Entering May, polypropylene continued its decline in April and continued to decline, mainly due to the following reasons: firstly, during the May Day holiday, downstream factories were shut down or reduced, resulting in a significant decline in overall demand, leading to inventory accumulation in upstream production enterprises and a slow pace of destocking; Secondly, the continuous decline in crude oil prices during the holidays has weakened the cost support for polypropylene, and has also had a significant impact on the operational mindset of the industry; Moreover, the weak operation of PP futures before and after the festival dragged down the price and mentality of the spot market.

Slow pace of destocking due to weak supply and demand

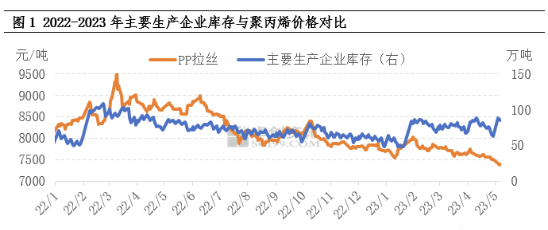

Inventory is a relatively intuitive indicator that reflects the comprehensive changes in supply and demand. Before the holiday, the maintenance of PP devices was relatively concentrated, and the spot supply in the front-end market decreased accordingly. With downstream factories just in need of procurement, the inflection point of upstream production enterprises going to the warehouse appeared in a short period of time. However, due to the unsatisfactory substantive consumption of downstream terminals, the extent of upstream enterprises going to the warehouse was relatively limited. Subsequently, during the holiday, downstream factories shut down for holidays or reduced their demand, leading to a further contraction in demand. After the holiday, major production enterprises returned with a significant accumulation of PP inventory. At the same time, combined with the impact of the sharp drop in crude oil prices during the holiday period, there was no significant improvement in market trading sentiment after the holiday. Downstream factories had low production enthusiasm, and they either waited or chose to follow up in moderation, resulting in limited overall trading volume. Under certain pressure of PP inventory accumulation and destocking, enterprise prices have gradually decreased.

Continuous decline in oil prices weakens support for costs and mentality

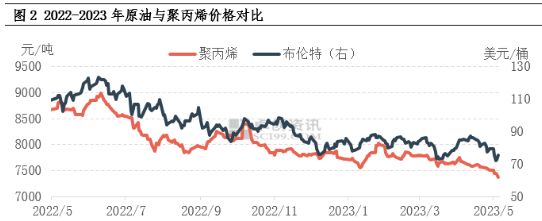

During the May Day holiday, the international crude oil market as a whole experienced a major decline. On the one hand, the Bank of America incident once again disrupted risky assets, with crude oil falling the most significantly in the commodity market; On the other hand, the Federal Reserve raised interest rates by 25 basis points as scheduled, and the market is once again concerned about the risk of economic recession. Therefore, with the banking incident as the trigger, under the macro pressure of interest rate hikes, crude oil has basically taken back the upward momentum brought by Saudi Arabia’s proactive production reduction in the early stage. As of the close on May 5th, WTI was at $71.34 per barrel in June 2023, a decrease of 4.24% compared to the last trading day before the holiday. Brent was at $75.3 per barrel in July 2023, a decrease of 5.33% compared to the last trading day before the holiday. The continuous decline in oil prices has weakened the support for polypropylene costs, but undoubtedly has a more significant impact on market sentiment, leading to a downward trend in the market’s quotations.

Weak Futures Downtrend Suppresses Spot Prices and Attitudes

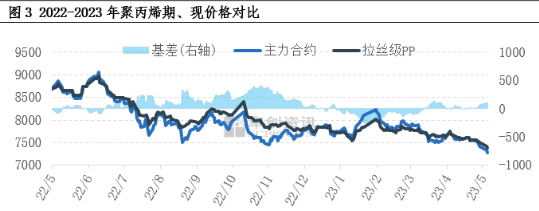

In recent years, the financial attributes of polypropylene have been continuously strengthened, and the futures market is also one of the important factors affecting the spot market of polypropylene. The futures market fluctuates lower and is highly correlated with the formation of spot prices. In terms of basis, the recent basis has been positive, and the basis has gradually strengthened before and after the holiday. As shown in the figure, the decline in futures is greater than that of spot goods, and the market’s bearish expectations remain strong.

When it comes to the future market, supply and demand fundamentals are still a key factor affecting market direction. In May, there are still multiple PP devices planned to be shut down for maintenance, which may alleviate the pressure on the supply side to some extent. However, the expected improvement in downstream demand is limited. According to some industry insiders, although the raw material inventory of downstream factories is not high, there is a large accumulation of inventory in the early stage of products, so the main focus is on digesting inventory. The production enthusiasm of downstream terminal factories is not high, and they are cautious in following up on raw materials, so the poor downstream demand directly leads to limited demand transmission effects in the industrial chain. Based on the above analysis, it is expected that the polypropylene market will continue to experience weak consolidation in the short term. It is not ruled out that phased positive news will boost prices slightly, but there is significant upward resistance.

Post time: May-10-2023