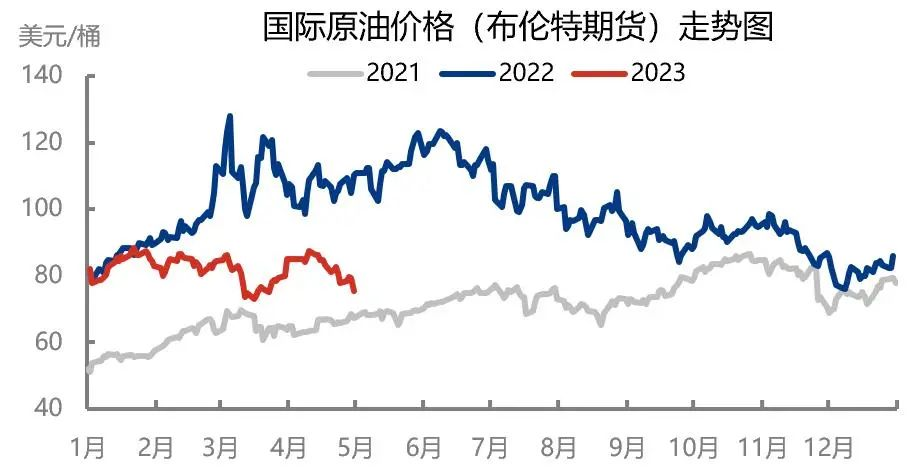

During the May Day holiday, the international crude oil market as a whole fell, with the US crude oil market falling below $65 per barrel, with a cumulative decline of up to $10 per barrel. On the one hand, the Bank of America incident once again disrupted risky assets, with crude oil experiencing the most significant decline in the commodity market; On the other hand, the Federal Reserve raised interest rates by 25 basis points as scheduled, and the market is once again concerned about the risk of economic recession. In the future, after the release of risk concentration, the market is expected to stabilize, with strong support from previous low levels, and focus on reducing production.

Crude oil experienced a cumulative decline of 11.3% during the May Day holiday

On May 1st, the overall price of crude oil fluctuated, with US crude oil fluctuating around $75 per barrel without a significant decline. However, from the perspective of trading volume, it is significantly lower than the previous period, indicating that the market has chosen to wait and see, waiting for the Fed’s subsequent interest rate hike decision.

As Bank of America encountered another problem and the market took early action from a wait-and-see perspective, crude oil prices began to plummet on May 2nd, approaching an important level of $70 per barrel on the same day. On May 3rd, the Federal Reserve announced a 25 basis point interest rate hike, causing crude oil prices to fall again, and US crude oil directly below the important threshold of $70 per barrel. When the market opened on May 4th, US crude oil even fell to $63.64 per barrel and began to rebound.

Therefore, in the past four trading days, the highest intraday drop in crude oil prices was as high as $10 per barrel, basically completing the upward rebound brought about by early voluntary production cuts by the United Nations such as Saudi Arabia.

Recession concerns are the main driving force

Looking back at late March, crude oil prices also continued to decline due to the Bank of America incident, with US crude oil prices hitting $65 per barrel at one point. In order to change the pessimistic expectations at the time, Saudi Arabia actively collaborated with multiple countries to reduce production by up to 1.6 million barrels per day, hoping to maintain high oil prices through supply side tightening; On the other hand, the Federal Reserve changed its expectation of raising interest rates by 50 basis points in March and changed its operations of raising interest rates by 25 basis points each in March and May, reducing macroeconomic pressure. Therefore, driven by these two positive factors, crude oil prices quickly rebounded from lows, and US crude oil returned to a fluctuation of $80 per barrel.

The essence of the Bank of America incident is monetary liquidity. The series of actions by the Federal Reserve and the US government can only delay risk release as much as possible, but cannot resolve risks. With the Federal Reserve raising interest rates by another 25 basis points, US interest rates remain high and currency liquidity risks reappear.

Therefore, after another problem with Bank of America, the Federal Reserve raised interest rates by 25 basis points as scheduled. These two negative factors prompted the market to worry about the risk of economic recession, leading to a decrease in the valuation of risky assets and a significant decline in crude oil.

After the decline in crude oil, the positive growth brought about by the early joint production reduction by Saudi Arabia and others was basically completed. This indicates that in the current crude oil market, the macro dominant logic is significantly stronger than the fundamental supply reduction logic.

Strong support from production reduction, stabilizing in the future

Will crude oil prices continue to decline? Obviously, from a fundamental and supply perspective, there is clear support below.

From the perspective of inventory structure, the destocking of US oil inventory continues, especially with lower crude oil inventory. Although the United States will collect and store in the future, the accumulation of inventory is slow. The price decline under low inventory often shows a decrease in resistance.

From a supply perspective, Saudi Arabia will reduce production in May. Due to market concerns about the risk of economic recession, Saudi Arabia’s production reduction can promote a relative balance between supply and demand against the backdrop of declining demand, providing significant support.

The decline caused by macroeconomic pressure requires attention to the weakening of the demand side in the physical market. Even if the spot market shows signs of weakness, OPEC+hopes that the attitude of reducing production in Saudi Arabia and other countries can provide strong bottom support. Therefore, after the subsequent release of risk concentration, it is expected that US crude oil will stabilize and maintain a fluctuation of $65 to $70 per barrel.

Post time: May-06-2023