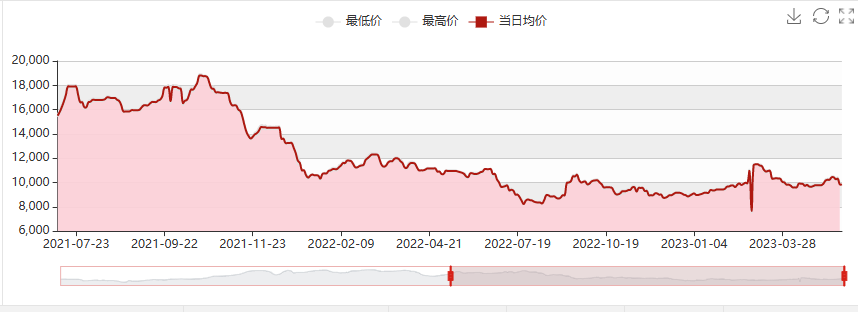

During the May Day holiday, due to the hydrogen peroxide explosion at Luxi Chemical, the restart of the HPPO process for the raw material propylene was delayed. Hangjin Technology’s annual production of 80000 tons/Wanhua Chemical’s 300000/65000 tons of PO/SM was successively shut down for maintenance. The short-term reduction in epoxy propane supply supported a sustained increase in prices to 10200-10300 yuan/ton, with a wide increase of 600 yuan/ton. However, with the large-scale export of Jincheng Petrochemical, the resumption of the short shutdown of the Sanyue Factory power plant due to pipe explosion, and the restart of the Ningbo Haian Phase I plant, the increase in supply of environmental protection and propylene has been significant. Downstream demand is weak, and bearish concerns still exist among operators. Therefore, cautious purchases are needed. In addition, Covestro polyether in the United States has intensified competition in the port market, leading to a rapid decline in the market from epoxy propane to polyether. As of May 16th, the mainstream factory price in Shandong has dropped to 9500-9600 yuan/ton, and some new device prices have risen to 9400 yuan/ton.

Market forecast for epoxy propane in late May

Cost side: Propylene prices have significantly decreased, liquid chlorine ranges fluctuate, and propylene support is limited. According to the current liquid chlorine price of -300 yuan/ton; Propylene 6710, the profit of chlorohydrin method is 1500 yuan/ton, which is overall considerable.

Supply side: The Zhenhai Phase I device will be put into operation from 7 to 8 days, with the load basically full; Jiangsu Yida and Qixiang Tengda are expected to restart; Compared to April, Jincheng Petrochemical’s official increase in external sales is significant. At present, only Shell’s load reduction and Jiahong New Materials (parking for shortage elimination, no inventory for sale, planned to start operation from May 20th to 25th, and delivery after start-up) and Wanhua PO/SM (300000/65000 tons/year) devices will undergo continuous maintenance for about 45 days starting from May 8th.

Demand side: The activity of the national real estate market has decreased, and the market is still facing downward pressure. The recovery pace of downstream demand for polyurethane is slow and the intensity is weak: summer falls, temperatures gradually rise, and the sponge industry shifts to the off-season; The demand power of the automobile market is still weak, and the effective demand has not been fully released; Home appliances/Northern insulation pipeline engineering/Some cold storage construction projects just need to be picked up, and the order performance is average.

Overall, it is expected that the domestic epoxy propane market will continue to be weak in late May, with prices falling below 9000.

Post time: May-17-2023