, respectively, the “Twelfth Five-Year Plan “The end of the period of 2.4 times, 2 times and 2.6 times.

In many insulation materials, polyurethane has excellent insulation performance, widely used. Compared with other materials, polyurethane insulation materials can save about 20% of the electricity expenses of large cold storage, and its market size is gradually expanding with the development of the cold chain logistics industry. The “14th Five-Year” period, as urban and rural residents continue to upgrade the consumption structure, the potential of large-scale market will accelerate the release of cold chain logistics to create a broad space. The Plan proposes that by 2025, the initial formation of cold chain logistics network, the layout and construction of about 100 national backbone cold chain logistics base, the construction of a number of production and marketing cold chain distribution center, the basic completion of the three-tier cold chain logistics node facilities network; by 2035, the full completion of modern cold chain logistics system. This will further boost the demand for polyurethane cold chain insulation materials.

TPU foam materials rise to prominence

TPU is the sunrise industry in the new polymer materials industry, the downstream applications continue to expand, the industry concentration to further enhance technological innovation and technology will further promote domestic substitution.

As TPU has excellent physical and mechanical properties, such as high strength, high toughness, high elasticity, high modulus, but also has chemical resistance, wear resistance, oil resistance, shock absorption ability and other excellent comprehensive performance, good processing performance, is widely used in shoe materials (shoe soles), cables, films, tubes, automotive, medical and other industries, is the fastest growing material in polyurethane elastomers. Footwear industry is still the most important application of TPU industry in China, but the proportion has been reduced, accounting for about 30%, the proportion of film, pipe applications TPU is gradually increasing, the two market share of 19% and 15% respectively.

In recent years, China’s TPU new production capacity has been released, TPU start-up rate in 2018 and 2019 steadily increased, 2014-2019 domestic TPU production compound annual growth rate of up to 15.46%. 2019 China’s TPU industry continues to expand the scale of the trend, in 2020 China’s TPU production of about 601,000 tons, accounting for one-third of global TPU production More than.

The total production of TPU in the first half of 2021 is about 300,000 tons, an increase of 40,000 tons or 11.83% compared with the same period in 2020. In terms of capacity, China’s TPU production capacity has expanded rapidly in the past five years, and the start-up rate has also shown a rising trend, with China’s TPU production capacity growing from 641,000 tons to 995,000 tons from 2016-2020, with a compound annual growth rate of 11.6%. From the consumption point of view 2016-2020 China’s TPU elastomer consumption overall growth, TPU consumption in 2020 exceeded 500,000 tons, a year-on-year growth rate of 12.1%. Its consumption is expected to reach about 900,000 tons by 2026, with an annual compound growth rate of about 10% in the next five years.

Artificial leather alternative is expected to continue to heat up

Synthetic polyurethane leather (PU leather), is the polyurethane composition of the epidermis, microfiber leather, quality is better than PVC (commonly known as Western leather). Now clothing manufacturers widely used such materials to produce clothing, commonly known as imitation leather clothing. PU with leather is a second layer of leather whose reverse side is cowhide, coated with a layer of PU resin on the surface, so also known as laminated cowhide. Its price is cheaper and the utilization rate is high. With the change of its process is also made of various grades of varieties, such as imported two-layer cowhide, because of the unique process, stable quality, novel varieties and other characteristics, for the current high-grade leather, price and grade are no less than the first layer of genuine leather.

PU leather is currently the most mainstream products in synthetic leather products; and PVC leather although contains harmful plasticizers in some areas are banned, but its super weather resistance and low prices make it in the low-end market still has a strong competitiveness; microfiber PU leather although has a comparable feel to leather, but its higher prices limit its large-scale use, market share of about 5%.

Post time: Feb-09-2022