Into March, as part of the downstream bisphenol A products plant maintenance, and part of the terminal start shortage, resulting in increased short-term supply and demand pressure on the phenol market, but the recent high crude oil futures prices run, driving the upper end of phenol raw material pure benzene and propylene prices rebounded, the cost of downward transmission strength, the cost and supply and demand game, the buy and sell plate sawing, rising break still need help.

In March, as Yanshan Petrochemical East phenol ketone unit restarted, Zhejiang Petrochemical 2 phenol ketone unit facing output, and the rest of the domestic phenol ketone unit in the month there is no plan to stop maintenance, the overall domestic phenol ketone unit start-up load maintained at a high level, the phenol market domestic supply side is expected to increase significantly compared to last month. However, the two sets of bisphenol A units under the Levoy Chemical entered the maintenance period, its upstream supporting phenol ketone units are not planned for the time being, in addition to the Zhejiang Petrochemical a bisphenol A unit from March 3 stop maintenance, restart time to be determined, coupled with the Chinese New Year downstream resumption time is slow, it is reported that part of the northern region downstream plant resumption time delayed to mid-March near.

Phenol market supply and demand pressures amplified for a short period of time, the phenol market in early March to continue the weak shock downward trend at the end of February, and the industry’s bearish atmosphere gradually turned thick, but the impact of the international situation, crude oil futures prices broke through the high level in succession, driving the phenol market on the upper end of the product pure benzene and propylene prices rebounded, the phenol market appeared to stop falling after a slight uptrend.

From the recent data changes in the phenol market, the cost side downward conduction is slow, the closer to the end of the product up relatively small. On the one hand, it shows that the supply and demand fundamentals of the lower-end products still need to be improved, and on the other hand, it shows that the downstream buyers have a wait-and-see attitude towards the sustainability of the rising cost side.

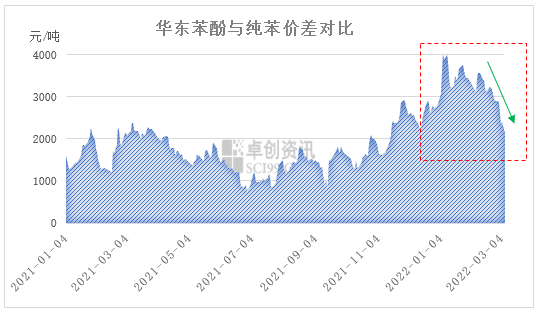

At present, East China phenol and pure benzene spread is rapidly declining, as of March 7 close, East China phenol market closed at 10900-11000 yuan / ton, East China pure benzene closed at 8750-8850 yuan / ton, the spread between the two has returned to 2150 yuan / ton. In the short term, crude oil futures prices boosted by pure benzene prices or delay the high running situation, but the phenol market is relatively slow, the spread between the two is expected to continue to narrow, the impact of late cost support for the phenol market will gradually strengthen.

At present, Europe and the United States crude oil futures rose to the highest since 2008, Brent crude oil futures intraday close to $ 140 per barrel, rising crude oil prices, resulting in refining downstream areas of increased cost pressure, with the phenol and pure benzene spread gradually narrowed, the cost side of the boost to the phenol market will enhance the role of phenol prices will show a higher trend, but back to the supply and demand fundamentals, the short term phenol supply and demand Pressure is still large, especially in the northern market, the recent southern flow of goods from the north on the one hand to inhibit the rhythm of the market price increases, on the other hand, also from the side to reflect the pressure of the northern market inventory. Short-term cost and supply and demand game, the buy and sell plate sawing, rising break still need help.

Post time: Mar-09-2022