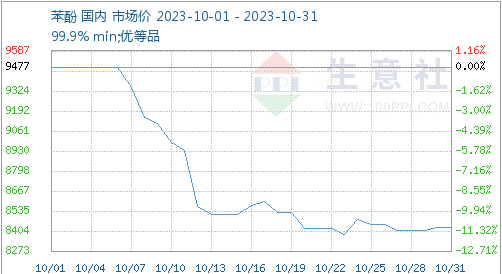

In October, the phenol market in China generally showed a downward trend. At the beginning of the month, the domestic phenol market quoted 9477 yuan/ton, but by the end of the month, this number had dropped to 8425 yuan/ton, a decrease of 11.10%.

From a supply perspective, in October, domestic phenolic ketone enterprises repaired a total of 4 units, involving a production capacity of approximately 850000 tons and a loss of approximately 55000 tons. Nevertheless, the total production in October increased by 8.8% compared to the previous month. Specifically, the 150000 ton/year phenol ketone plant of Bluestar Harbin has been restarted and started operation during maintenance, while the 350000 ton/year phenol ketone plant of CNOOC Shell continues to shut down. The 400000 ton/year phenol ketone plant of Sinopec Mitsui will be shut down for 5 days in mid October, while the 480000 ton/year phenol ketone plant of Changchun Chemical will be shut down from the beginning of the month, and it is expected to last for about 45 days. Further follow-up is currently underway.

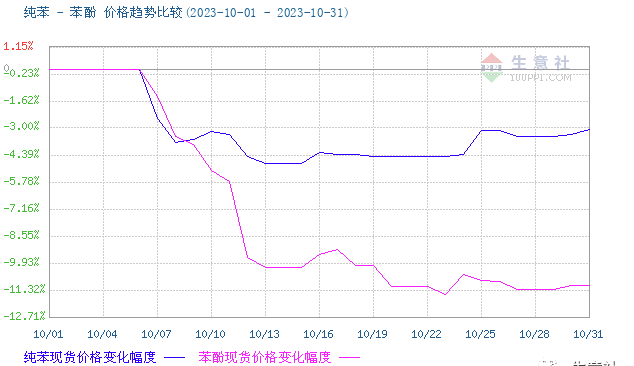

In terms of cost, since October, due to the significant decline in crude oil prices during the National Day holiday, the price of raw material pure benzene has also shown a downward trend. This situation has had a negative impact on the phenol market, as traders began to make concessions in order to ship goods. Despite factories insisting on high listing prices, the market still experienced a significant decline despite overall poor demand. The terminal factory has a high demand for procurement, but the demand for large orders is relatively scarce. The negotiation focus in the East China market quickly dropped below 8500 yuan/ton. However, with the pull of crude oil prices, the price of pure benzene has stopped falling and rebounded. In the absence of pressure on the social supply of phenol, traders began to tentatively push up their offers. Therefore, the phenol market showed a rising and falling trend in the middle and late stages, but the overall price range did not change much.

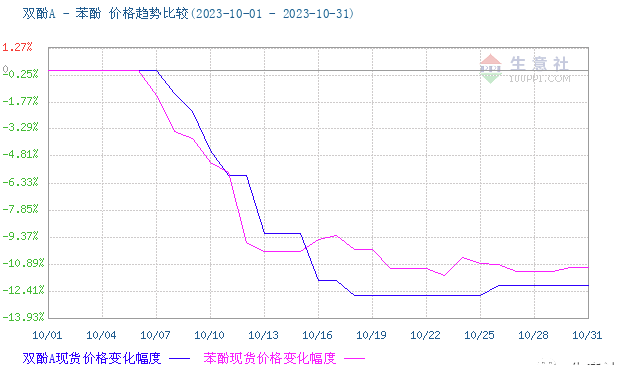

In terms of demand, although the market price of phenol continues to decline, inquiries from terminals have not increased, and purchasing interest has not been stimulated. The market situation is still weak. The focus of the downstream bisphenol A market is also weakening, with the mainstream negotiated prices in East China ranging from 10000 to 10050 yuan/ton.

In summary, it is expected that domestic phenol supply may continue to increase after November. At the same time, we will also pay attention to the replenishment of imported goods. According to current information, there may be maintenance plans for domestic units such as Sinopec Mitsui and Zhejiang Petrochemical Phase II phenolic ketone units, which will have a positive impact on the market in the short term. However, downstream bisphenol A plants of Yanshan Petrochemical and Zhejiang Petrochemical Phase II may have shutdown plans, which will have a reducing effect on the demand for phenol. Therefore, Business Society expects that there may still be downward expectations in the phenol market after November. In the later stage, we will closely monitor the specific situation of the upstream and downstream of the industrial chain as well as the supply side. If there is a possibility of rising prices, we will promptly notify everyone. But overall, there is not expected to be much room for fluctuations.

Post time: Nov-01-2023