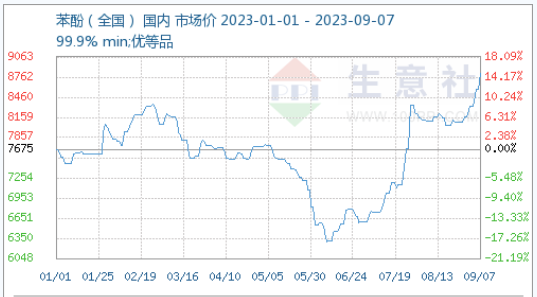

In 2023, the domestic phenol market experienced a trend of first falling and then rising, with prices plummeting and rising within 8 months, mainly influenced by its own supply and demand and cost. In the first four months, the market fluctuated widely, with a significant decline in May and a significant increase in June and July. In August, the negotiation center fluctuated around 8000 yuan/ton, and in September, it continued to climb and reached a new high of 8662.5 yuan/ton for the year, with an increase of 12.87% and a maximum amplitude of 37.5%.

Since the upward trend in July, the market has been fluctuating at high levels in August, and the upward trend in September has continued. As of September 6th, the national market average price was 8662.5 yuan/ton, a cumulative increase of 37.5% compared to the lowest point of 6300 yuan/ton on June 9th.

During the period from June 9th to September 6th, the phenol offers in various regions were as follows:

East China region: The price has increased from 6200 yuan/ton to 8700 yuan/ton, with an increase of 2500 yuan.

Shandong region: The price has increased from 6300 yuan/ton to 8600 yuan/ton, with an increase of 2300 yuan.

The surrounding area of Yanshan: The price has increased from 6300 yuan/ton to 8700 yuan/ton, with an increase of 2400 yuan.

South China region: The price has increased from 6350 yuan/ton to 8750 yuan/ton, with an increase of 2400 yuan.

The rise in the phenol market is mainly influenced by the following factors:

The factory has raised the listing price and delayed the arrival of domestic trade cargo at the port. Sinopec’s phenol market in East China increased by 100 yuan/ton to 8500 yuan/ton, while Sinopec’s phenol price in North China increased by 100 yuan/ton to 8500 yuan/ton. On September 7th, Lihuayi’s phenol price increased by 8700 yuan/ton. After multiple price hikes by factories in the second half of the year, there was not much spot pressure in the market, and traders were reluctant to sell and offered higher prices. At the end of August, domestic trade shipments were delayed in arriving at the port for fermentation, and due to low inventory at the phenol port, supply was tight, boosting the market trend.

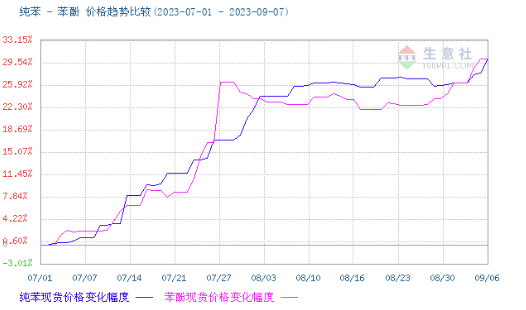

Strong cost support. The raw material market has risen, with pure benzene negotiated at 8000-8050 yuan/ton. Downstream styrene profits have been restored, and factory procurement has increased. With the rapid rise of pure benzene to a high level in recent times, cost support has increased, and factory cost has increased. Actively raising prices is in line with market prices.

Be cautious in chasing up high prices at the terminal, prioritize hard demand, and have limited trading volume.

It is expected that the phenol market will continue to operate at a high level in the short term, with negotiations ranging from 8550 to 8750 yuan/ton. However, attention needs to be paid to the production status of Jiangsu Ruiheng Phase II unit and the downstream phenolic resin’s high-temperature off-season trend, which may have an impact on demand. In addition, although cost support still exists, there may be resistance from downstream towards high prices.

Post time: Sep-07-2023