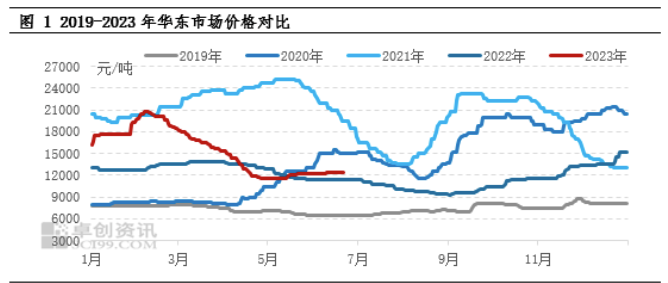

Since 2023, the MIBK market has experienced significant fluctuations. Taking the market price in East China as an example, the amplitude of high and low points is 81.03%. The main influencing factor is that Zhenjiang Li Changrong High Performance Materials Co., Ltd. ceased operating MIBK equipment at the end of December 2022, resulting in a series of changes in the market. In the second half of 2023, domestic MIBK production capacity will continue to expand, and it is expected that the MIBK market will face pressure.

Price Review and the Logical Analysis Behind It

During the upward phase (December 21, 2022 to February 7, 2023), prices increased by 53.31%. The main reason for the rapid increase in prices is the news of the parking of Li Changrong’s equipment in Zhenjiang. From the absolute value of production capacity, Zhenjiang Li Changrong has the largest production capacity equipment in China, accounting for 38%. The shutdown of Li Changrong’s equipment has raised concerns among market participants about future supply shortages. Therefore, they actively seek supplementary supply, and market prices have unilaterally increased significantly.

During the decline phase (February 8th to April 27th, 2023), prices fell by 44.1%. The main reason for the continuous decline in prices is that terminal consumption is lower than expected. With the release of some new production capacity and the increase in import volume, social inventory pressure is gradually increasing, leading to unstable mentality among market participants. Therefore, they actively sold their goods, and market prices continued to decline.

As the price of MIBK drops to a lower level (April 28th to June 21st, 2023), the maintenance of multiple sets of equipment in China has increased. In the second half of May, the inventory of production enterprises is controllable, and the above quotation increases the shipment volume. However, the start-up load of the main downstream antioxidant industry is not high, and the overall upward expectation is cautious. Until early June, due to the release of new production capacity plans, the downstream extraction industry’s early quantitative procurement supported the increase in transaction focus, down from 6.89% in the first half of the year.

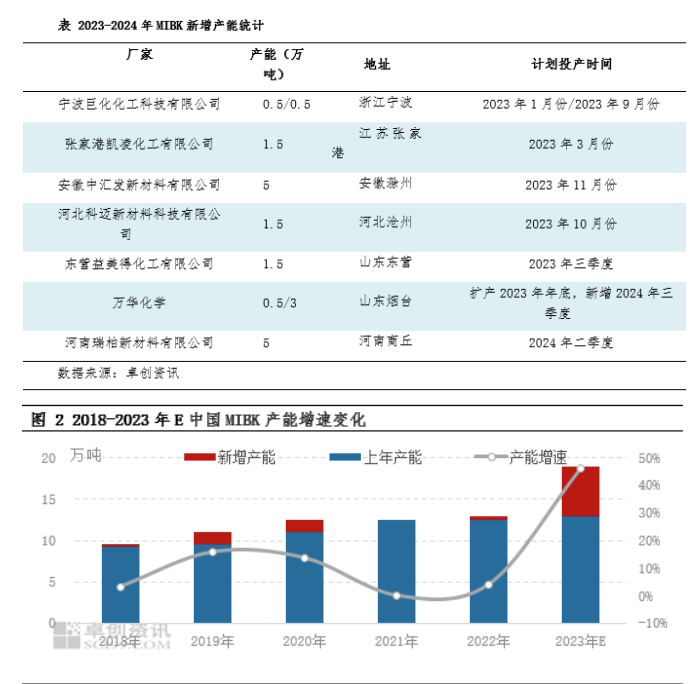

The production capacity will continue to expand in the second half of the year, and the supply pattern will change

In 2023, China will produce 110000 tons of MIBK new production capacity. Excluding Li Changrong’s parking capacity, it is expected that the production capacity will increase by 46% year-on-year. Among them, in the first quarter of 2023, there were two new production enterprises, Juhua and Kailing, which added 20000 tons of production capacity. In the second half of 2023, China MIBK plans to release 90000 tons of new production capacity, namely Zhonghuifa and Kemai. In addition, it has also completed the expansion of Juhua and Yide. It is expected that by the end of 2023, the domestic MIBK production capacity will reach 190000 tons, most of which will be put into production in the fourth quarter, and supply pressure may gradually become apparent.

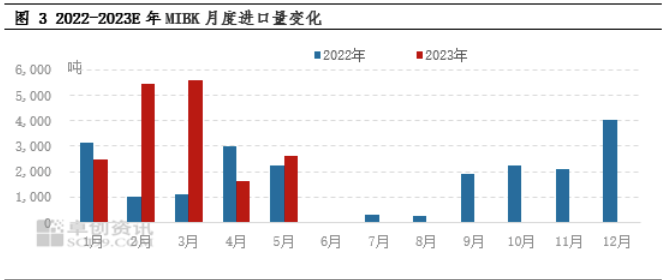

According to customs statistics, from January to May 2023, China’s MIBK imported a total of 17800 tons, a year-on-year increase of 68.64%. The main reason is that the monthly import volume in February and March exceeded 5000 tons. The main reason is the parking of Li Changrong’s equipment in Zhenjiang, which has led to intermediaries and some downstream customers actively seeking import sources to supplement, leading to a significant increase in import volume. In the later stage, due to sluggish domestic demand and fluctuations in the RMB exchange rate, the price difference between domestic and foreign markets is relatively small. Considering the expansion of MIBK in China, it is expected that the import volume will significantly decrease in the second half of the year.

Overall analysis suggests that in the first half of 2023, although China released two sets of new production capacity, the production growth after the new production capacity investment cannot keep up with the lost production after the shutdown of Li Changrong’s equipment. The domestic supply gap mainly relies on the replenishment of imported supply. In the second half of 2023, domestic MIBK equipment will continue to expand, and the price trend of MIBK in the later stage will focus on the production progress of new equipment. Overall, the market supply in the third quarter cannot be fully replenished. According to analysis, it is expected that the MIBK market will consolidate within the range, and after concentrated expansion in the fourth quarter, market prices will face pressure. During the upward phase (December 21, 2022 to February 7, 2023), prices increased by 53.31%. The main reason for the rapid increase in prices is the news of the parking of Li Changrong’s equipment in Zhenjiang. From the absolute value of production capacity, Zhenjiang Li Changrong has the largest production capacity equipment in China, accounting for 38%. The shutdown of Li Changrong’s equipment has raised concerns among market participants about future supply shortages. Therefore, they actively seek supplementary supply, and market prices have unilaterally increased significantly.

Post time: Jun-27-2023