The Chinese chemical industry is developing from a large-scale to a high-precision direction, and chemical enterprises are undergoing transformation, which will inevitably bring more refined products. The emergence of these products will have a certain impact on the transparency of market information and promote a new round of industrial upgrading and aggregation.

This article will take stock of some important industries in China’s chemical industry and their most concentrated regions to reveal the impact of their history and resource endowments on the industry. We will explore which regions have a prominent position in these industries and analyze how these regions affect the development of these industries.

1. The largest consumer of chemical products in China: Guangdong Province

Guangdong Province is the region with the largest consumption of chemical products in China, mainly due to its huge GDP scale. The total GDP of Guangdong Province has reached 12.91 trillion yuan, ranking first in China, which has promoted the prosperous development of the consumer end of the chemical industry chain. In the logistics pattern of chemical products in China, about 80% of them have a logistics pattern from north to south, and one important end target market is Guangdong Province.

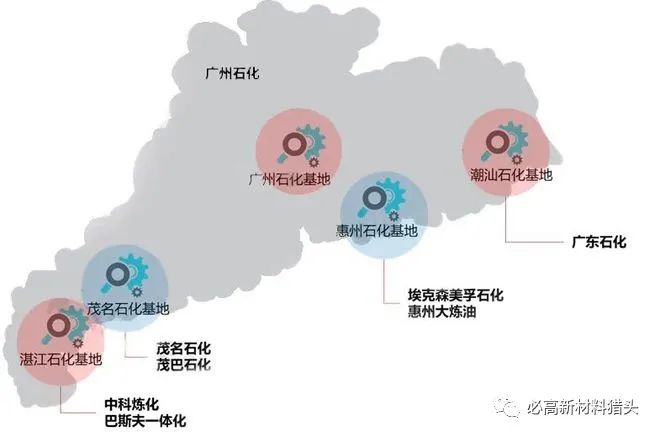

At present, Guangdong Province is focusing on the development of five major petrochemical bases, all of which are equipped with large-scale integrated refining and chemical plants. This has enabled the development of the chemical industry chain in Guangdong Province, thereby improving the refinement rate and supply scale of products. However, there is still a gap in market supply, which needs to be supplemented by northern cities such as Jiangsu and Zhejiang, while high-end new material products need to be supplemented by imported resources.

Figure 1: Five major petrochemical bases in Guangdong Province

2. The largest gathering place for refining in China: Shandong Province

Shandong Province is the largest gathering place for oil refining in China, especially in Dongying City, which has gathered the world’s largest number of local oil refining enterprises. As of mid 2023, there are over 60 local refining enterprises in Shandong Province, with a crude oil processing capacity of 220 million tons per year. The production capacity of ethylene and propylene have also exceeded 3 million tons per year and 8 million tons per year, respectively.

The oil refining industry in Shandong Province began to develop in the late 1990s, with Kenli Petrochemical being the first independent refinery, followed by the establishment of Dongming Petrochemical (formerly known as Dongming County Oil Refining Company). Since 2004, independent refineries in Shandong Province have entered a period of rapid development, and many local refining enterprises have started construction and operation. Some of these enterprises are derived from urban-rural cooperation and transformation, while others are derived from local refining and transformation.

Since 2010, local oil refining enterprises in Shandong have been favored by state-owned enterprises, with multiple enterprises being acquired or controlled by state-owned enterprises, including Hongrun Petrochemical, Dongying Refinery, Haihua, Changyi Petrochemical, Shandong Huaxing, Zhenghe Petrochemical, Qingdao Anbang, Jinan Great Wall Refinery, Jinan Chemical Second Refinery, etc. This has accelerated the rapid development of local refineries.

3. The largest producer of pharmaceutical products in China: Jiangsu Province

Jiangsu Province is the largest producer of pharmaceutical products in China, and its pharmaceutical manufacturing industry is an important source of GDP for the province. Jiangsu Province has a large number of pharmaceutical intermediate industry enterprises, totaling 4067, making it the largest finished pharmaceutical production area in China. Among them, Xuzhou City is one of the largest pharmaceutical production cities in Jiangsu Province, with leading domestic pharmaceutical industry enterprises such as Jiangsu Enhua, Jiangsu Wanbang, Jiangsu Jiuxu, and nearly 60 national high-tech enterprises in the field of biopharmaceuticals. In addition, Xuzhou City has established four national level research and development platforms in professional fields such as tumor biotherapy and medicinal plant function development, as well as more than 70 provincial-level research and development institutions.

Yangzijiang Pharmaceutical Group, located in Taizhou, Jiangsu, is one of the largest pharmaceutical manufacturing enterprises in the province and even in the country. Over the past few years, it has repeatedly topped the top 100 list of China’s pharmaceutical industry. The group’s products cover multiple fields such as anti infection, cardiovascular, digestive, tumor, nervous system, and many of them have high awareness and market share in domestic and international markets.

In summary, the pharmaceutical manufacturing industry in Jiangsu Province holds a very important position in China. It is not only the largest producer of pharmaceutical products in China, but also one of the largest pharmaceutical manufacturing enterprises in the country.

