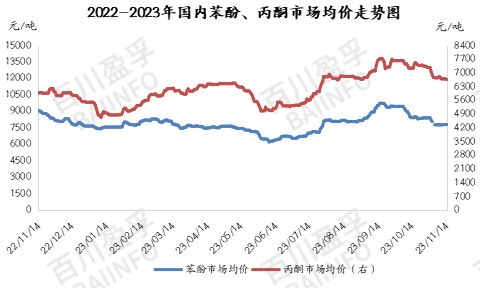

On November 14, 2023, the phenolic ketone market saw both prices rise. In these two days, the average market prices of phenol and acetone have increased by 0.96% and 0.83% respectively, reaching 7872 yuan/ton and 6703 yuan/ton. Behind seemingly ordinary data lies the turbulent market for phenolic ketones.

Looking back at the market trends of these two major chemicals, we can discover some interesting patterns. Firstly, from the perspective of the overall trend, the price fluctuations of phenol and acetone are closely related to the concentrated release of new production capacity and the profitability of downstream industries.

In mid October of this year, the phenolic ketone industry welcomed a new production capacity of 1.77 million tons, which was put into centralized production. However, due to the complexity of the phenolic ketone process, the new production capacity requires a cycle of 30 to 45 days from feeding to producing products. Therefore, despite the significant release of new production capacity, in reality, these new production capacities did not steadily output products until mid November.

In this situation, the phenol industry has limited supply of goods, and coupled with the tight market situation in the pure benzene market, the price of phenol has rapidly increased, reaching a high of 7850-7900 yuan/ton.

The acetone market presents a different picture. In the early stage, the main reasons for the decline in acetone prices were the production of new production capacity, losses in the MMA industry, and pressure on isopropanol export orders. However, over time, the market has undergone new changes. Although some factories have shut down due to maintenance, there is a maintenance plan for phenol ketone conversion in November, and the amount of acetone released has not increased. At the same time, prices in the MMA industry have rapidly rebounded, returning to profitability, and some factories’ maintenance plans have also slowed down. These factors combined to cause a certain rebound in acetone prices.

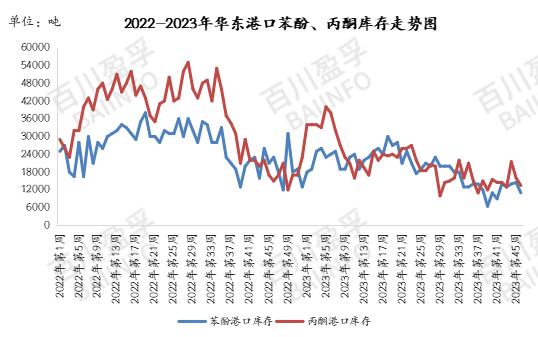

In terms of inventory, as of November 13, 2023, the inventory of phenol at Jiangyin Port in China was 11000 tons, a decrease of 35000 tons compared to November 10; The inventory of acetone at Jiangyin Port in China is 13500 tons, a decrease of 0.25 million tons compared to November 3rd. It can be seen that although the release of new production capacity has caused some pressure on the market, the current situation of low inventory in ports has offset this pressure.

In addition, according to the statistical data from October 26, 2023 to November 13, 2023, the average price of phenol in East China is 7871.15 yuan/ton, and the average price of acetone is 6698.08 yuan/ton. At present, the spot prices in East China are close to these average prices, indicating that the market has sufficient expectations and digestion for the release of new production capacity.

However, this does not mean that the market has become completely stable. On the contrary, due to the release of new production capacity and uncertainty in the profitability of downstream industries, there is still a possibility of market volatility. Especially considering the complexity of the phenolic ketone market and the varying production schedules of various factories, the future market trend still needs to be closely monitored.

In this context, it is crucial for investors and traders to closely monitor market dynamics, allocate assets reasonably, and flexibly use derivative instruments. For production enterprises, in addition to paying attention to market prices, they should also pay attention to optimizing process flow and improving production efficiency to cope with potential market risks.

Overall, the phenolic ketone market is currently in a relatively complex and sensitive stage after experiencing the concentrated release of new production capacity and profit fluctuations in downstream industries. For all participants, only by fully understanding and grasping the changing laws of the market can they find their foothold in the complex market environment.

Post time: Nov-15-2023