In the first half of 2022, the overall performance of the isopropanol market was not satisfactory. Some new capacity has been released, but compared to last year, some capacity has been eliminated and capacity remains stable, but supply and demand pressure remains unabated. Inventory pressure in some plants is still dependent on export demand relief, and market prices have been largely at low to medium levels with limited amplitude in recent years.

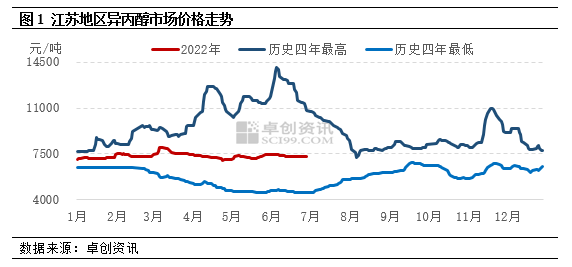

In the first half of 2022, the overall isopropanol market was at a low to medium level. In the Jiangsu market, for example, the average market price in the first half of the year was 7,343 yuan / ton, up 00 yuan.62% YoY and down 11.17% YoY. Among them, the highest price of 8,000 yuan / ton, which appeared in mid-March, the lowest price of 7,000 yuan / ton, which appeared in April. .29%.

Limited amplitude of interval fluctuations

In the first half of 2022, the isopropanol market basically showed a trend of first up and then down, but the fluctuation space was relatively limited. From January to March, the isopropanol market oscillated upward. At the beginning of Spring Festival, the market trading activities gradually decreased, and most of the buying and selling segments were in a wait-and-see state, and the market price basically fluctuated in the range of 7050-7250 yuan/ton; after the Spring Festival, the upstream raw materials acetone and propylene market rose to different degrees, driving the enthusiasm of isopropanol factories. Domestic isopropyl alcohol market negotiation center of gravity quickly rose to 7,500-7,550 yuan / ton, but due to the slow recovery of terminal demand, the market gradually fell back to 7,250-7,300 yuan / ton; March export demand is strong, some isopropyl alcohol plants export port superimposed on the WTI crude oil futures prices quickly exceeded $ 120 / barrel, isopropyl alcohol plants and market offers continue to improve. Under the downstream buying mentality, the purchase intention increased. By mid-March, the market had risen to a high level of 7,900-8,000 yuan/ton. The isopropanol market fell from March to the end of April. On the one hand, in March, Ningbo Juhua’s isopropanol plant successfully produced for export and the market supply-demand balance was broken again. On the other hand, in April, the logistics capacity in the region decreased, leading to a gradual shrinkage of domestic trade demand. Nearly in April, the market price fell to a low level of 7,000-7,100 yuan/ton. May-June, the isopropanol market was dominated by narrow oscillations. after the price continued to fall in April, some domestic isopropanol units concentrated on parking and maintenance, and the market tightened at low prices, but domestic demand was flat. After the end of export preparation, the impulse of market prices is not enough. At this stage, the mainstream operating range of the market is 7,200-7,400 yuan/ton.

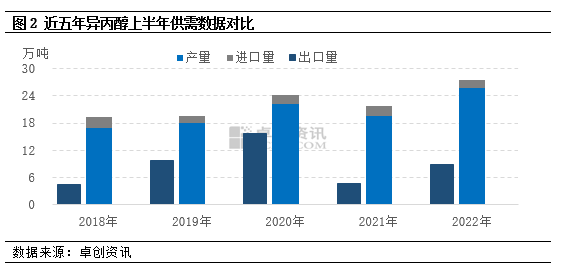

The upward trend of total supply is obvious, and export demand has also rebounded

In terms of domestic production, Ningbo Juhua’s 50,000 t/a isopropanol unit was successfully produced and exported in March, but at the same time, Dongying Haike’s 50,000 t/a isopropanol unit was dismantled. According to Zhuo Chuang information method, it was removed from the isopropanol production capacity, so that the domestic isopropanol production capacity remained stable at 115.80,000 tons. In terms of production, the export demand in the first half of the year was okay, and the production was on an upward trend. According to Zhuo Chuang information statistics, in the first half of 2022, China’s isopropanol production is about 25%.59 million tons, an increase of 60,000 tons or 30%.63%.