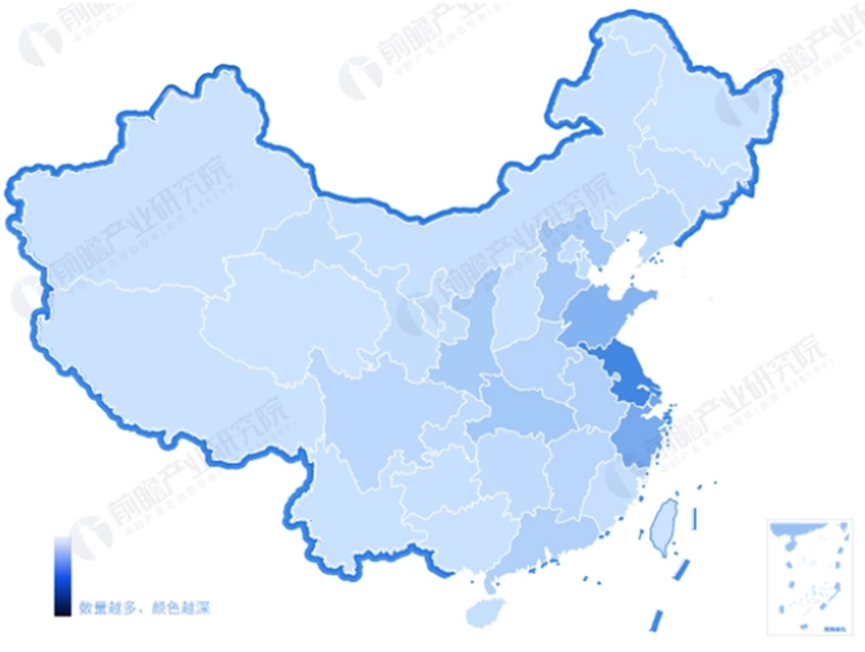

Figure 2 Global distribution of pharmaceutical intermediate production enterprises

Data source: Prospective Industry Research Institute

4. China’s largest producer of electronic chemicals: Guangdong Province

As the largest electronic industry production base in China, Guangdong Province has also become the largest electronic chemical production and consumption base in China. This position is mainly driven by the consumer demand in Guangdong Province. Guangdong Province produces hundreds of types of electronic chemicals, with the widest range of products and the highest refinement rate, covering fields such as wet electronic chemicals, electronic grade new materials, thin film materials, and electronic grade coating materials.

Specifically, Zhuhai Zhubo Electronic Materials Co., Ltd. is an important manufacturer of electronic grade glass fiber cloth, low dielectric, and ultrafine glass fiber yarn. Changxin Resin (Guangdong) Co., Ltd. mainly produces electronic grade amino resin, PTT, and other products, while Zhuhai Changxian New Materials Technology Co., Ltd. mainly sells electronic grade soldering flux, environmental cleaning agent, and Fanlishui products. These enterprises are representative enterprises in the field of electronic chemicals in Guangdong Province.

5. The largest polyester fiber production location in China: Zhejiang Province

Zhejiang Province is the largest polyester fiber production base in China, with polyester chip production enterprises and polyester filament production scale exceeding 30 million tons/year, polyester staple fiber production scale exceeding 1.7 million tons/year, and more than 30 polyester chip production enterprises, with a total production capacity exceeding 4.3 million tons/year. It is one of the largest polyester chemical fiber production regions in China. In addition, there are many downstream textile and weaving enterprises in Zhejiang Province.

Representative chemical enterprises in Zhejiang Province include Tongkun Group, Hengyi Group, Xinfengming Group, and Zhejiang Dushan Energy, among others. These enterprises are the largest polyester chemical fiber production enterprises in China and have grown and developed since Zhejiang.

6. China’s largest coal chemical production site: Shaanxi Province

Shaanxi Province is an important center of China’s coal chemical industry and the largest coal chemical production base in China. According to data statistics from Pingtouge, the province has over 7 coal to olefin production enterprises, with a production scale of over 4.5 million tons per year. At the same time, the production scale of coal to ethylene glycol has also reached 2.6 million tons/year.

The coal chemical industry in Shaanxi Province is concentrated in the Yushen Industrial Park, which is the largest coal chemical park in China and gathers numerous coal chemical production enterprises. Among them, the representative enterprises are middling coal Yulin, Shaanxi Yulin Energy Chemical, Pucheng Clean Energy, Yulin Shenhua, etc.

7. China’s largest salt chemical production base: Xinjiang

Xinjiang is the largest salt chemical production base in China, represented by Xinjiang Zhongtai Chemical. Its PVC production capacity is 1.72 million tons/year, making it the largest PVC enterprise in China. Its caustic soda production capacity is 1.47 million tons/year, also the largest in China. The proven salt reserves in Xinjiang are about 50 billion tons, second only to Qinghai Province. The lake salt in Xinjiang has a high grade and good quality, suitable for deep processing and refining, and producing high value-added salt chemical products, such as sodium, bromine, magnesium, etc., which are the best raw materials for producing related chemicals. In addition, Lop Nur Salt Lake is located in Ruoqiang County in the northeast of Tarim Basin, Xinjiang. The proven potash resources are about 300 million tons, accounting for more than half of the national potash resources. Numerous chemical enterprises have entered Xinjiang for investigation and have chosen to invest in chemical projects. The main reason for this is the absolute advantage of Xinjiang’s raw material resources, as well as the attractive policy support provided by Xinjiang.

