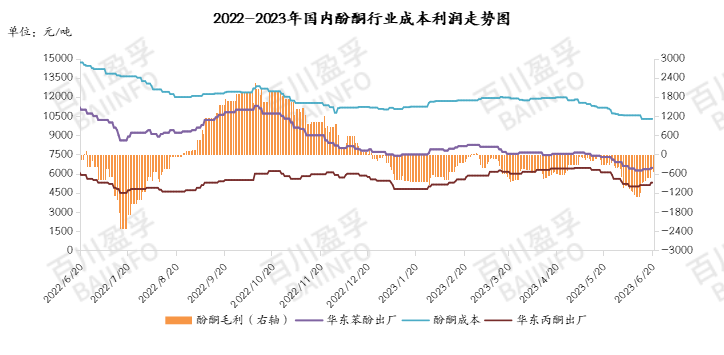

In June 2023, the phenol market experienced a sharp rise and fall. Taking the outbound price of East China ports as an example. At the beginning of June, the phenol market experienced a significant decline, dropping from a taxed ex-warehouse price of 6800 yuan/ton to a low point of 6250 yuan/ton, with a decrease of 550 yuan/ton; However, since last week, the price of phenol has stopped falling and rebounded. On June 20th, the outbound price of phenol at East China Port was 6700 yuan/ton, with a low rebound of 450 yuan/ton.

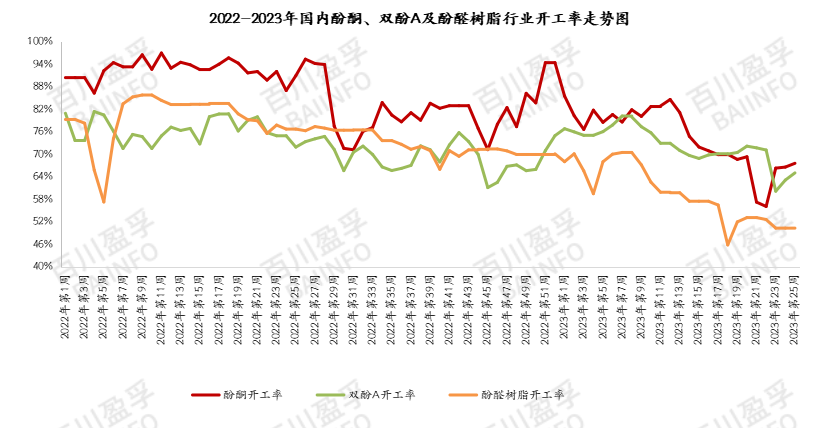

Supply side: In June, the phenolic ketone industry started to improve. In early June, production resumed with 350000 tons in Guangdong, 650000 tons in Zhejiang, and 300000 tons in Beijing; The industrial operating rate increased from 54.33% to 67.56%; But Beijing and Zhejiang enterprises are equipped with bisphenol A digestion phenol devices; In the later stage, due to factors such as equipment production reduction in a certain area of Lianyungang and delayed start time of maintenance enterprises, the external sales of phenol in the industry decreased by about 18000 tons. Last weekend, a 350000 ton equipment in South China had a temporary parking arrangement. Three phenol enterprises in South China basically did not have spot sales, and spot transactions in South China were tight.

Demand side: In June, there was a significant change in the operating load of the bisphenol a plant. At the beginning of the month, some units shut down or reduced their load, resulting in the industry’s operating rate dropping to around 60%; The phenol market has also provided feedback, with prices dropping significantly. In the middle of this month, some units in Guangxi, Hebei, and Shanghai resumed production. Affected by the increase in load on the bisphenol a plant, Guangxi phenolic manufacturers have suspended exports; In the middle of this month, the load of Hebei BPA plant increased, triggering a new wave of spot purchase, directly driving the price of phenol in the Spot market from 6350 yuan/ton to 6700 yuan/ton. In terms of phenolic resin, major domestic manufacturers have basically maintained contract procurement, but in June, resin orders were weak, and the price of raw material phenol unilaterally weakened. For phenolic resin enterprises, sales pressure is too high; Phenolic resin companies have a low proportion of spot purchases and a cautious attitude. After the rise in phenol prices, the phenolic resin industry has received certain orders, and most phenolic resin companies are taking orders back to back.

Profit margin: The phenolic ketone industry suffered a significant loss this month. Although the prices of pure benzene and propylene have decreased to some extent, the single ton of phenol ketone industry in June can reach as high as -1316 yuan/ton. Most enterprises have reduced production, while a few enterprises are operating normally. The phenolic ketone industry is currently in a state of significant loss. In the later stage, with the rebound of phenolic ketone prices, the industry’s profitability increased to -525 yuan/ton. Although the level of losses has decreased, the industry still finds it difficult to bear. In this context, it is relatively safe for holders to enter the market and hit the bottom.

Market mentality: In April and May, due to many phenolic ketone companies having maintenance arrangements, most holders were unwilling to sell, but the performance of the phenol market was lower than expected, with prices mainly falling; In June, due to strong supply recovery expectations, most holders sold at the beginning of the month, causing price panic and falling. However, with the recovery of downstream demand and significant losses for phenolic ketone enterprises, phenol prices slowed down and prices stopped rebounding; Due to early panic selling, it was gradually difficult to find spot goods in the mid month market. Therefore, since mid June, the phenol market has experienced a turning point in price rebound.

At present, the market near the Dragon Boat Festival is weak, and the pre festival replenishment has basically ended. After the Dragon Boat Festival, the market entered the settlement week. It is expected that there will be few transactions in the Spot market this week, and the market price may fall slightly after the festival. The estimated shipping price for phenol port in East China next week is 6550-6650 yuan/ton. Suggest paying more attention to large order procurement.

Post time: Jun-21-2023