Imports:Imports are on a downward trend due to increased domestic supply and excess domestic supply and demand.From January to June 2022, China imported a total of about 19.3 thousand tons of isopropanol, down 000 tons.22 thousand tons, a decrease of 10.23%.

Exports:There is no decline in domestic supply pressure, and inventory pressure in some plants still depends on the easing of export demand.From January to June 2022, China’s total exports of isopropanol were about 89,300 tons, up 40,000 tons.210,000 tons, or 89.05%.

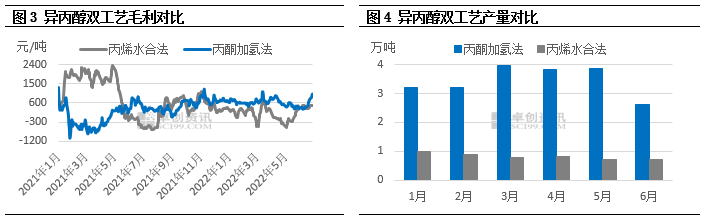

Dual process gross profit and production divergence

According to Zhuo Chuang information isopropyl alcohol theoretical gross profit model calculations, the first half of 2022, isopropyl alcohol acetone hydrogenation process theoretical gross profit of 603 yuan / ton, higher than the same period last year 630 yuan / ton, an increase of 2333.33%; propylene hydration method isopropyl alcohol process theoretical gross profit of 120 yuan / ton, lower than the same period last year 1138 yuan / ton, down 90%.46%. From isopropyl alcohol dual process gross profit comparison chart can be seen, 2022, isopropyl alcohol two process theory of gross profit trend has been divided, acetone hydrogenation process theory of gross profit level is stable, the monthly average profit basically fluctuates between 500-700 yuan / ton, but propylene hydration process theory of gross profit once loss of nearly 600 yuan / ton. Compared with the gross profit of these two processes, the profitability of the isopropyl alcohol acetone hydrogenation process is currently better than that of propylene water.

From the isopropyl alcohol production demand data in recent years, the domestic demand growth rate has not kept pace with the expansion of production capacity. In the long-term oversupply situation, the theoretical profitability level of isopropanol plants has become a key factor in determining the start-up level. 2022, the gross profit of isopropanol hydrogenation process continues to outperform propylene water, making the plant output of isopropanol hydrogenation process much higher than propylene water. According to Zhuo Chuang information data monitoring: in the first half of 2022, isopropanol production accounted for about 80% of the total national production.73%.

Focus on cost trends and export demand in the second half of the year

In the second half of 2022, from the supply and demand fundamentals, there are no new isopropanol units in the market, domestic isopropanol production capacity will remain at 1.158 million tons, and domestic production is still dominated by acetone hydrogenation process. With the rising risk of stagflation in the global economy, export demand for isopropanol weakened. At the same time, the domestic terminal demand is slow to recover, or “peak season is not prosperous” in the second half of the year, the supply and demand pressure is still not reduced. From the cost point of view, taking into account some new phenolic equipment in the second half of this year, the acetone market oversupply, the upper end of the raw material acetone prices will continue to low impact mode; the second half of this year, the impact of the Federal Reserve interest rate hike policy and the risk of recession in Europe and the United States, the focus of international oil prices may fall. The cost side is the main factor affecting propylene prices, propylene market prices will decline compared to the second half of this year. Generally speaking, the cost pressure on isopropanol enterprises is not significant for the time being, and the cost pressure on propylene hydrate isopropanol enterprises is expected to be relieved, but at the same time, in the absence of effective cost support, the ability of the isopropanol market to rebound is insufficient. Isopropyl alcohol market is expected to maintain a range oscillation pattern in the second half of the year, focusing on upstream acetone price trends and changes in export demand.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Aug-24-2022