8. China’s largest natural gas chemical production site: Chongqing

Chongqing is the largest natural gas chemical production base in China. With abundant natural gas resources, it has formed multiple natural gas chemical industry chains and become a leading natural gas chemical city in China.

The important production area of Chongqing’s natural gas chemical industry is Changshou District. The region has extended the downstream of the natural gas chemical industry chain with the advantage of raw material resources. At present, Changshou District has produced various natural gas chemicals, such as acetylene, methanol, formaldehyde, polyoxymethylene, acetic acid, vinyl acetate, polyvinyl alcohol, PVA optical film, EVOH resin, etc. At the same time, a batch of natural gas chemical product chain varieties are still under construction, such as BDO, degradable plastics, spandex, NMP, carbon nanotubes, lithium battery solvents, etc.

Representative enterprises in the development of natural gas chemical industry in Chongqing include BASF, China Resources Chemical, and China Chemical Hualu. These enterprises actively participate in the development of Chongqing’s natural gas chemical industry, promote technological innovation and application, and further enhance the competitiveness and sustainability of Chongqing’s natural gas chemical industry.

9. Province with the largest number of chemical parks in China: Shandong Province

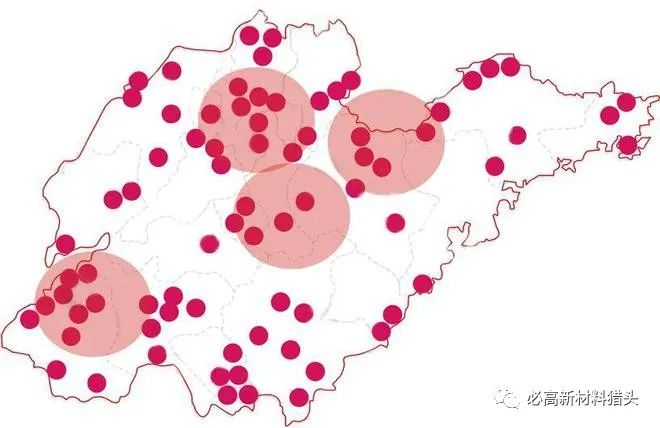

Shandong Province has the largest number of chemical industrial parks in China. There are over 1000 provincial-level and national level chemical parks in China, while the number of chemical parks in Shandong Province exceeds 100. According to the national requirements for the entry of chemical industrial parks, the location of the chemical industrial park is the main gathering area for chemical enterprises. The chemical industrial parks in Shandong Province are mainly distributed in cities such as Dongying, Zibo, Weifang, Heze, among which Dongying, Weifang, and Zibo have the highest number of chemical enterprises.

Overall, the development of the chemical industry in Shandong Province is relatively concentrated, mainly in the form of parks. Among them, chemical parks in cities such as Dongying, Zibo, and Weifang are more developed and are the main gathering places for the chemical industry in Shandong Province.

Figure 3 Distribution of Main Chemical Industry Parks in Shandong Province

10. The largest phosphorus chemical production site in China: Hubei Province

According to the distribution characteristics of phosphorus ore resources, China’s phosphorus ore resources are mainly distributed in five provinces: Yunnan, Guizhou, Sichuan, Hubei, and Hunan. Among them, the supply of phosphorus ore in the four provinces of Hubei, Sichuan, Guizhou, and Yunnan meets most of the national demand, forming a basic pattern of phosphorus resource supply of “transporting phosphorus from the south to the north and from the west to the east”. Whether it is based on the number of production enterprises of phosphate ore and downstream phosphides, or the ranking of production scale in the phosphate chemical industry chain, Hubei Province is the main production area of China’s phosphate chemical industry.

Hubei Province has abundant phosphate ore resources, with phosphate ore reserves accounting for over 30% of the total national resources and production accounting for 40% of the total national production. According to data from the Department of Economy and Information Technology of Hubei Province, the province’s production of five products, including fertilizers, phosphate fertilizers, and fine phosphates, ranks first in the country. It is the first major province in the phosphating industry in China and the largest production base of fine phosphate chemicals in the country, with the scale of phosphate chemicals accounting for 38.4% of the national proportion.

Representative phosphorus chemical production enterprises in Hubei Province include Xingfa Group, Hubei Yihua, and Xinyangfeng. Xingfa Group is the largest sulfur chemical production enterprise and the largest fine phosphorus chemical production enterprise in China. The export scale of monoammonium phosphate in the province has been increasing year by year. In 2022, the export quantity of monoammonium phosphate in Hubei Province was 511000 tons, with an export amount of 452 million US dollars.

Post time: Sep-05-2023